Futures, Yields, Oil And Gold Slide As German Confidence Plummets To 2011 Lows, Euro Hits Parity

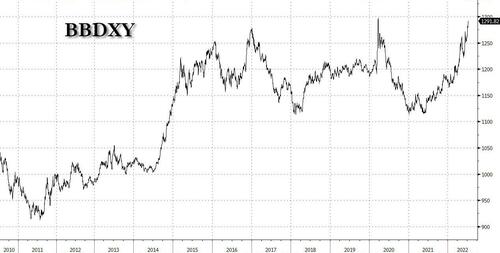

US index futures, global markets, Treasury yields, bitcoin and oil all fell on Tuesday as the dollar continued its relentless ascent to levels just shy of the March 2020 global crash record high…

… highlighting pervasive trader unease about the economic outlook as high inflation and a looming recession are set to unleash a catastrophic global recession coupled with a worldwide dollar shortage, now with the added boost of China’s renewed struggles with Covid. S&P and Nasdaq 100 emini futures dropped about 0.5% each having slumped as much as 0.9% earlier, as traders brace for an ugly Q2 earnings season which may provide clues on how companies are weathering inflation and recession concerns.

The US 10-year Treasury yield falls to about 2.91% amid a broad-based flight to safety; bonds also rallied in Europe. German bonds surged, sending the benchmark 10-year yield to the lowest since May, after data showed investor confidence plunged to a 2011 low.

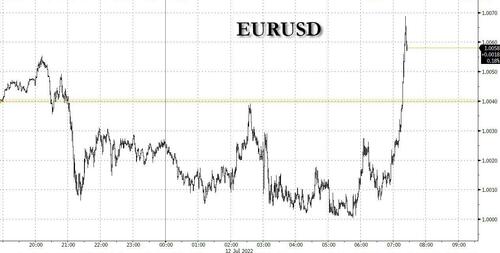

As shown above, the dollar rose just shy of record highs last seen at the height of the 2020 market panic over Covid and the yen strengthened, underlining investor caution. The euro meanwhile briefly touched parity (technically, it was 1.00003 but that’s semantics for purists who have nothing better to do) hammered by the region’s energy crisis and acute recession fears.

Dollar strength will not only “affect this quarter’s earnings, but more likely it’s going to affect the revenue generation outlook for the next couple of quarters and that, I think, is a big problem,” Kimberly Forrest, founder and chief investment officer of Bokeh Capital Partners, said on Bloomberg Radio.

PepsiCo, one of the first major corporations to report, rose in premarket trading after lifting its revenue forecast. The soft-drinks maker said demand remained robust despite inflation, though it expected headwinds from the strong dollar. Bank stocks, meanwhile, were lower in premarket trading amid a broader slump in risk assets. Cryptocurrency stocks drop in premarket trading as Bitcoin drops below $20,000 in its fourth straight day of declines amid a stronger dollar. In corporate news, LoanDepot said it will cut about 2,000 additional staff by the end of the year. Here are the other notable premarket movers:

- Gap (GPS US) shares fall 6.4% in premarket trading after the apparel retailer fired CEO Sonia Syngal and said it expects rising costs and deepening discounts to erase this quarter’s operating profit.

- American Express (AXP US) shares are down 2.2% in premarket trading after Morgan Stanley cut the recommendation on the stock, as well as on Capital One (COF US), to equal- weight from overweight as inflation takes a larger share of household disposable incomes.

- STORE Capital (STOR US) shares fall 3.3% in premarket trading after Morgan Stanley downgrades it to underweight from equal-weight and cuts National Retail Properties (NNN US) to equal-weight from overweight, saying that US triple net REITs could see a headwind from the rising cost of capital.

- Ginkgo Bioworks (DNA US) shares are up 9% in premarket trading after exchange-traded funds managed by Cathie Wood’s Ark Investment Management bought 860,480 shares in the company.

Meanwhile, the latest Fed commentary highlighted both the central bank’s hawkishness and the risks that come with aggressive interest-rate hikes. Fed Bank of Atlanta President Raphael Bostic said the US economy can copewith higher interest rates and repeated his support for another jumbo move this month. Fed Bank of Kansas City President Esther George, who dissented last month against the central bank’s 75 basis-point rate increase, cautioned that rushing to tighten policy could backfire.

