Morgan Stanley: Central Bank “Liquidity Surge” Could Push S&P To 3,500

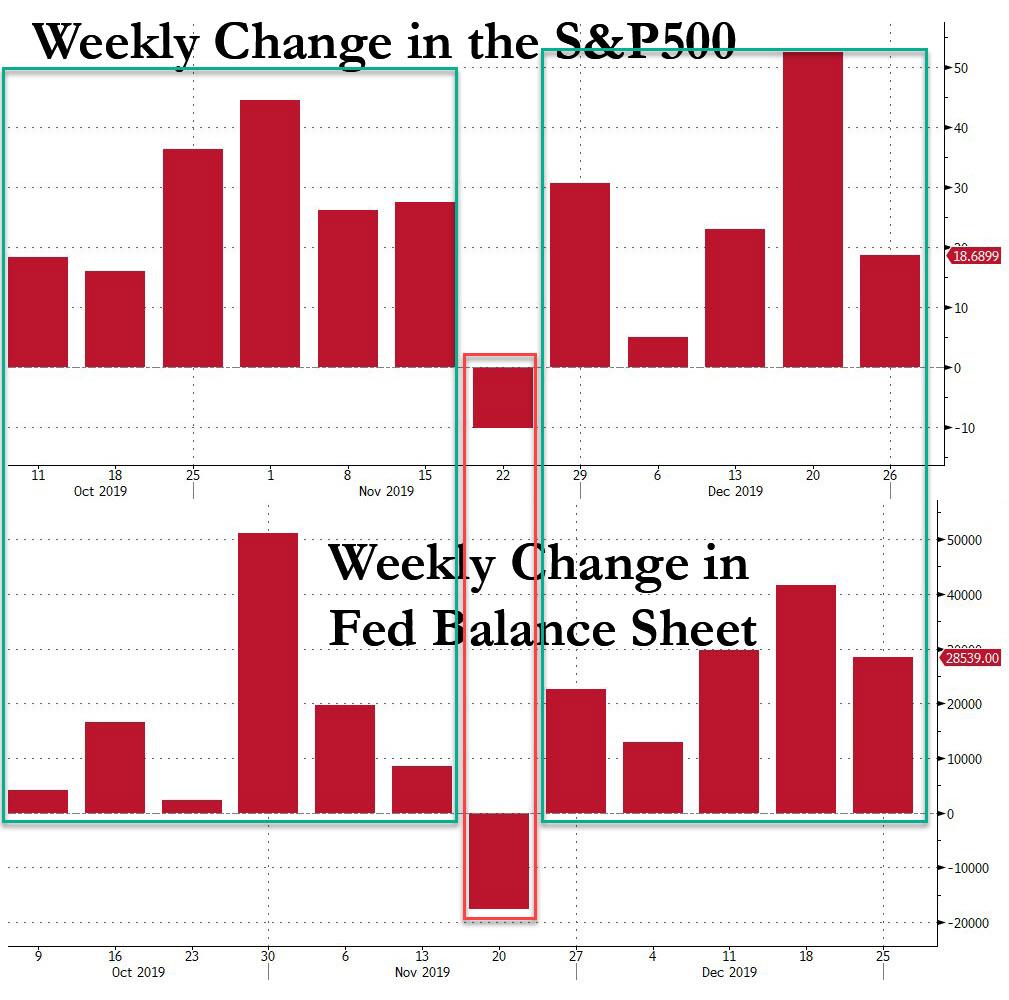

Over the past two months, when commenting on the market meltup, we said that there is just one chart that traders need to track as to the causes of this impressive move higher in risk assets. It is the chart – presented below – which shows the weekly change in the Fed’s balance sheet, and which has increased 11 of the past 12 weeks ever since the launch of the Fed’s QE4, superimposed over the weekly change in the S&P500. And as we have pointed out repeatedly, whereas the S&P has risen every week when the Fed’s balance sheet rose, it dropped the one week when the balance sheet declined, effectively indicating that the entire market surge has been a function of Fed liquidity.

And while this theory has had its share of opponents, especially among the armchair “traders” of fintwit, one bank which is in full agreement with the “liquidity surge” as the cause for the market meltup is Morgan Stanley, whose chief US equity strategist Michael Wilson, writes in his latest weekly note that “we begin the New Year where we left off with excessive liquidity supporting risky assets.“

Commenting simply that “liquidity wins”, Wilson writes that “the fourth quarter of 2019 was a mirror image of 4Q2018” as almost all stocks and sectors participated in a strong rally “fueled by a central bank pivot.” Putting his own trade reco in context, Wilson writes that in the US, “we have had much more confidence in the first part (liquidity) of that narrative than the second (accelerating growth) and have been expecting liquidity to win out. In our year ahead outlook back in November and subsequent research notes, we suggested the S&P 500 could surpass our 2020 year end 3250 Bull case target due to this almost unprecedented liquidity surge.“

Echoing what we have repeatedly said, the Morgan Stanley strategist writes that with “over half a trillion dollars of balance sheet expansion provided by the Fed and others, it was pretty easy for us to be bullish on asset prices into year end. Sure enough, the S&P 500 has achieved our year end 2020 bull case already and looks poised to go higher.”

