World Stocks Pause At Record High To Asses US-China Trade Deal

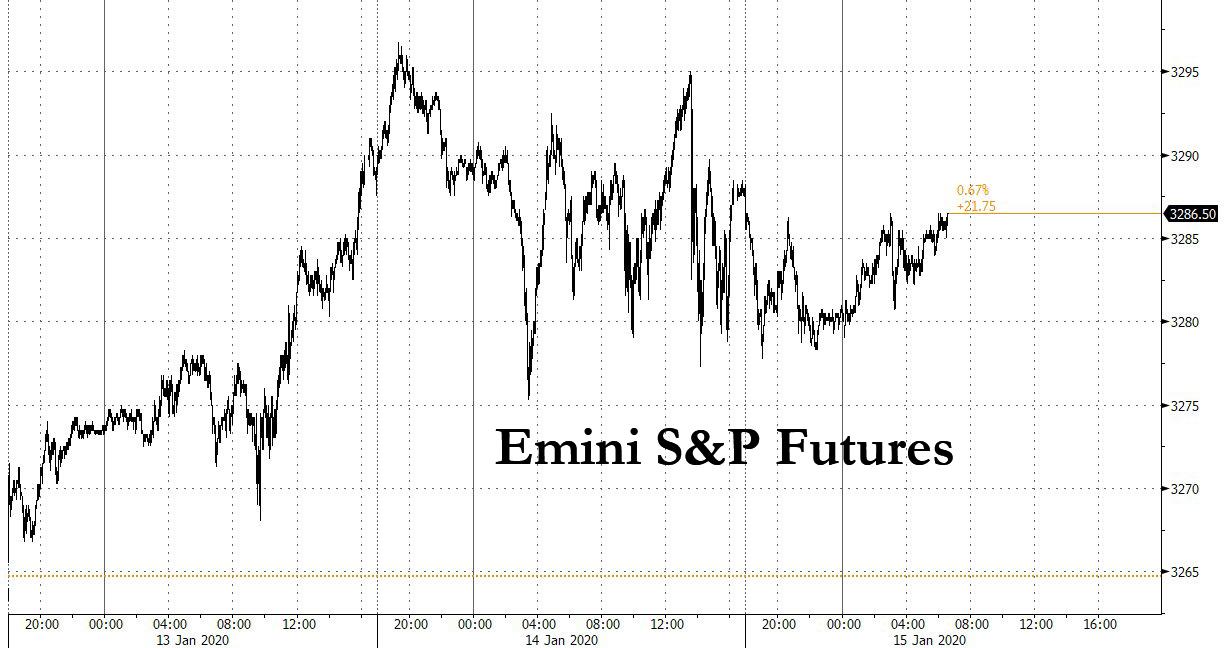

US equity futures dipped and world stocks eased off record highs on Wednesday with US and German bond yields slipping as euphoria over the US-China trade deal set to be announced today fizzled after Steven Mnuchin said tariffs on billions of dollars of Chinese goods coming into the U.S. are likely to stay in place until after the U.S. presidential election.

Today’s main event will be the phase one trade deal signing. As DB’s Jim Reid writes, the closely guarded text still remains a bit of a mystery and as such the devil will be in the detail. All will be revealed later though with a reminder that the signing is expected to take place at the White House at 11.30am EST. It’s said to be an 86 page document but for those of us used to 550 plus page Brexit agreements that were eventually voted down this is a walk in the park. Joking aside the main headline yesterday came after Europe went home as Bloomberg reported (after others had hinted earlier) that existing tariffs on billions of Chinese goods will remain until after the US election to allow the administration to review Chinese compliance before removing them. However, Treasury Secretary Steven Mnuchin said later that China won’t win US tariff relief until the two countries reach a Phase 2 accord and added that there was no link between the timeline for tariff reductions and the November election. So the US will maintain 25% tariffs on $250 billion of Chinese imports and 7.5% on a further $120 billion for now. This news wasn’t a big surprise really but markets lost traction and dipped into the red after the headlines offsetting the small positive momentum post the dovish US CPI and the bumper start to US bank earnings. Elsewhere, the top trade officials of the US, the EU and Japan struck a deal yesterday in Washington to expand the kinds of industrial subsidies prohibited by the WTO.

