Goldman Doubles 2023 European Gas Price Target As It No Longer Sees “Full Restoration Of Nordstream 1 Flows”

A few days ago, Deutsche Bank strategist Jim Reid asked if July 22 would be the most important day of the year for both Europe and the rest of the world, as that’s the day when Russian gas should resume transit on the Nord Stream 1 pipeline, to wit: “while we all spend most of our market time thinking about the Fed and a recession, I suspect what happens to Russian gas in H2 is potentially an even bigger story. Of course by July 22nd parts may have be found and the supply might start to normalise. Anyone who tells you they know what is going to happen here is guessing but as minimum it should be a huge focal point for everyone in markets.”

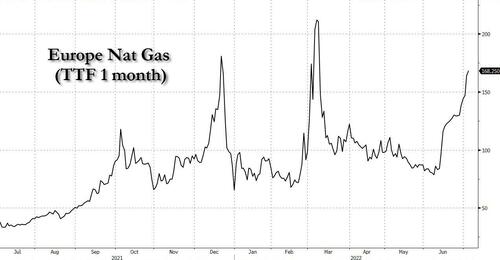

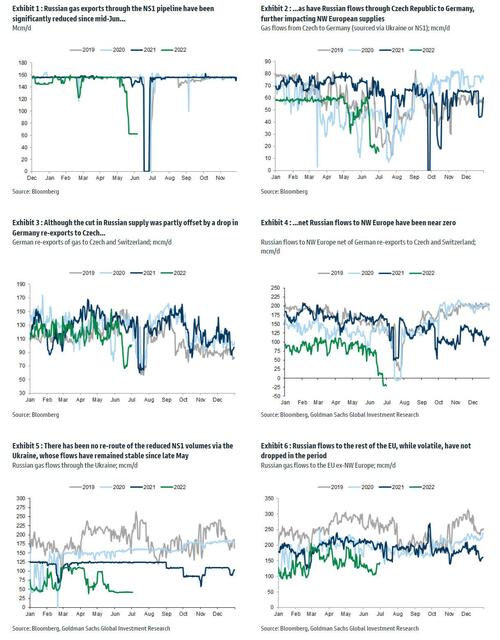

Hinting that they may have some clue what happens with Europe’s gas market in three weeks, overnight Goldman’s European commodity strategists wrote a note titled “Increased supply risks lead us to raise our TTF forecasts” in which they note that the 60% reduction in Russian gas exports via the Nord Stream 1 (NS1) pipeline in place since mid-Jun has left net Russian flows to NW Europe near zero, with most of what’s left in the pipe re-exported out of Germany towards Czech Republic and from there to other buyers. This has raised gas supply uncertainty in Europe ahead of NS1’s full maintenance in mid-July, driving TTF prices up 70% in the period to 168 EUR/MWh as a result, the highest since the Ukraine invasion in March.

Why does this matter? Because as Goldman’s Samantha Dart writes, while she initially assumed a full restoration of NS1 flows following its upcoming maintenance event, she no longer see this as the most probable scenario; “instead, the lack of resolution around required turbine repairs, and the absence of any Gazprom-driven re-routing of the reduced NS1 flows via an alternative pipeline to mitigate the impact to supply suggest a prolonged reduced flow rate at NS1 is more likely going forward.”

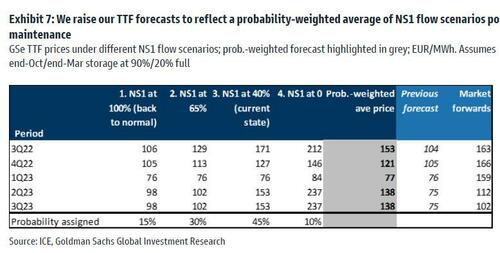

Accordingly, Goldman has revised its TTF price forecasts to reflect such a scenario around NS1 flows post maintenance. Specifically, the bank raises its 3Q22/4Q22/1Q23/Sum23 TTF price forecasts to 153/121/77/138 EUR/MWh from 104/105/76/75 previously, vs current market forwards at 163/166/159/106. In other words, the Q3 price is raised roughly 50% and the full 2023 price forecast nearly 100% higher!

Goldman’s revised forecasts embed a modal scenario of NS1 flows returning following maintenance at their current 40% run rate, while the bank still sees a full cut of NS1 flows made permanent as the least likely scenario, as shown in the table below.

This is because keeping export flows this restricted would largely leave Russia’s flow flexibility one sided – flows could only go up from there. Further, keeping NS1 at zero post maintenance would effectively eliminate most, if not all, of Russia’s TTF-indexed revenue from gas sales, limiting any revenue upside that would come from subsequent spikes in TTF prices. It would also imply an accelerated rate of Russian gas production shut-ins relative to the 9% year-to-date year-on-year decline in Gazprom production reported so far.

