An Increasingly Hungry World: 8 Key Takeaways From The Food Inflation And Security Symposium

Morgan Stanley recently held a virtual Food Inflation & Security Symposium, in which the bank discussed a wide range of topics with experts from around the world. The Symposium followed the publication of the bank’s global collaborative note that involved over 30 Morgan Stanley analysts, entitled “Food Security & Inflation: From Seeds to Stores” (the note is available to professional subs).

Below we summarize the bank’s key takeaways and variables that will drive future food prices, along with associated impacts to businesses and geopolitics.

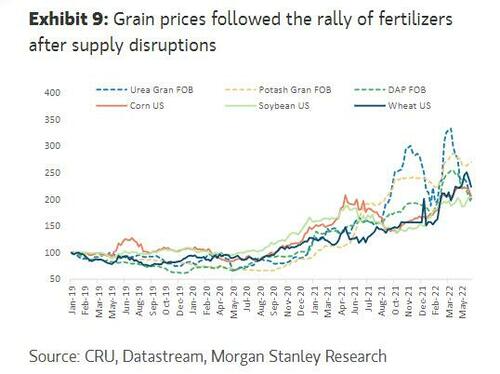

1. The majority view among experts and executives broadly matched Morgan Stanley’s view that food prices will likely reach a peak in 2022, a view that is below consensus among investors and below forward commodity prices. That said, there was significant discussion during multiple Symposium sessions around the magnitude of variables that could impact pricing, variables that are challenging to predict. For example, a chemical company executive viewed potash prices as likely to have already hit a peak, but the executive also believed that potash prices would remain high, representing a disconnect from prior periods of much lower fertilizer prices. Other experts pointed out the magnitude of impacts to food prices from crucially important (and challenging to predict) variables such as weather (especially in South America over the next several months), energy prices and geopolitics (and many speakers highlighted how closely these last two variables are linked).

2. Regarding the outlook for grain prices, with fertilizer prices declining, farmers are still investing sufficiently to drive strong yields, which supports the bank’s view that grain prices will peak in 2022. That said, weather could take the world to Morgan Stanley’s high price case on grains, especially as the odds of a third consecutive La Niña are increasing (last time this happened was in 2001), and soil in Brazil and Argentina is already dry. This could be disruptive to inventories in the next year and has become a key concern. Market players are less worried about USA weather and crops, and in their views yields should be good, bringing more inventories and relief to short-term prices. Market players believe export restrictions generate short-term stress but gradually fade away, and were not overly concerned about the impacts of the reduction in Ukrainian supply.

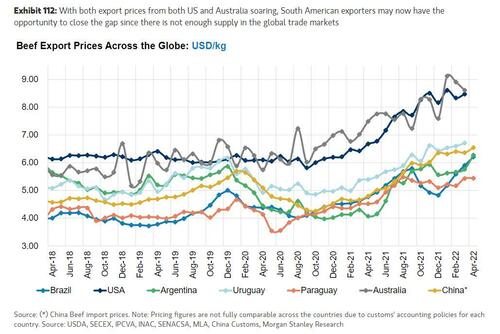

3. Protein prices, especially beef, could continue to rise, a dynamic that MS analyst, Ricardo Alves, has emphasized in recent reports including. The quote from Ricardo’s recent “Beef Super Cycle” report that has resonated with many investors: “Our in-depth supply & demand analysis shows that there’s just not enough beef in the world right now.” Beef is the most expensive protein, so of course demand is related to trade-down issues (pork and chicken relations), but there are multiple trends that favor strong continued demand for beef (e.g. China with gradual urbanization process, higher income per capita, higher and gradual penetration of beef).

4. Impacts to “downstream” industries: packaged Food companies are likely to face increasing retailer pushback to higher pricing as the leverage is shifting from suppliers to retailers. For many “downstream” industries such as Packaged Food producers, Morgan Stanley’s base case food price estimates would be in-line to modestly bullish (in the sense that margin impacts from higher food prices may be somewhat overdone among the investor community). While input cost pressures are likely to moderate, consumers’ increasing focus on value when food shopping and greater retailer pushback to higher pricing can weigh on packaged food companies’ topline outlook. The expert discussion highlighted that retailers’ increasing focus on costs and offering consumers value should lead to tougher price negotiations.

5. Geopolitical issues may continue to pressure existing food supply chains, with no easy short term fix. NATO recently stated the probability of the Russia/Ukraine conflict turning into a years-long war and under such conditions, it would be difficult to envision stable supply chain and trade corridors that could be established for agricultural commodities in the Ukraine. Similarly it’s difficult to envision sanctions on Russia being lifted, which should continue to create friction for their food exports. As Morgan Stanley details in its recent Blue Paper, the food issue is part of a larger secular challenge to supply chains from geopolitical issues. The twin trends of Slowbalization and the move to a ‘Multipolar World’ are forcing a rewiring of the global economy, where companies will out of necessity for supply chain security and public policy compliance invest in geographical diversification of supply chains. These transitions can be costly and have unintended consequences as they evolve. They also drive opportunities for the companies and countries that will be called on to build and house new supply chains.

6. The impacts of elevated food prices are dramatically different at the national level, with some countries benefiting (such as Argentina and Brazil), while other countries are likely to experience multiple negative impacts. For instance, countries including Egypt, Ethiopia, Somalia, and Yemen rely on food aid while not having offsetting oil revenues. Only Nigeria has oil revenues to offset food costs. While food prices are down from recent record highs, prices are still higher than any time since 1974. The ranks of deeply food import-dependent countries are growing. In the United States, programs such as food stamps and school meal programs impact tens of millions of Americans. Though inflation-based indexing and maximum benefit policies have been put in place in response to the Covid-19 pandemic, the shift back to pre-Covid policies is poised to significantly impact everyone receiving benefits from any one of 18 programs. Sizing it up, the 18 programs grew from $50b to $150b in program size during Covid. The Supplemental Nutrition Assistance Program (SNAP) alone is $100b. Every three months, the US HHS must extend the Public Health Emergency designation, currently in place through August this year. HHS has indicated that it would give the states a two-month notice prior to expiration. Seven states have already come off the public health emergency, and once it is over, a state may step in to offset a reduction in benefits. However, the amount of government assistance that goes away is likely to be stark. A silver lining would be if the loss of maximum benefits creates a sufficient incentive to increase labor force participation.

7. The biggest game-changer for AgTech in the last 5 years has not been new innovation so much as cheap computing power. Technology is no longer a nice-to-have but rather a must-have. New technologies from drones to precision fertilizers can deliver 7-15% returns improvements within year one; importantly agnostic to the size of fields which had always been a limiting factor for smaller landowners. However, the biggest challenge at the moment remains sourcing labor. While automation tools are available, there is no expeditious solution in current markets.

8. Sustainability implications are complex and require a nuanced approach from investors. ESG must address both food security and sustainable approaches to food production, which in some instances, have a complicated relationship. In the current backdrop, historic parallels of food-related social unrest emphasize the social considerations of economically producing sufficient amounts of food. Long-term, however, unsustainable farming practices contribute to climate change, a key structural risk to food security. According to MS panelists, investors should “realistically” approach solutions that have no agreed upon definition from a sustainability perspective – such as gene editing. Investors should also recognize farmers are often too “risk saturated” to realize potentially lower yields from a shift toward regenerative farming practices. As a result, corporates that are dependent on farmers, a critical and climate-vulnerable part of the supply chain, should consider supporting the industry’s transition by absorbing some of this risk.

More in the full Morgan Stanley note available to pro subs.

Tyler Durden

Sun, 07/10/2022 – 20:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com