“Despite the landmark signing of the U.S.-Sino trade deal today, markets are unenthused,” said Rand Merchant Bank economist Nema Ramkhelawan-Bhana. “Phase One, though positive, is merely the start of a long process to undo the damage already inflicted on the global trade order.”

Share prices pulled back from recent highs on Wednesday after Wall Street closed weaker on Tuesday, with the Stoxx 600 index dipping in the red, with gains for health-care shares countered by drops in carmakers and insurers, triggered by Mnuchin’s comments that U.S. tariffs on Chinese goods would stay until the completion of a second phase of a U.S.-China trade agreement. Their eventual removal hinged on Beijing’s compliance with the Phase 1 accord, Bloomberg reported, citing sources.

Earlier in the session, MSCI’s index of Asian shares ex-Japan retreating from 19-month peaks and Japan’s benchmark Nikkei likewise falling 0.5%, off a four-week high, hours before the U.S. and China are due to sign their phase-one trade deal. The region’s benchmark MSCI Asia Pacific Index snapped a four-day winning streak. Philippine and Indonesia shares were among the biggest decliners, while Australia’s S&P/ASX 200 Index and the New Zealand Exchange 50 Gross Index hit new highs. Bourses in China, South Korea and Hong Kong lost between 0.5%-0.7% on the day. India’s Sensex also declined. Technology was the worst-performing sector. Heavyweights such as Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co. both retreated after recent rally. Here are some notable movers in the region:

European bonds held gains after data showed the German economy expanded at the slowest pace in six years in 2019…

… with gilts outperforming after U.K. inflation ebbed to a three-year low, virtually assuring more Bank of England interest-rate cuts.

The 18-month long trade feud between the US and China is set for a ceasefire in just hours as President Donald Trump and Chinese Vice Premier Liu He sign an initial agreement that would boost Chinese purchases of U.S. manufactured and agricultural goods, energy and services. Dubbed the Phase 1 deal, it may ease concerns about the economy, if not markets which are at all time highs on constant “trade war optimism”, as the conflict between the world’s two largest economies hit hundreds of billions of dollars in goods, uprooted supply chains and slowed economic growth.

Stocks stumbled after Mnuchin’s Tuesday comments that U.S. tariffs on Chinese goods would stay until the completion of a second phase of a U.S.-China trade agreement. Their eventual removal hinged on Beijing’s compliance with the Phase 1 accord. The news did not entirely surprise markets, however, and many attributed the pullback to profit-taking off the recent rally than to any turn in underlying sentiment.

“The Phase One deal had pretty much been priced in so (Mnuchin’s) comments took some steam out of the market last night and that’s feeding through into today,” said Justin Onuekwusi, a portfolio manager at Legal & General Investment Management.

The jittery mood gave a mild boost to safe-haven assets such as gold, with the precious metal ticking up 0.3% after two days of losses. The Japanese yen and high-grade bonds also firmed slightly, though the yen was only 0.1% higher versus the dollar and a whisker off 7-1/2-month lows of 110.22. The euro rose versus the dollar, which erased earlier gains against some of its biggest peers. The trade-reliant Australian dollar slipped 0.3% against the greenback while the euro was broadly flat.

The big mover was the British pound which is down almost 2% this month versus the dollar as dismal economic numbers and policymaker comments have fanned expectations of an interest rate cut as soon as this month. A quarter-point cut is now fully priced by end-2020.

Elsewhere, U.S. Treasury yields also ticked down, with the benchmark 10-year note yield falling more than 2 basis points to 1.7864%, hurt also by Tuesday’s data showing consumer prices undershooting expectations in December, which could allow interest rates to stay unchanged this year. German 10-year yields also eased 2 bps, having earlier hit two-week highs around minus 0.169% but their direction may hinge on 2019 German growth numbers which showed the biggest euro zone economy grew at its slowest since 2013.

The Market was also weighing the impact of the U.S. government nearing publication of a rule to vastly expand its powers to block shipments of foreign-made goods to China’s Huawei, as it seeks to squeeze the blacklisted telecoms firm.