European bourses are also deep in the red. Euro Stoxx 50 falls 0.7% with the Stoxx Europe 600 sliding for a second day, though it pared the decline with utilities outperforming as EDF jumped after a report that the French government will pay a premium to take control of the electricity company. The DAX lags, dropping 0.8%. Banks, travel and autos are the worst performing sectors. German bonds surged, sending the benchmark 10-year yield to the lowest since May, after data showed investor confidence plunged to a level not seen since the sovereign debt crisis in 2011.

Asian stocks fell to a new two-year low as China’s technology shares continued to face selling pressure amid regulatory jitters and a resurgence of Covid cases in the nation. The MSCI Asia Pacific Index slipped as much as 1.5%, dragged by tech and consumer discretionary shares. The Hang Seng Tech Index fell 11% from a June high to enter a technical correction as regulatory fines for the country’s tech giants continued to damp sentiment.

In China, investors are concerned more Covid lockdowns may lie ahead as Beijing continues with a strategy of mass testing and mobility curbs. Chinese benchmarks took a hit from renewed lockdown fears from a fresh virus outbreak in Shanghai. Japan and Taiwan were among the region’s worst performing markets on lingering concerns of a global economic slowdown. Market participants are hoping that key US inflation data due Wednesday and China’s GDP figures on Friday will provide clues on the global economy’s direction. Asia’s stock benchmark has slumped 20% this year amid worries about higher interest rates and the prospect of an economic downturn. Investor sentiment continued to weaken in Asia despite remaining positive in China, said Olivier d’Assier, the head of APAC applied research at Qontigo. “Within an inflationary background, hopes of continued high profit margins in developed markets can only be balanced with fears of a margin squeeze among the developing world’s supply chain.”

In FX, the Bloomberg Dollar Spot Index rose a second day as the greenback was steady or higher against all of its Group-of-10 peers apart from the yen amid rising recession concerns. The euro fell to a low of 1.00003 per dollar but struggled to go below parity. Options traders are still preparing for life below this psychological support level. The pound lagged all of its Group-of-10 peers. UK retailers reported another drop in sales, while economists see the risk of a UK recession in the next 12 months at almost 50-50. Australian and New Zealand fell gradually. Iron ore prices sank to a seven- month low, with the demand outlook dimming on fears China may again impose strict Covid-19 curbs that hurt construction activity.

In rates, Treasuries were underpinned following gains for bunds and gilts after German ZEW expectations gauge dropped to -53.8 vs -40.5 estimate. Treasury yields richer by up to 7.5bp across intermediates, flattening 2s10s spread by 1.4bp on the day to -10.3bp, deepest inversion since 2007; German 10s outperform Treasuries by ~5bp, gilts by ~7bp. German 10-year yields dropped to lowest since May, dragging Treasury yields lower. German curve bull-flattens, richening 12-14bps across the back end. Gilts bull-steepen, with short-dated yields dropping over 15bps. Peripheral spreads widen to Germany with 10y BTP/Bund widening ~3bps to 199bps. In bond auctions we get a $33BN reopening of 10-year notes at 1pm ET follows good demand for Monday’s 3-year new issue, which stopped 0.5bp through. WI 10-year yield around 2.92% is ~11bp richer than June result, which tailed by 1.2bp.

Crude futures decline. WTI falls ~2.5% to trade near $101.60. Base metals are mixed; LME tin falls 3.1% while LME aluminum gains 0.3%. Spot gold is little changed at $1,735/oz. Spot silver loses 1.1% near $19. Bitcoin drops over 3.5% to trade back below $20,000.

Looking at the day ahead now, and data releases include the US NFIB small business optimism index for June. Central bank speakers include BoE Governor Bailey, the Fed’s Barkin and the ECB’s Villeroy. Finally, earnings releases today include PepsiCo.

Market Snapshot

- S&P 500 futures down 0.6% to 3,835.50

- STOXX Europe 600 down 0.4% to 413.46

- MXAP down 1.3% to 154.65

- MXAPJ down 1.3% to 508.44

- Nikkei down 1.8% to 26,336.66

- Topix down 1.6% to 1,883.30

- Hang Seng Index down 1.3% to 20,844.74

- Shanghai Composite down 1.0% to 3,281.47

- Sensex down 0.6% to 54,067.35

- Australia S&P/ASX 200 little changed at 6,606.28

- Kospi down 1.0% to 2,317.76

- German 10Y yield little changed at 1.16%

- Euro down 0.3% to $1.0008

- Brent Futures down 2.1% to $104.83/bbl

- Gold spot up 0.2% to $1,736.88

- U.S. Dollar Index up 0.43% to 108.48

Top Overnight News from Bloomnerg

- Investor confidence in Germany’s economy slumped to the lowest since 2011 as the country faces the growing prospect of a recession and risks mount that it’s shut off from Russian energy supplies