The problem Wilson is grappling with is just how much further (and longer) will this unprecedented “liquidity surge” last and whether it will push the market substantially higher.

Here are the fact: as a reminder, the Fed, BOJ and ECB are expanding their collective balance sheets by $100B per month in addition to the Fed’s overnight Repo operations which have ranged from $75B to $490B at year end. This is the exact opposite of year end 2018 when tight liquidity conditions led to a broad year-end meltdown in asset prices. As Wilson notes, “the market impact this year has been the opposite too–a 4Q melt-up. While year end repo operations will now fade, the Fed’s $60B per month T-Bill buying will not, nor will the ECB or BOJ’s more traditional QE operations. Not to be left out, the PBOC decided to cut its RRR rate by 50bps last week which effectively releases $115B worth of reserves into the financial system.”

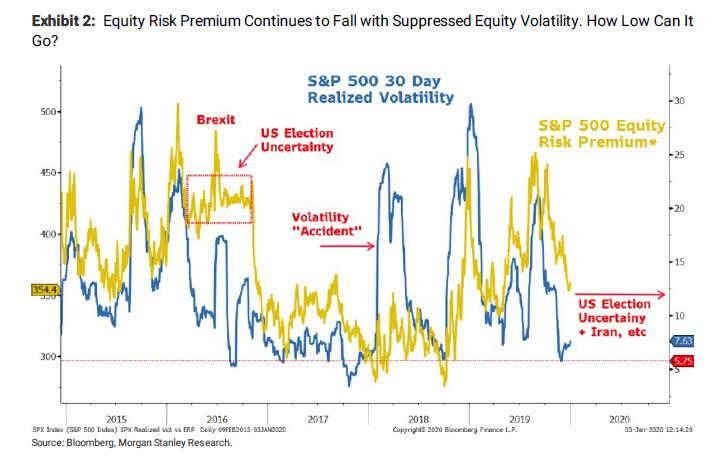

Now whether one wants to call what the Fed is doing QE4 or not (we do, some other more clueless elements still refuse to admit what BofA , Deutsche Bank and Jefferies recently conceded is indeed QE), Wilson tanley writes that in his view, “this excess liquidity has suppressed volatility to extremely low levels, potentially eliminating two way risk in markets”, and adds:

While higher than a few weeks ago, 30 day realized vol for the S&P 500 is still just 7.3% which is in the first percentile for the past 100 years. Given the proliferation of systematic strategies that target volatility or use volatility as an input for how much risk they can take, we know that this low volatility has attracted significant flows to the equity markets with liquid futures markets (i.e. S&P 500, Nasdaq 100) the most likely recipients. Since September, our QDS team calculates there has been close to $200B of inflows to global equities just from this source alone with about ⅔ of those flows making it to US equities. It is highly likely that low vol and price momentum has attracted investment from other passive investors and active managers, too.

Morgan Stanley also notes that is also “more than coincidental” that the August and October lows occurred simultaneously with the Fed’s announcement of temporary and the permanent open market operations to deal with the stresses in the repo market. Furthermore, once the Fed announced on October 11th it would also purchase $60B in T-Bills as a means of increasing the banking system’s excess reserves by $300-400B, the S&P 500 was able to finally break out of its well defined channel that had contained it since January 2018.

To demonstrate this point, Morgan Stanley also has published a chart that is sure to trigger fintwit’s chart nazis, Fed sycophants and snowflake academics:

And while Wilson notes that the de-escalation in US-China trade tensions may have also played an important role too, “liquidity was the primary factor and will continue to be the most important variable going forward in our view.” To the end, Wilson cautions that fading year end repo operations may create a small window here where vol can rise temporarily before ongoing balance sheet expansion provides further salve later.

What does the Fed’s liquidity onslaught mean for markets? As Wilson notes, using the bank’s ERP framework, “P/Es could expand toward 20x should the equity risk premium fall toward 300-325bps and rates remain roughly constant”.

So assuming forward 12 month EPS forecasts of $177.75 fall modestly toward $175 over the next few months, that multiple gets Wilson to predict that the market meltup can hit up to 3500 in the first half, which is rather close to Michael Hartnett’s 3,333 S&P target by March 3.

That said, the equity strategist cautions that “the second half could be a different story as the Fed and other central banks curtail their balance sheet expansion and volatility returns to more normal levels along with 10 year yields. Depending on how the economic and earnings data come in during the year will determine if we need to raise our year end targets or not.”

Even so, the main point Wilson underscores is that “a liquidity driven bull market typically overshoots fair value, which we still see closer to 3000-3250 by year end as rates rise from economic growth reaccelerating in the second half but earnings growth still disappoints from weaker margins.“

Yet even if data keeps coming in poor, “strong liquidity should limit the damage from disappointing data to less than 5 percent for the S&P 500. Friday’s muted reaction in the S&P 500 to yet another disappointing mfg PMI number and to the recent events in the Mideast is a good example of how problematic data/news continues to be absorbed by excess liquidity.”

Tyler Durden

Wed, 01/08/2020 – 14:35

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com