Inflation Dumpster Dive

By Peter Tchir of Academy Securities

With today’s big drop in the GDP Price Index (from 9% to 4.1% vs expectations of 5.3%), it seemed like a good day to do an inflation dumpster dive.

The Fed and so many others are apparently convinced that inflation remains a problem and the Fed is going to have to tighten at least into February. Some argue for even longer. Is that inflation risk real? Or is it as wrong as when so many people were screaming “transitory!” at the top of their lungs last year?

This report will work on two main premises:

- Let’s look for the most up to date and potentially leading indicators of where inflation is headed, rather than looking backward.

- The Fed, all else being equal, would still like to engineer a soft landing.

- Starting conditions are crucially important to the path that inflation will follow.

Maybe this analysis will resurrect the policies of Volcker, but I suspect not.

Ignoring Foreign Inflation Data

I am not going to spend more than about 30 seconds thinking about inflation in Europe, the UK, or Japan.

The Yen has depreciated over 25% versus the dollar this year and the British Pound and Euro have declined more than 10%. Given how much these countries need to import, especially on the commodity front, it would be shocking if they weren’t experiencing inflation.

Much of the inflation in other parts of the world is linked to their currency weakness. Either they can in theory hike more (to catch up to us) or we could ease the pressure.

As mentioned in this weekend’s VUCA piece, FX is becoming a geopolitical issue. It is an issue that some of our allies are likely asking for relief from (in return for supporting some of our policies across the globe). So far Treasury Secretary Yellen has refused to acknowledge any concerns from other countries, but that could change.

Yes, foreign inflation is bad, but it tells us very little about U.S. inflation.

Commodity Inflation

I don’t think that commodity inflation is the key here, but it is so easy to address that we might as well get this out of the way.

I chose oil and gasoline because they attract so many headlines. I chose copper because who doesn’t like Dr. Copper as both an inflation metric and a gauge of economic activity.

I did use the 3rd contract rather than the front contract because I like the relative stability and it is less crazy in and around settlement dates. It tells the same story, just more nuanced. In any case, commodity prices are headed in the right direction (at least these three big commodities).

FX moves have certainly helped our inflation picture on the commodity front.

The fact that industrial commodities seem to be leading the way lower could be a sign that the economy is grinding to a halt behind the scenes faster than we realize (or just a function of China’s Zero-COVID policy). On the industrial side, commodities are “only” up 9.4% since the start of 2021 and are down 14% YTD. Not great, but the trend seems clear and probably reflects more than just dollar strength.

Housing

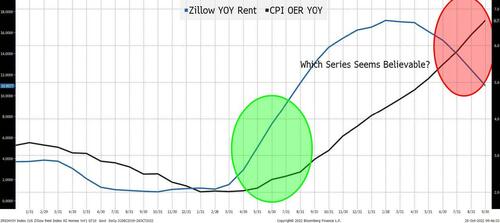

The most recent CPI data had the highest monthly increase in shelter costs since 1990! We discussed it in OER Seems Crazy and again in The Wall of Worry Knows No Bounds. I cannot harp on this subject enough – not only was shelter inflation high, but it was RECORD HIGH! We all know why it set a record (bad calculations, lags, estimates, etc.) but that doesn’t mean we should use an obviously useless number to determine policy! I’m told that the definition of insanity is doing the same thing and expecting different results (like ignoring housing inflation in the summer of 2021), but a simpler definition of insanity is using data that you know is patently false to drive models and determine policy.

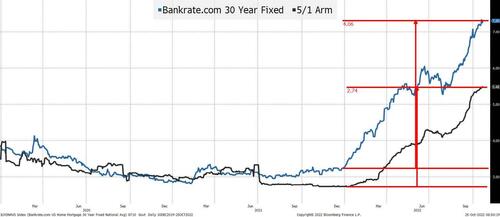

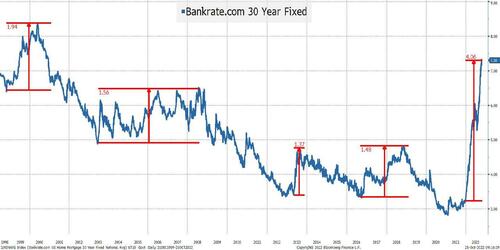

Mortgage rates have skyrocketed! They have risen over 400 bps on the 30-year fixed and even a 5/1 arm offers little respite (having risen 274 bps). The U.S. is the one country that really promotes longer-dated mortgages (much to the chagrin of UK borrowers right now), so while it would seem risky to only lock in 5 years, the cost difference is very large.

I would be remiss not to point out that mortgage rates started rising the minute QT was discussed. QE likely impacted the mortgage market more than any other market (the Fed was a disproportionately large and yield indiscriminate buyer). These much higher mortgage rates are the price we now have to pay for all those purchases that drove us to non-market levels.