“I think the Trump administration will continue to put pressure on China in this way or some other, even after signing a Phase 1 deal,” Yuichi Kodama, chief economist at Meiji Yasuda Life Insurance said.

And then there are earnings, with traders now focusing closely on company earnings from now, as Q4 EPS are expected to fall 0.6%. Big banks Goldman Sachs, Bank of America, BlackRock are among those reporting results later on Wednesday and expectations are high after JPMorgan posted record profits and Citi beat estimates, though Wells Fargo profits slumped.

“The market will see trade escalation taken off the table but it will start to focus on earnings. We saw huge multiple expansions in 2019 and that won’t happen again until we see earnings coming through,” Onuekwusi said.

In commodities, oil futures drifted, with West Texas Intermediate trading close to $58 a barrel. Gold nudged higher.

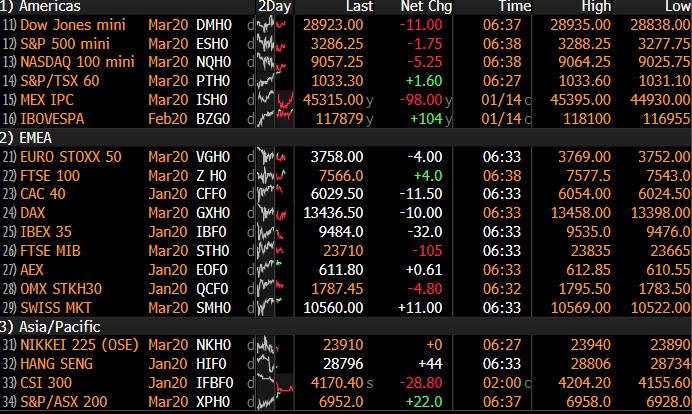

Market Snapshot

- S&P 500 futures down 0.1% to 3,283.25

- STOXX Europe 600 down 0.07% to 419.31

- MXAP down 0.4% to 173.58

- MXAPJ down 0.3% to 568.44

- Nikkei down 0.5% to 23,916.58

- Topix down 0.5% to 1,731.06

- Hang Seng Index down 0.4% to 28,773.59

- Shanghai Composite down 0.5% to 3,090.04

- Sensex down 0.3% to 41,809.62

- Australia S&P/ASX 200 up 0.5% to 6,994.84

- Kospi down 0.4% to 2,230.98

- German 10Y yield fell 3.0 bps to -0.201%

- Euro up 0.04% to $1.1132

- Brent Futures down 0.5% to $64.16/bbl

- Italian 10Y yield rose 1.8 bps to 1.224%

- Spanish 10Y yield fell 1.8 bps to 0.461%

- Brent Futures down 0.5% to $64.16/bbl

- Gold spot up 0.4% to $1,552.75

- U.S. Dollar Index up 0.01% to 97.39

Top Overnight News from Bloomberg

- Existing tariffs on billions of dollars of Chinese goods coming into the U.S. are likely to stay in place until after the U.S. presidential election, and any move to reduce them will hinge on Beijing’s compliance with the phase-one accord, people familiar said

- President Donald Trump is poised to sign a deal with China on Wednesday that for the first time would punish Beijing if it fails to deliver on pledges related to its currency, intellectual property and the trade balance.

- Germany’s economy expanded at the slowest pace in six years in 2019, when manufacturing took a battering and the country was dragged to the brink of a recession. Expansion was just 0.6% amid trade tensions and a broader slowdown in demand that added to fundamental structural challenges the country is battling

- Qube Research & Technologies Ltd., the quant fund spun out from Credit Suisse Group AG with $1 billion in assets, has hired a trader from Barclays Plc as the firm expands into credit

- University of Oxford, which traces its roots back to the 11th century, plans to sell sterling notes maturing in 2117, as pound investors seek out names likely to ride out Brexit risks

- Ashmore Group Plc posted a 12th straight quarter of investor inflows, driving its assets to a record and bucking the downward trend among active asset managers

- U.S. government is nearing publication of a rule that would vastly expand its powers to block shipments of foreign-made goods to China’s Huawei as it seeks to squeeze the blacklisted telecoms company, Reuters said, citing two sources

- ECB officials see euro-area economy stabilizing at the start of 2020. Bank of France Governor Francois Villeroy de Galhau said recessions in the U.S. or Europe can practically be excluded this year. Executive Board member Yves Mersch said the 19-nation economy was “certainly giving good signs of stabilization”

- China added liquidity to the financial system, helping to offset a cash squeeze ahead of the Lunar New Year holiday, while keeping interest rates on the loans unchanged.

