Manhattan Rents Soar To New Record Amid Inflation Storm

Manhattan apartment rents jumped again in June on a relentless climb into uncharted territory. A combination of low supply, soaring interest rates, and increasing demand implies leasing activity will keep climbing through August and push median average rents in the city well over the $4,000 mark.

Bloomberg reports new data from appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate that shows average apartment rents in Manhattan topped $4,050, a new record high. It was an increase of $50 over May when prices breached the $4,000 mark for the first time. Prices from a year ago are up a whopping 25%. Average rents for most-expensive units topped $5,000 for the first time, the firms said in the report.

Rents are smashing records and will increase further this month and August, mainly because of seasonal flows.

Julia Segal, leasing director at the brokerage firm Compass, said rising mortgage rates had sparked housing affordability issues that increased the number of renters in a market with limited inventory.

“Interest rates rising is certainly turning some buyers into renters,” Segal said, “and that’s increasing the renter pool.”

The report shows apartment listing times on the market slid from 52 days in May to 50 in June — a year before, listed apartments sat for 87 days.

Supply remains very tight across the borough. The vacancy rate a year ago was around 12% and has since plunged to 2%. High demand and tight supply are other reasons for summer rent price acceleration.

We noted in mid-April “Not A Peak” – Manhattan Apartment Rents Hit Another Record High and correctly pointed out how prices would soar this summer.

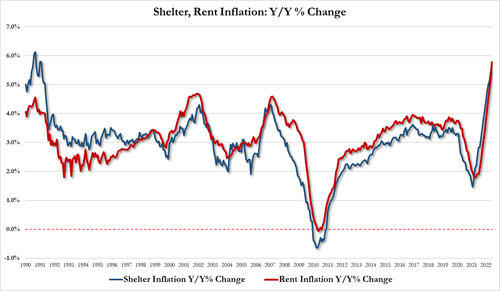

Rising rents in NYC is not an isolated problem — it’s a nationwide crisis as consumer prices in June jumped to another 40-year high. Focusing on housing costs, shelter inflation +5.61%, up from 5.61%, highest since 1992, and rent inflation +5.78%, up from 5.22%, highest since 1986.

And what’s worse is real wages continue to slump for the 15th month in a row as Americans’ purchasing power is wiped out in the inflation storm.

Rising rent, gas, and food costs are squeezing working-poor households to a near-breaking point — where millions of people are on the verge of eviction.

The rising risk of a recession could offer consumers relief with a downshift in prices. Still, there’s a caveat: increasing job loss.

One positive development is a prediction by Jonathan Miller, president of Miller Samuel, who believes rent prices could cool in September. He noted price declines might come with a recession.

Tyler Durden

Fri, 07/15/2022 – 20:40

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com