For every $100,000 of borrowing, interest on a 30-year has gone from about $3,250 annually to $7,300 for a new loan. Existing owners with longer-dated mortgages are protected, but that doesn’t help a new homebuyer. I cannot think of a faster way to stop upward mobility than having mortgage rates skyrocket (and I suspect that lending standards have also tightened, which is a double whammy).

So, how do higher mortgage rates translate into the housing and rental markets?

- For most Americans, the “balance sheet” item that has done the best this year is their mortgage. The change in mortgage rates is literally impacting how people are thinking about their house and where to live. How do you move to a similarly priced house in another part of the country if you have to pay 400 bps more on any mortgage? Will this cause people to rent their homes out?

Since 1998, as far back as this time series goes, we have never seen anything like this in terms of not just the total size of the move, but how fast that move occurred. I’m assuming that there is an entire cottage industry of lawyers and accountants figuring out ways to “sell your house” while retaining the mortgage, but in any case, this move is unprecedented and we have to think about how buyers, sellers, renters, and landlords will adapt to this.

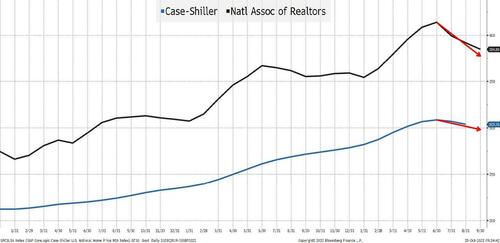

We see home prices starting to tick down, but how useful is this data? If sellers don’t want to sell, is this reflecting much of anything? My understanding is that the Case-Shiller data has embedded lag effects, so it may not be reflective if prices are moving rapidly.

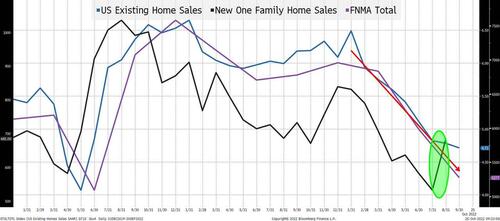

We see home sales across the board dropping from the start of the year. In August (there is a lag), new home sales actually had an uptick. At first, that seems strange, but 1) builders are in the business of selling homes and clearing inventory, so they might have more price flexibility and 2) there is no existing mortgage, so that element is weird. Probably a touch early on this trade considering the increase in builder announced cancellations (remember our “wait list” economy thesis?), but then again, maybe this level of bad news is already priced in?

It almost seems weird to think about, but with the cost of construction presumably dropping (the aforementioned commodity prices, for example) and mortgages making existing homeowners reluctant to sell, it might be an interesting time to revisit homebuilders for a long-term perspective (XHB, the ETF, is down 34% YTD and 27% for the year).

Which series seems believable? Which one looks like something we lived through, and which one seems just plain wrong? It is highly unlikely that monthly rents actually jumped by the most in over 30 years in September (it is more likely that they declined in September relative to August).

Autos and Other Big-Ticket Items

The cost to borrow money has gone up across the board. Autos are particularly interesting to me and I will harp on the importance of “starting” conditions. We have had two public companies comment on the used car market: CarMax (KMX) a few weeks ago and AutoNation (AN) today. One message that is clear is that the shortage of supply across all used auto segments is a thing of the past (certain segments are holding their own, but it is not a universal free for all anymore).

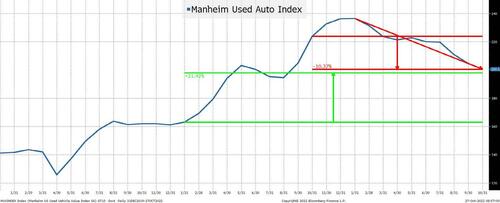

That is supported by the Manheim Used Auto Index, which is down 10% YOY based on mid-October estimates and while it is up 21% from late 2020, it is trending down rapidly.

Starting conditions matter:

- Work from home meant more driving for many people. Certainly, in major city centers, public transportation use fell as people drove themselves. COVID and WFH created a spur in demand for cars!

- With fewer things to spend money on (COVID shortages), stimulus checks, day trading, crypto, stock options, etc. and with cheap financing readily available, more people could afford “more” car.

- Supply chain issues were very real in the new auto space, forcing people to pay up for used cars when the alternative was an uncertain delivery date for a new car.

None of those conditions exist today!

I will grant that the new auto space isn’t back to where it was, but lots are no longer empty. Advertising (at least in my streams) has picked up for auto sales. I’ve even seen some messages offering discounts!

Autos, were also one of the biggest examples of the “wait list” economy that I could think of – see Baby Needs New Shoes.

Whether it was existing EV companies, new EV companies, bringing back old brands, etc., there was a surge in wait list activity. People were signing up for wait lists and the more expensive the car, the better (maybe a bit of hyperbole there, but not much).

