JPM Beats Thanks To Record Net Interest Income Despite Surge In Credit Loss Provisions, $1 Billion In “Investment Security Losses”

The Third quarter earnings season has officially launched with a bang and with JPMorgan firing the started pistol at 645am ET when it reported Q3 earnings that came in stronger than expected, beating on the top and bottom line, with the company announcing that it hopes to resume its buyback “early next year” thus casting into doubt Jamie’s 6-9 month timeline for the next recession start.

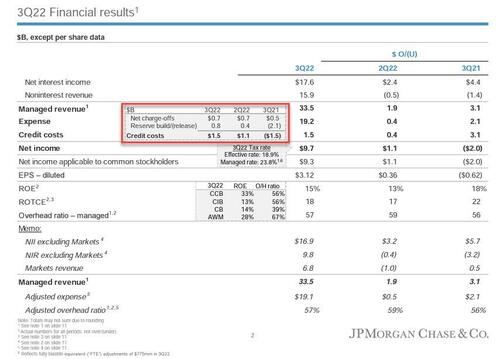

Here are the Q3 highlights:

The largest US bank reported adjusted revenue of $33.49 billion, up $3.1 billion from a year ago and beating the estimate of $32.35 billion a number which included net investment securities losses of $959 million, a 24c hit to EPS: expect to hear more about these in the conference call.

JPM’s top line translated into EPS of $3.12, which beat the consensus estimate of $2.88 but was 62 cents below the year ago number, largely due to $1.54 billion provision for credit losses, a $5 billion reversal from the $1.5 billion provision for gains a year ago. And while charge-offs rose only modestly from $0.5BN a year ago to $727 million (which was below the $885.3 million expected) it was the jump in reserve build to $808 million, a sharp reversal from the $2.1BN reserve release a year ago that was the biggest swing factor. This was far higher than the $545 million consensus estimate and suggests that the Hurricane Dimon warned about is getting closer.

A quick note on taxes: JPM disclosed that its effective tax rate was 18.9%, which is down from 20.4% last quarter, but up from 17.2% a year ago.

Commenting on the results, CEO Jamie Dimon was as usual cheerful, accentuating the positive, saying fees in global investment banking were down 47% – falling almost half – although the bank “maintained our #1 ranking.” Or in asset and wealth management, revenue was up 6% “as higher net interest income more than offset the impact of lower market levels.” He credits employees who “worked hard to extend credit and raise $1.9 trillion in capital” for customers, touting the bank’s “discipline and rigor.” A very Dimon-esque phrase. He also took the usual dig at regulators while saying he hopes to resume stock buybacks “early next year”…

“JPMorgan Chase delivered solid performance across our businesses as we generated $9.7 billion in net income, $32.7 billion in revenue, an ROTCE of 18% and a CET1 capital ratio of 12.5%. While we unfortunately still don’t know the ultimate effect of changes in capital requirements due to the completion of Basel III, through our earnings power and demonstrated ability to manage down risk-weighted assets, we expect to reach our current target CET1 ratio of 13%, which includes a 50 basis point buffer, in the first quarter of 2023. Importantly, we continue to make all the investments that we need to grow our businesses and serve our customers, and we hope to be able to resume stock buybacks early next year.”

… however he did again carry a stark warning about the “significant headwinds” ahead of us:

“In the U.S., consumers continue to spend with solid balance sheets, job openings are plentiful and businesses remain healthy. However, there are significant headwinds immediately in front of us – stubbornly high inflation leading to higher global interest rates, the uncertain impacts of quantitative tightening, the war in Ukraine, which is increasing all geopolitical risks, and the fragile state of oil supply and prices. While we are hoping for the best, we always remain vigilant and are prepared for bad outcomes so we can continue to serve customers even in the most challenging of times.”

Going back to the bank’s results, as expected net interest income (NII) came out swinging at a time when rates are soaring: the number came in at $17.6 billion, a gain of 34% and an all-time record (excluding markets, the value was $16.9 billion, and the bank credits higher rates for the increase). This was that to the net yield on interest-earning assets rising to 2.09%, and soundly beating the estimate 1.99%

It was not all roses however, as non-interest revenue dipped 8% from the same time last year, with investment banking fees and securities losses bringing the figure to $15.9 billion. Some more details from the quarter:

- Standardized CET1 ratio 12.5%, estimate 12.4%

- Managed overhead ratio 57%, estimate 58.8%

- Return on equity 15%, estimate 13.5%

- Return on tangible common equity 18%, estimate 16.5%

- Assets under management $2.62 trillion, estimate $2.72 trillion

- Tangible book value per share $69.90

- Book value per share $87.00

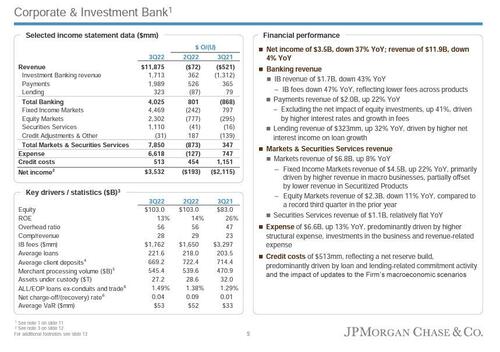

And speaking of non-interest revenue, let’s take a closer look at the bank’s corporate & Investment bank where $3.5 billion of net income was down 37%, and net revenue fell 4% to $11.9 billion, which was not good, but at least it largely beat consensus expectations with the exception of equities sales & trading which dropped 11% and missed expectations modestly:

- CIB Markets total net revenue $6.77 billion, beating estimate $6.58 billion

- FICC sales & trading revenue $4.47 billion, +22% Y/Y, beating the estimate $4.11 billion and “primarily driven by higher revenue in macro businesses, partially offset by lower revenue in Securitized Products”

- Equities sales & trading revenue $2.30 billion, -11% Y/Y, missing the estimate $2.48 billion, “compared to a record third quarter in the prior year”

- Investment banking revenue $1.71 billion, -43% y/y, beating the estimate $1.59 billion

- Advisory revenue $848 million, beating estimates of $696.9 million

- Equity underwriting rev. $290 million, beating estimates of $274.1 million

- Debt underwriting rev. $624 million, missing estimates of $692.6 million

- Corporate & investment bank IB fees $1.76 billion, beating the estimate $1.66 billion

Some more good news: lending revenue of $323 million was up 32% thanks to “higher net interest income on loan growth.” And look at that $2 billion of payments revenue, up 22% if you include “the net impact of equity investments” and up 41% if you don’t. Meanwhile, on the costs side, JPM reported expenses of $6.6B, up 13% YoY, “predominantly driven by higher structural expense, investments in the business and revenue-related expense.”

Also of note, JPM reported Credit costs in the investment bank of $513mm, reflecting a net reserve build, “predominantly driven by loan and lending-related commitment activity and the impact of updates to the Firm’s macroeconomic scenarios.” Recall last year’s provision “was driven by a net reserve release” or how quickly the times change. Meanwhile there was barely any change to JPM’s VaR which rose to $53MM from $52MM in Q2.

A quick look at the community bank now shows that net income was “relatively flat” at $4.3 billion as home lending took a beating this quarter – net revenue was down 34%, with “lower margins and volume” dragging down production revenue. Another interesting thing: net charge-offs for the segment were up $188 million, with JPM noting that was mostly tied to the card business line.

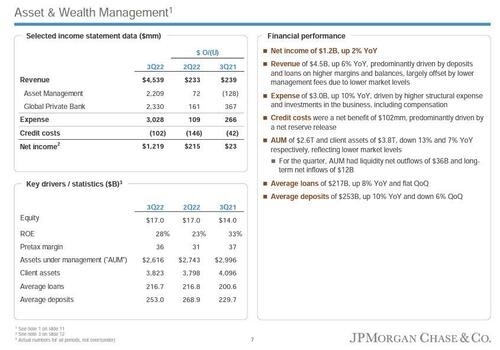

Next, a quick look at the results for asset and wealth management where we find that assets under management at the unit fell 13%, to $2.6 trillion. The bank said that was a function of lower markets and “net outflows from liquidity products.”

Looking at the bank’s balance sheet, we find that total loans rose 7% Y/Y (and 2% Q/Q) to $1.11 trillion, below the estimate of $1.12 trillion, while total deposits of $2.41 trillion rose 3% from last year – if shrank 3% Q/Q – and came in below the estimate of $2.48 trillion.

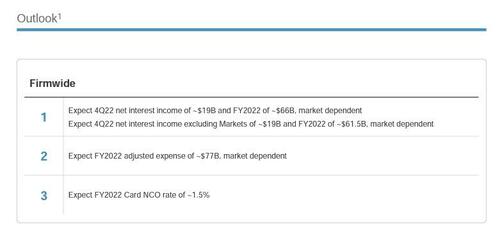

What was perhaps most remarkable was not what the bank reported about Q3, but what it expected for Q4 and the full year: here the bank now sees full year Net Interest Income net of Markets at $61.5 billion, up from $58 billion.

Finally, the bank provided some interesting “additional comments”, writing that it “needs to be careful about the impact of QT on deposits, deposit migration, lags on deposit repricing and change and shape of the yield curve.”

As BBG notes for context, banks are careful about when and how they nudge up interest rates they deliver on deposits, typically sending them higher only after increasing their own cost of borrowing. Executives from the biggest banks were scolded by members of Congress over why those rates haven’t gone higher faster even as the Fed tightens monetary policy and inflation runs wild.

In any case, JPM stock was relatively happy with the largely stronger than expected results, jumping as much as 3.5% premarket before fading gains modestly.

The full JPM earnings presentation is below (pdf link).

Tyler Durden

Fri, 10/14/2022 – 07:55

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com