- Australian Prime Minister Scott Morrison said government will spend “as much as it takes” to help fire victims

- U.S. House will vote Wednesday to send articles of impeachment against Donald Trump to the Senate for a trial that’s expected to begin early next week, but the president has yet to settle on either his defense strategy or the team that will represent him

Asian equity markets followed suit to the cautious performance on Wall St where there was a bias to the downside for most major indices on trade-related headwinds after US officials confirmed that China tariffs are to remain until after the US election despite the Phase 1 deal, although the DJIA remained afloat helped by banking names including JPMorgan at the start of earnings season. ASX 200 (+0.5%) extended on record highs and edged closer to the 7000 landmark amid mild gains in financials and as gold miners outperformed after a rebound in the precious metal, while Nikkei 225 (-0.5%) was lacklustre following the recent pullback from the 24k level and near its yearly high. Hang Seng (-0.4%) and Shanghai Comp. (-0.5%) also traded subdued on disappointment that the Phase 1 deal will not include a tariff rollback, which overshadowed the liquidity efforts by the PBoC that had announced CNY 300bln in MLF lending and to inject CNY 100bln through 14-day reverse repos ahead of the Lunar New Year scheduled next week. Finally, 10yr JGBs oscillated beneath the 152.00 level with participants sidelined ahead of a 5yr JGB auction and after BoJ Governor Kuroda failed to provide any fresh insights regarding monetary policy ahead of next week’s meeting, although prices later recovered as all metrics pointed to a stronger 5yr auction.

Top Asian News

- MUFG Is Said to Appoint Kamezawa as CEO, Replacing Mike

- China Adds $58 Billion Into Banking System as Holiday Nears

- Bharti Airtel Raises $3 Billion for Fee Payment Due in a Week

- Indonesia Makes Arrests as Scandal-Hit Insurer Probe Widens

European equities mostly see a relatively lacklustre session [Euro Stoxx 50 -0.1%] ahead of the much-anticipated Phase One deal signing with the region holding a more cautious bias. This follows on from a similar APAC performance which saw Chinese markets subdued on disappointment that US will not currently roll back on existing China tariffs. UK’s FTSE 100 outperforms on the back of a weaker Sterling boosting exporters in light of further dovish rhetoric from BoE dissenter Saunders coupled with sub-par UK CPI readings. Sectors are mixed with no clear reflection of the overall risk sentiment in the market. Healthcare outperforms with support from Roche (+0.6%) after the Pharma-giant announced commercial availability of a test which will help healthcare professionals better monitor and manage transplant patients at risk of infections. Elsewhere, the IT sector is underpinned by ASM International (+9.6%) whose share were bolstered by an upgrade to prior guidance. In terms of individual movers, Chr Hansen (-6.8%) fell to the foot of the Stoxx 600 following overall downbeat earnings and a downgraded outlook. Elsewhere, RBS (-2.7%), Eurazeo (+3.3%), Safran (+1.5%) have all been influenced by broker action.

Top European News

- Aston Martin Needs at Least GBP400m of Equity, Jefferies Says

- U.K.’s Flybe Rescue Shows It’s Tough for Governments to Go Green

In FX, the Pound wasn’t that perturbed about typically dovish commentary from BoE’s Saunders, but Cable subsequently retreated towards recent sub-1.3000 lows and Eur/Gbp rebounded to circa 0.8570 from just under 0.8540 when headline and core UK inflation both missed consensus by some distance. Indeed, the former printed at its weakest y/y pace in 3+ years and latter slowed to 1.4% from 1.7% previously and forecast to tip January easing expectations over 60% compared to less than evens ahead of remarks from one of the resident MPC rate cut dissenters.