- US Treasury Secretary Janet Yellen agreed with her Japanese counterpart Tuesday that volatile exchange rates pose a risk, and pledged to consult and cooperate as appropriate

- A global squeeze on energy supply that’s triggered crippling shortages and sent power and fuel prices surging may get worse, according to the head of the International Energy Agency

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were mostly negative after the weak performance across global counterparts as China’s COVID flare-up and Europe’s energy concerns added to the headwinds for the growth outlook. ASX 200 bucked the trend with the index kept afloat by defensives although the upside was capped by weak consumer and business confidence data. Nikkei 225 underperformed as the Japanese currency attempted to compose itself from recent rapid depreciation and with automakers pressured after Toyota flagged a potential cut to its output plan citing a chip shortage and COVID impact. Hang Seng and Shanghai Comp. were lower amid the ongoing COVD concerns which overshadowed reports that China’s authorities will increase financial support for manufacturers, as well as the recent stronger than expected aggregate financing and loans data.

Top Asian News

- China is to lockdown Wugang city in Henan for 3 days due to 1 COVID case, according to Bloomberg.

- Japanese Finance Minister Suzuki said they will conduct necessary economic steps taking prices and economy into account, while he added that they are watching the FX market even more closely while working with the BoJ and will take necessary steps against the FX market with FX authorities from other nations, according to Reuters.

- Japanese Finance Minister told US Treasury Secretary Yellen that Japan is concerned about the rapid JPY weakening recently; watching currency markets with a sense of urgency; agreed to continue consulting in foreign exchange.

European bourses are pressured in a broad China-COVID driven risk move, Euro Stoxx 50 -0.5%; alongside known concerns and a dismal ZEW. Stateside, futures are lower across the board with the NQ somewhat more choppy than peers amid pronounced rate activity this morning and on PEP earnings. Back to Europe, sectors are mixed and feature IT as the laggard while Energy is green despite benchmark pricing amid outperformance in EDF.

PepsiCo Inc (PEP) Q2 2022 (USD): EPS 1.86 (exp. 1.74), Revenue 20.2bln (exp. 19.51bln). FY Revenue view 82.7bln (exp. 82.72bln)

Top European News

- UK’s Heathrow airport is imposing a capacity cap of 100k departing passengers a day, until September 11th. Beleive further action is needed now; cap means some summer journeys will be rescheduled, relocated or cancelled. Asks airline partners to stop the sale of summer tickets in order to limit the passenger impact.

- Former UK Chancellor Sunak confirmed his commitment to fiscal discipline and will stand firm on taxes until he has ‘gripped inflation’, according to FT.

- German ZEW Economic Sentiment (Jul) -53.8 vs. Exp. -38.3 (Prev. -28.0); ZEW Survey Expectations (Jul) -51.1 (Prev. -28.0)

- ZEW: current major concerns about energy supply, ECB’s announced rate hikes, restrictions in China, led to a deterioration in the outlook; economic situation significantly more negative than in previous month, experts further lower their already unfavourable forecast for the next six months.

Fixed Income

- Bonds breach recent resistance levels, with Bunds up to new July highs at 153.48 after a bleak German ZEW survey

- Gilts back on the 116.00 handle from a 115.04 Liffe low awaiting more comments from BoE Governor Bailey and 10 year T-note towards top of 119-03/118-09+ range pre-USD 33bn refunding leg

- DMO’s 2032 tap well received and German Schatz covered, but results mixed overall

FX

- Pound underperforms awaiting UK political developments as Labour Party prepares no-confidence motion against Tories; Cable on the cusp of 1.1800, while EUR/GBP rebounds over 0.8450.

- Euro prods parity vs Dollar before and after dire German ZEW survey, while DXY breaches 108.500 amidst broad Buck gains.

- Yen regroups as risk sentiment remains sour and yields retreat further, with Japan’s Finance Minister also raising concern about rapid decline, USD/JPY closer to 137.00 than 137.50+ top and Monday’s 137.75 peak.

- Loonie and Nokkie recoil alongside crude prices, but Kiwi holds up better than Aussie ahead of anticipated 50bp RBNZ rate hike on Wednesday, USD/CAD back up near 1.3050, EUR/NOK propped around 10.2600, NZD/USD holding just above 0.6100 and AUD/USD sub-0.6750.