My contention is that since it cost nothing to be on most wait lists, and in some cases you could sell your spot in line, they massively overstated demand. Certainly, with crypto prices lower, stock options (for many) being far less valuable, and the general wealth effect issues, we could see people dropping off wait lists or not taking delivery when cars are available. If you look closely at some deliveries versus production reports, I think you can see this occurring.

Auto companies are ramping up production for new cars as the supply chains are healing. However, as demand is waning (and likely satisfied by used cars) and the ability to pay is dropping fast, they may face an uphill battle.

In any case, the auto market is not going to be a source of inflation for months to come.

More broadly, as housing prices decline (at least if you had to sell) and rates rise, it seems logical that many other capital expenditures would suffer (today’s Capital Goods report was negative for September and August was revised down).

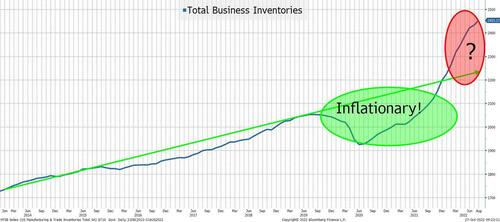

According to ISM data, inventories continue to build and new orders are actually declining. It takes time to dial back production, but that seems to be the likely outcome as not only have we caught up (post the supply shortages), but we are also creating a large inventory overhang.

There seems to be a significant amount of above trend inventory. Yes, this includes both large and small products, but it seems logical that when we have below trend inventory we can see inflation, and that when we have above trend inventory, there is some deflationary pressures (hence all the sales).

Let’s not forget that the cost of holding inventory is no longer trivial as SOFR has risen from 0.04% to 3.02% and credit spreads have widened as well – further incentivizing companies to cut costs to reduce inventories if buyers don’t appear.

Goods inflation seems to be behind us as well.

Jobs

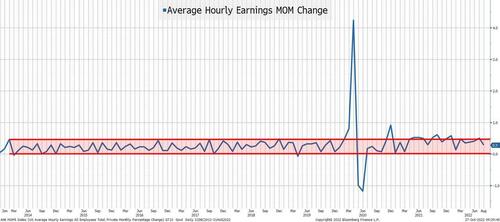

Jobs and wages are the weakest part of my argument – maybe.

I have to admit, I was shocked when I pulled up this chart. I forgot about the wage spikes when COVID first hit. I believe that it had more to do with lower income people getting let go in droves as opposed to actual wage increases. However, the five years before COVID doesn’t look very different from the recent data, at least not to the naked eye. I thought I’d have a lot more explaining to do on wages.

How I see the job market playing out:

It was so difficult to hire workers that companies won’t fire workers (at least not right away). Companies will try and cut the outside services they use first.

Could this be what we are seeing in some of the big tech earnings? Will we see it in accounting, consulting, and legal firms? Anecdotal evidence is yes, but not seeing a consistent story here, yet.

Cuts seem to be focused on underperformers who are viewed as expendable. Tolerable, but potentially it is only the first wave. The next wave, if it occurs, will start cutting into the actual meat of the organizations.

Data between the Establishment and Household surveys has been inconsistent, and ADP hasn’t been much of a guide as they were switching their methodologies. We could see some serious revisions to old data (that was originally very strong) in the coming months .

As belts tighten, raises will be focused on critical spots where companies can generate revenues with those extra costs. Far less overall wage pressure. • So far, nothing seems to move the labor force participation rate, but as savings decline, the wealth effect erodes, and moratoriums expire, will we see some increase in the supply of labor?

Labor, while not a strong part of the inflation story, isn’t as weak as I’ve been led to believe.

Starting Conditions Matter

I won’t belabor the point, as you can read Dredging Up Pendulums to get the details (I do think that it is a very worthwhile read). What this highlights is that a simple pendulum is easily modelled and starting conditions (that are similar) produce very similar results. In a more complex system, like a double pendulum, you can no longer predict the results with the naked eye.

Both the single pendulum system and double pendulum system can be modelled exactly, but:

- Much more precise measurements are required for the double system (think about how flawed many of our measurements are in the economics world).

- More complex algorithms and more computing power is needed for the double pendulum. It is possible to do but doesn’t lend itself to one-sentence soundbites.

There are so many conditions that are “unique” to the current environment that I think it is extremely dangerous to try and “solve” for inflation with rather basic tools without accounting for the differences in how inflation was created this time around.

Bottom Line

Rates should perform well here as the inflation reality sinks in.

The longer the Fed sticks to hiking based on old data and not allowing the effects of earlier hikes to kick in, the more risk we get of a hard landing.

I’m in the camp that the recession will be sooner and deeper than expected, but we can still get one more “everything rally” before that gets priced in. I’m increasingly worried that earnings calls are pushing the average economic outlook towards my rather bleak call.

Tyler Durden

Thu, 10/27/2022 – 16:30

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com