AUD – Revelations that US-China trade deal Phase One will not come with any further tariff roll-backs or removal of existing levies on Chinese goods have undermined the Aussie more than most majors given its closer correlation to sentiment surrounding the issue and Yuan moves by proxy. Hence, Aud/Usd has reversed through 0.6900 again, as Usd/Cnh pares more losses and hovers above the latest lower Usd/Cny midpoint fix in contrast to the recent trend.

CHF/JPY/EUR/CAD/NZD/NOK/SEK – The Franc continues to outperform its G10 peers in wake of Switzerland’s inclusion on the list of currency manipulators compiled by the US Treasury, but Usd/Chf and Eur/Chf are also slipping on technical grounds and an element of safe-haven positioning to around 0.9655 and 1.0745 respectively. Similarly, Usd/Jpy is probing lower amidst an unwind of risk-on flows, and after topping out only a pip or so over 110.00 compared to 110.20 at one stage on Tuesday, while Eur/Usd is forging fresh 1.1150+ peaks after finally breaching aligning DMAs (21/200 marks both at 1.1138). Elsewhere, the Loonie remains softer within 1.3055-78 parameters against the backdrop of softer crude prices that are also niggling the Norwegian Krona, but not quite as much as its Swedish counterpart following a wider trade surplus vs broadly in line/benign CPI and CPIF metrics.

EM – Some respite for the Rand as SA retail sales exceed forecast, but little consolation for the Lira due to ongoing Libya angst.

In commodities, WTI and Brent front-month futures traded somewhat lacklustre after the Russian and UAE Energy Ministers dismissed source reports that the OPEC+ is to delay the March 5th/6th meeting to June. WTI Feb’20 futures reside just above the USD 58/bbl mark having dipped below the figure earlier in the session ahead of the 200DMA around USD 57.84/bbl. As a reminder, the OPEC Oil Market Report is to be released at 12:40GMT following yesterday’s EIA STEO which downgraded its 2020 world oil demand growth. Meanwhile, today will also see the weekly EIA crude stocks release after last night’s API figures printed a surprise build of 1.1mln barrels (vs. exp. draw of 500k barrels) which added selling pressure to the complex. Elsewhere, spot gold saw modest gains as APAC traders digested reports that US will not be rolling back existing China tariffs until after the election – with the yellow metal meandering around 1550/oz. Meanwhile, copper prices fell from 8-month highs on the aforementioned tariff reports which potentially dampens demand prospects for the red metal. Finally, Dalian iron ore futures swayed within tight ranges as traders juggled the US tariffs on China with lower port inventories.

US Event Calendar

- 7am: MBA Mortgage Applications, prior 13.5%

- 8:30am: PPI Final Demand MoM, est. 0.2%, prior 0.0%; PPI Final Demand YoY, est. 1.3%, prior 1.1%

- 8:30am: PPI Ex Food and Energy MoM, est. 0.2%, prior -0.2%; PPI Ex Food and Energy YoY, est. 1.3%, prior 1.3%

- 8:30am: PPI Ex Food, Energy, Trade MoM, est. 0.2%, prior 0.0%; PPI Ex Food, Energy, Trade YoY, prior 1.3%

- 8:30am: Empire Manufacturing, est. 3.6, prior 3.5

- 2pm: U.S. Federal Reserve Releases Beige Book

Central Banks

- 11am: Fed’s Harker Speaks in New York

- 11am: Fed’ Daly Speaks in San Ramon, CA.