- Yuan breaks below recent range as China’s Covid situation continues to deteriorate – USD/CNH and USD/CNY probe 6.7500 and 6.7350 respectively.

Commodities

- WTI and Brent have extended on APAC pressure as the demand-side of the equation remains sensitive to lockdowns with the OPEC MOMR and EIA STEO due.

- Currently, benchmarks are in relative proximity to their respective USD 101.06/bbl and USD 104.35/bbl lows.

- IEA’s Birol said the world is in the midst of the first energy crisis and it has not seen the worst of the energy crisis, according to Bloomberg.

- US senior official warned that a failure to implement a proposed price cap on Russian oil with the exemption of purchases below the cap, could see oil prices increase to around USD 140/bbl, while the official added that Treasury Secretary Yellen will speak to Japanese Finance Minister Suzuki on the proposed Russian oil price cap, according to Reuters.

- US Department of Energy announced a contract for 14 companies to purchase crude oil from the SPR with deliveries to take place between August 16th to September 30th, according to Reuters.

- China’s NDRC says retail prices of gasoline and diesel will be cut by CNY 360/tonne and CNY 345/tonne respectively from July 13th.

- US National Security Adviser Sullivan responded that there is a capacity for further steps that can be taken when questioned about oil output, according to Reuters.

- Spot gold is relatively resilient despite broader price action, and the yellow metal is torn between COVID-driven haven allure and the USD’s ongoing advances.

US Event Calendar

- 06:00: June SMALL BUSINESS OPTIMISM, 89.5, est. 92.5, prior 93.1

Central Banks

- 12:30: Fed’s Barkin Discusses the ‘Recession Question’

Government:

- President Biden will meet with Mexico President Andrés Manuel López Obrador at 11:15am ET

- House Jan. 6 select committee will hold a hearing on the extremists involved in the assault at 1pm ET

DB’s Jim Reid concludes the overnight wrap

It’s so hot, even at 5am, that I have two fans pointing at me as I type this. Electric ones not two people that have kindly voted for me in the II survey. Never has a commute to the office and the lure of aircon been so alluring. When we renovated 3-4 years ago we considered having some aircon fitted but decided that given the cost we would forgo that for the couple of days a year where Britain sweltered. Given that this spell looks set to last a couple of weeks I may sleep in the office, especially as the kids have now broken up and are running riot at home.

The heat may have also tired markets out after a mini rally so far in July. The last 24 hours has seen sentiment become more gloomy once again as investors looked forward to multiple data releases and earnings reports this week that’ll set the stage for some important central bank meetings over the next couple of weeks. The US CPI report will be the main highlight tomorrow, but we shouldn’t forget the start of the Q2 earnings season either, which will shed some light on how corporates are faring as the market narrative has flirted with the view that the US economy might already be in a recession. One bit of “good” news yesterday was the NY Fed’s long-run consumer inflation expectations series which showed a decent dip and helped encourage a big rally in bonds as the tug of war in the asset class continues.

More on that later but equities didn’t get that memo as they lost ground on both sides of the Atlantic yesterday with the S&P 500 shedding -1.15% by the close of trade, in what looked like a classic risk off rotation, with only Utilities and Real Estate higher, and the latter only barely up (+0.01%). Tech stocks led the declines, with the NASDAQ down by -2.26% whilst the FANG+ index of megacap tech stocks saw an even larger -4.52% decline as all 10 companies in the index lost ground. Along with a sour risk day, mega-cap shares were probably sluggish following the news over the weekend that Elon Musk would be pulling out of his Twitter deal. Small-caps were another underperformer, with the Russell 2000 down -2.11%, whereas the Dow Jones experienced a more modest -0.52% loss. Meanwhile in Europe it was much the same story, with the STOXX 600 (-0.50%) and Germany’s DAX (-1.40%) seeing decent losses of their own.

Speaking of Europe, all eyes are on what’s going to happen with the gas situation now that the Nord Stream pipeline is undergoing scheduled 10-day maintenance. European natural gas futures (-6.10%) did come down yesterday after rising for 4 consecutive weeks, thanks to the news at the very end of last week that Canada would return a turbine for the Nord Stream pipeline after their government issued a “time-limited and revocable” permit that removed it from sanctions. That said there are still significant jitters as to whether the pipeline will be turned back on again after the maintenance concludes, which meant that the Euro itself fell even closer to parity against the US Dollar. In fact, the euro closed near its weakest levels of the day at $1.0040, and has hit a fresh low of $1.0010 as we go to press as markets face up to the prospect of what a full cut-off of Russian gas would mean for the European economy. Speaking to DB’s Peter Sidorov yesterday, he tells me that the ambiguity over gas may linger as even if Russia did need this turbine part to restore stronger gas flows, the technical logistics may mean it would take an extra week or two to integrate into the pipeline. So the uncertainty may linger until early August.