To be sure, the path ahead for European gas prices will be impacted by several different drivers, not least of which the level of storage at the end of summer the market will be comfortable with. Hence, Goldman’s price forecasts under each scenario shown in Exhibit 7 embed specific storage targets, as well as the estimated impact of mitigating factors such as coal restarts, government-led buy-backs of industrial gas, residential and commercial responses and potential incremental LNG imports:

- Storage targets at 90% full by end-Oct, 20% by end-Mar. While the EU has published an 80% full storage target for the end of this summer (and 90% full from next year), Germany and France have independently guided towards higher targets, at or above 90% full. Further, TTF price action since the NS1 cuts in mid June suggests the market is positioning to achieve storage levels above the 80% full EU target, contributing to lower supply uncertainty, and lower prices, in winter. The 20%-full storage target Goldman applies at the end of winter is enough to withstand a one standard deviation colder-than-average winter plus a small margin.

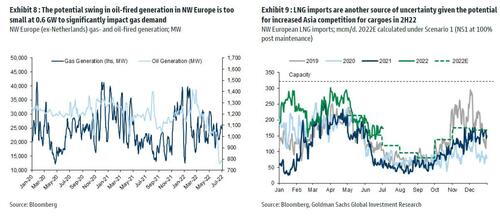

- Incremental coal and oil generation to reduce NW European gas demand by up to 22 mcm/d. In the NW European region GS includes the coal capacity increases announced in Germany and the Netherlands, adding up to an estimated 8 GW of coal-fired generation added over the course of the next several months, with the bank’s gas burn model suggesting 3 mcm/d of gas demand impacted by each 1 GW of energy generated with alternative fuels. While the latest rally in TTF prices has once again taken it above diesel costs in Europe (adjusted for burn efficiency and CO2 cost differentials), leading to lower gas burns at the margin, Goldman doesn’t see the potential gas-to-oil substitution for power in Europe as significant. Data for the past several months suggest a swing in oil generation in NW Europe of up to 0.6 GW only (Exhibit 8), equivalent to less than 2 mcm/d of gas demand, which is also embeded in the bank’s calculations.

- Government-driven reduction in NW European industrial demand for gas of up to 9 mcm/d. The lack of details behind Germany’s Emergency Gas Plan makes it difficult to estimate the timing, duration and the scale of potential government intervention in the industrial sector. Scenarios include a 0%-10% reduction in industrial gas demand driven by Government action, with the lowest reductions applied to the scenarios with highest gas availability, and the largest intervention assumed for the scenarios with lowest gas availability.

- Decline in residential and commercial (heating) demand for gas of up to 28 mcm/d. Here, Goldman assumes a 0%-7% drop in NW European heating demand for gas, with the highest drop associated with the tightest gas supply scenario. This is not dissimilar to the weather-adjusted swings in heating demand seen this year.

- Up to 20 mcm/d of incremental NW European LNG imports. Again, Goldman assumes that the tightest gas supply scenarios in Europe would lift TTF prices to attract the largest incremental LNG imports (up to 12%) into the region. That said, Goldman has low conviction in these estimates as LNG buyers outside of Europe have not responded to LNG prices in a stable manner. For instance, low spot market participation from India, Pakistan and Bangladesh earlier in the year has reversed given the heat wave these regions have experienced. Similarly, the pace of economic activity recovery in China in 2H22 and storage restocking in Northeast Asia ahead of the next winter will likely increase Asia competition for spot cargoes despite high European gas prices. The higher LNG inflows now assumed on balance into NW Europe lead Goldman to lower our Sum22/Win22-23/Sum23 JKM-TTF spread forecasts to $0/$0.40/$0.10/mmBtu from $0.50/$0.90/$0.60 previously.

Finally, while price-capping measures applied to Russian gas have also been discussed, Goldman – similar to us – does not believe that these will be effective in reducing Europe’s gas tightness or even gas prices at the margin, as such measures would not bring additional supplies into Europe.

Given the high volatility in the front of the curve and its expectation that the ongoing European tightness is not likely resolved in the near-to-medium term, it’s hardly a surprise that Goldman continues to recommend long TTF exposure further out the curve, on the Dec23 contract, currently priced at 104 EUR/MWh, and which Goldman sees rising by about 40%! An alternative way to express this view is to go long Sum24, since it’s pricing at much lower levels at 69 EUR/MWh, below minimum industrial-demand-destruction price levels of 75 EUR/MWh.

There is more in the full Goldman note available to professional subs.

Tyler Durden

Tue, 07/05/2022 – 12:45

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com