- 12pm: Fed’s Kaplan Speaks to the Economic Club of New York

- 2pm: U.S. Federal Reserve Releases Beige Book

DB’s Jim Reid concludes the overnight wrap

The highlight today will likely be the phase one trade deal signing. The closely guarded text still remains a bit of a mystery and as such the devil will be in the detail. All will be revealed later though with a reminder that the signing is expected to take place at the White House at 11.30am EST. It’s said to be an 86 page document but for those of us used to 550 plus page Brexit agreements that were eventually voted down this is a walk in the park. Joking aside the main headline yesterday came after Europe went home as Bloomberg reported (after others had hinted earlier) that existing tariffs on billions of Chinese goods will remain until after the US election to allow the administration to review Chinese compliance before removing them. However, Treasury Secretary Steven Mnuchin said later that China won’t win US tariff relief until the two countries reach a Phase 2 accord and added that there was no link between the timeline for tariff reductions and the November election. So the US will maintain 25% tariffs on $250 billion of Chinese imports and 7.5% on a further $120 billion for now. This news wasn’t a big surprise really but markets lost traction and dipped into the red after the headlines offsetting the small positive momentum post the dovish US CPI and the bumper start to US bank earnings. Elsewhere, the top trade officials of the US, the EU and Japan struck a deal yesterday in Washington to expand the kinds of industrial subsidies prohibited by the WTO.

By the close of play the S&P 500 and NASDAQ ended -0.15% and -0.24% respectively with both pulling back from fresh intra-day all time highs again. This followed the STOXX 600 eking out a small gain of +0.29% before the trade headlines. Elsewhere 10y Treasury yields were -3.5bps lower following a slightly delayed reaction to the CPI report while the 2s10s curve flattened a couple of basis points. The 10y Treasury-Bund spread also broke below 200bps meaning the spread has tightened for five successive sessions. In commodities Gold (-0.09%) continued to edge lower while Brent rose +0.73%.

In an otherwise quiet session it was the big beats for JP Morgan and Citi which grabbed the headlines in the early going. In the case of the former, revenues were ahead of consensus by over $1bn driven by FICC while EPS of $2.57 also smashed expectations for $1.98. Similarly for Citi, strong FICC performance also boosted revenues above consensus to over $18bn while EPS came at $1.90 compared to expectations for $1.83. Elsewhere Wells Fargo did buck the trend somewhat after reporting earnings slightly below consensus. In response, the share prices for JPM and Citi were up +1.17% and +1.56% respectively but with Wells Fargo closing down -5.39%.

Back to trade and Reuters reported overnight that the US Commerce Department has drafted a rule that would allow it to block exports to Huawei specifically if US components make up more than 10% of the product value. Currently, the US can block exports of many high-tech products to China from other countries if US-made parts make up more than 25% of the value. The Commerce department has also drafted another rule that would subject foreign-made goods based on US technology to American oversight. This could be a sign that trade related tension are likely to linger even with a phase one deal signed today.

Asian markets are trading down this morning on the trade and tariff related news mentioned above. The Nikkei (-0.53), Hang Seng (-0.75%), Shanghai Comp (-0.69%), CSI (-0.81%) and Kospi (-0.54%) are all lower. The onshore Chinese yuan is also trading down -0.14% to 6.8936. Elsewhere, futures on the S&P 500 are down -0.24%.

Back to the details of the CPI data yesterday in the US. The core reading of +0.1% (+0.113% unrounded) was below expectations for +0.2% however the annual rate did still hold steady at +2.3% yoy. In the details personal care products had the fourth largest fall in history and lodging away and household furnishings were also significant detractors. On the positive side health insurance prices continued to grow while medical care commodities was a big contributor.

The only other print in the US was the December NFIB small business optimism reading which weakened 2pts to 102.7 (vs. 104.6 expected), albeit within the c.3pt range of the last three months. There was no data of note in Europe yesterday.

Before the day ahead a mention that yesterday Nick and Craig in my credit team published a report looking at current valuations for USD and EUR HY from the perspective of cash prices and analyse what current levels have historically meant for performance going forward. See the link to the full report here.

To the day ahead now, where all eyes will be on the signing of the first phase of the trade deal between the US and China and Washington. As for data, in the US we’re due to get the December PPI report and January Empire manufacturing reading. In Europe the main data of note are December inflation prints in France and the UK as well as November industrial production for the Euro Area. The 2019 GDP reading for Germany is also scheduled. Away from the data we get the Fed’s Beige Book while the Fed’s Daly, Harker and Kaplan are also due to speak. The ECB’s Holzmann and Villeroy, along with the BoE’s Saunders also speak. Finally, Bank of America and Goldman Sachs report earnings.

Tyler Durden

Wed, 01/15/2020 – 07:06

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com