Another factor behind the Euro’s decline recently has been the growing divergence in interest rates between the Fed (who’ve already hiked by 150bps this year) and the ECB (who haven’t even begun yet and with worries as to how far they will get). If the upcoming moves this month are in line with our economists’ (and market) expectations, then that divergence will only grow as the Fed hikes by 75bps for a second consecutive meeting, while the ECB commences the hiking cycle with a much smaller 25bps move. However, yesterday brought some more dovish news from the Fed, with Kansas City President George warning against moving too fast on rate hikes, saying that moving “too fast raises the prospect of oversteering”. That may not be too surprising given that George was the only FOMC voters to dissent from the 75bps majority last month in favour of a smaller 50bps hike. George also warned that the extra volatility the Fed injects into the market when its policy path is so uncertain may hurt Treasury market functioning, which seems like she was not a fan changing policy guidance with such short notice before the June FOMC, perhaps another reason for her dissent. Elsewhere, as discussed at the top, we also received the New York Fed’s latest Survey of Consumer Expectations for June. And whilst 1-year ahead inflation expectations hit a record high since the series began at 6.8%, 3-year ahead expectations came down from 3.9% in May to 3.6% in June, and 5-year ahead expectations fell from 2.9% to 2.8%.

That newsflow along with the more general risk-off tone helped support a major rally in Treasuries, with 10yr yields falling -8.8bps to 2.99%, as both inflation breakevens and real rates fell on the day. There was also a fresh flattening in the yield curve, with the 2s10s closing in inversion territory for a 5th day running, finishing at -8.5bps, which isn’t such a good sign as a recessionary indicator, and the length of the inversion now puts it ahead of the 3-day inversion back in late-March/early April, so this is getting harder to dismiss as just a blip. Furthermore, even the Fed’s preferred yield curve indicator of the near-term forward spread flattened to just 114bps, which is something we haven’t seen since early January after peaking at 270bps on April 1. This morning yields on 10yr USTs are another -3.34 bps lower at 2.954% as I type.

In Europe there was much the same pattern, with yields on 10yr bunds (-9.9bps), OATs (-10.3bps) and BTPs (-7.3bps) all moving lower. But the risk-off move meant there was a widening in peripheral spreads, and the iTraxx Crossover was another to widen (+8.6bps to 585bps), thus reversing three consecutive moves lower.

The losses in US and European equities are echoing in Asian this morning. The nervousness is not being helped by news of another Covid-19 surge in China as the renewed outbreak is raising fears of more lockdowns (see below). As I type, the Nikkei (-1.68%) is leading losses across the region followed by the Hang Seng (-1.57%) and the Kospi (-1.37%). In mainland China, the Shanghai Composite and (-0.83%) and CSI (-0.74%) are also lower. Outside of Asia, equity futures in DMs point to further losses with contracts on the S&P 500 (-0.54%), NASDAQ 100 (-0.68%) and DAX (-0.71%) all weaker. Oil prices are also lower overnight as recession fears and China’s Covid curbs weigh on demand prospects. As we go to press, Brent futures are -1.46% at $105.54/bbl and WTI futures -1.68% at $102.34/bbl.

Over in China, Shanghai city reported 59 new infections for Monday, above 50 for the fourth day in a row thus prompting the city authorities to another mass testing effort after finding a highly transmissible Omicron subvariant.

Early morning data showed that producer prices in Japan rose +0.7% m/m in June (v/s +0.6% expected) and against a +0.1% rise in May.

In the UK, the ruling Conservative party are opening nominations for the next leadership today, with voting starting tomorrow. MPs will then, through a series of voting rounds over the next week choose their favourite two candidates, from which point the party membership will make their decision and with the new PM expected to be announced on September 5.

There wasn’t much data to speak of yesterday, but Italian retail sales for May grew by +1.9% (vs. +0.4% expected), and the prior month was also revised positively.

To the day ahead now, and data releases include the German ZEW survey for July, as well as the US NFIB small business optimism index for June. Central bank speakers include BoE Governor Bailey, the Fed’s Barkin and the ECB’s Villeroy. Finally, earnings releases today include PepsiCo.

Tyler Durden

Tue, 07/12/2022 – 07:59

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com