White House Panics As Gasoline Prices Rebound, Mulls Export Ban, Blasts OPEC+ “Hostile Acts”

OPEC+ could be on the verge of one of the largest production cuts in two years, a move White House officials would undoubtedly have a ‘panic attack’ as they attempt to dissuade the 23 crude-producing countries and its allies, such as Russia, from making the cuts.

OPEC+ is considering cutting 2 million barrels a day, and on the smaller side, a reduction of 1-1.5 million barrels a day, delegates said. Such a move would be a blow to Washington as the Biden administration has scrambled to unleash record amounts of crude from the strategic petroleum reserve to tame soaring crude prices this summer.

“Higher oil prices, if driven by sizeable production cuts, would likely irritate the Biden administration ahead of US midterm elections,” Citi strategists wrote in a note.

Citi strategists appear correct: CNN obtained some of the draft talking points circulated by the White House to the Treasury Department this week and called the prospect of a production cut a “total disaster” and “hostile act.”

“There could be further political reactions from the US, including additional releases of strategic stocks,” the strategists added. They said the Biden administration could also push forward with an anti-trust bill targeting OPEC.

But that’s not all. According to Bloomberg, White House officials are discussing possible export bans on gasoline, diesel, and other refined petroleum with the Energy Department.

People familiar with discussions said administration officials are discussing export bans of refined products with top oil industry leaders as the risk of an OPEC+ reduction could catapult fuel pump prices higher ahead of the midterm elections in November.

And given the resurgence in crude and wholesale gasoline prices, regular pump prices are set to soar again…

Another person said the Energy Department is analyzing the economics of an export ban. Bloomberg said both people familiar with talks asked not to be identified because discussions are still private.

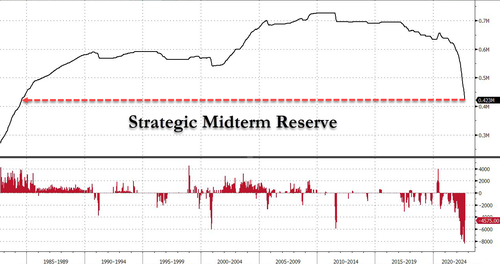

Despite Biden’s SPR drain, hitting levels not seen since 1984, the export ban could be the most controversial move yet by the desperate administration to tame pump prices ahead of the midterm elections next month.

Biden’s political emptying of the SPR has left it with a record low of just 22 days of supply…

Top oil execs and industry experts have blasted the proposed export ban, saying it could backfire and result in even higher gasoline, diesel, and jet fuel prices, while throwing energy markets into turmoil in Europe ahead of winter.

In a letter to the Energy Department, Exxon’s CEO Darren Woods wrote last week that “continuing current Gulf Coast exports is essential to efficiently rebalance markets—particularly with diverted Russian supplies.”

“Reducing global supply by limiting US exports to build region-specific inventory will only aggravate the global supply shortfall,” Woods said.

On Tuesday, the American Petroleum Institute warned any attempt to ban exports will disrupt not just global markets but harm US national security and geopolitical standing. API continued:

Banning or limiting the export of refined products would likely decrease inventory levels, reduce domestic refining capacity, put upward pressure on consumer fuel prices, and alienate US allies during a time of war. For these reasons, we urge the Biden administration to take this option off the table and focus instead on working with us on policies that will strengthen US energy security and protect consumers.

API outlined the major points from a July study via the American Council for Capital Formation about the economic impacts of a potential export ban of refined products:

1. An export ban could result in the shuttering of an estimated 1.3 million barrels per day of US refining capacity (7% of US total) due to trapped refinery production in the Gulf Coast. The loss of this capacity would likely strand a surplus of crude oil in the Central United States, halting important upstream energy production.

2. An export ban could result in higher product prices for US fuel consumers, with more than two-thirds likely to experience price increases of more than 15 cents per gallon for gasoline and 45 cents per gallon for distillates.

3. An export ban could cause a net loss to US GDP of more than $44 billion in 2023.

4. An export ban could eliminate 85,000 jobs this year and 35,000 job losses during 2023.

“There simply is not sufficient pipeline connectivity or the range of economic shipping alternatives that would be required to transport significantly more fuel to the East Coast from refineries in the Gulf, API continued, adding, “Banning exports of fuel from the United States will not eliminate this challenge or make it easier and more affordable to supply American-refined fuel to the East Coast. Instead, by cutting into global fuel supplies, it would likely raise the cost of fuel imported into the East Coast from the global market.”

Tyler Durden

Wed, 10/05/2022 – 07:44

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com