JPMorgan’s Payrolls Scenario Analysis

While we posted an extensive preview of what the market expects from today’s NFP, JPM is out with a last minute scenario analysis of how it thinks the number will impact markets.

As JPM’s Ellen Wang writes, today’s report is an important catalyst prior to the Nov 2 Fed meeting. Powell commented the labor market as “extremely tight” with “unemployment rate near a 50-year low, job vacancies near historical highs, and wage growth elevated” in his last conference call. The Fed has now focused on slowing down the price level but also cooling off the labor market.

The NFP has been the key indicator for the Fed to gauge the status of labor market and a lower-than-expected NFP could be equities positive. NFP will be released at 8.30am ET; 255k survey vs. 315k prior. JPM chief economist Michael Feroli sees 300k increase with unemployment rate down to 3.6% (his full note is here).

Below is the US Market Intel scenario analysis for today:

- NFP prints above 400k – negative for stocks as bond markets reprice a higher terminal rate amid more hawkishness from the Fed to tight against the tight labor market.

- NFP prints above 260k – slight negative for stocks as the strong print would hurt the loosening labor market narrative we heard since the below-expected JOLTS number. Feroli sees 300k and BBG survey is 260k.

- NFP prints 100k – 200k – positive for equities. The combination of decline in JOLTS Job Openings and lower NFP could give the Fed more comfort on a loosened job market.

- NFP prints below 100k – unlikely but will be very favorable for stocks. The bond markets start pricing in a lower terminal rate as the labor market has shown material signs of loosening.

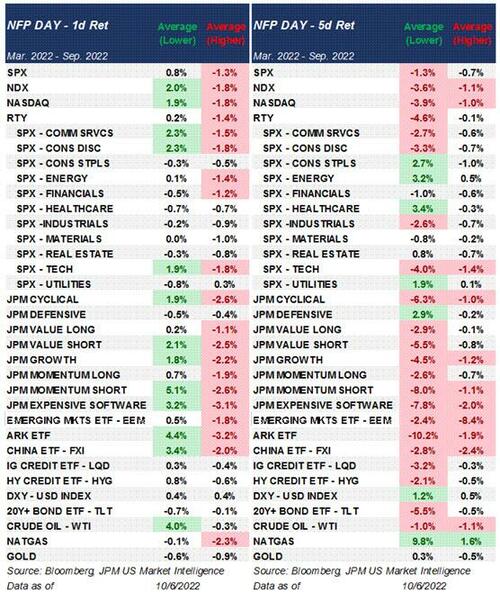

Finally, as a reminder, five of the last six monthly payrolls prints have ended with the S&P lower on the day (whether the data beat or missed)…

So will bad news be good news for traders, or will the market selloff regardless?

Tyler Durden

Fri, 10/07/2022 – 07:59

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com