China Pauses Purchases Of Some Russian Oils Ahead Of Price Cap

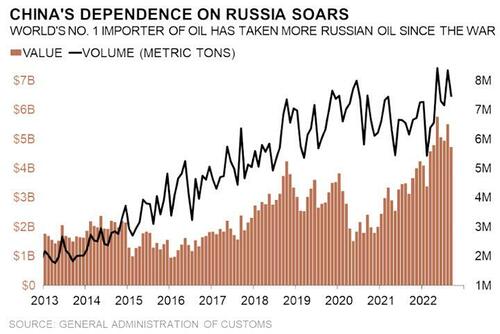

While we wait for the US and EU to unveil details of the Russian oil price caps which will be implemented in two weeks (we may have a lot to to wait after John Kirby said that “It’s not just about the dollar figure. It’s about the implementation, of course, making sure as many countries as possible can sign on to that,” he tells reporters, clearly stalling as nobody in the west knows just how badly such a price cap could backfire and send prices soaring), China is not taking any risks as its crude buyers – who have emerged as the biggest buyers of Russian oil in 2022 taking advantage of western sanctions and buying up Russian oil with discounts as large as $30 below spot – have paused purchases of some Russian oil as they too wait for details of a US-led cap to see if it presents a better price.

As Bloomberg reports citing “traders with knowledge of the matter”, several cargoes of Russian ESPO crude for December-loading remain unsold and there’s hesitation among sellers and Chinese buyers to close deals before more clarity on the exact price cap level is known, according to traders with knowledge of the matter.

The Russian oil price cap is set to be implemented alongside European Union sanctions on Russian crude on Dec. 5, with those adhering to the measure gaining access to insurance, banking and shipping services from the bloc. The cap is designed to keep crude flowing from the OPEC+ producer to prevent a global supply shock but crimp the Kremlin’s revenues as it wages war in Ukraine.

However, Russia has reiterated that it won’t sell to nations that implement the cap, potentially sending oil sharply higher (back in July JPMorgan said that “Oil Price Could Hit “Stratospheric” $380 If Russia Retaliates To G7 Oil Price Cap“). Instead, Moscow will redirect supply to “market-oriented partners” or reduce production, according to Deputy Prime Minister Alexander Novak. In other words, the status quo will continue, since to this day Russian oil makes its way to European markets, only instead of being bought directly from Russia, it comes by way of China or India instead, with Europe paying a substantial premium to where oil would trade if all these artificial trade barriers did not exist.

ESPO, or Eastern Siberia-Pacific Ocean oil is popular with China’s independent refiners due to the high diesel yield and short shipping distance. Traders said many market participants appear open to referencing the price cap — even if they don’t officially support it — provided the level isn’t too dislocated from current prices.

Should the level be set too low, however, the party responsible for shipping and insurance coverage — which can be the seller or buyer, depending on contract terms — may need to seek services from non-EU providers, thereby complicating the process and drastically changing the economics of the deal.

At the same time, and as Zoltan Pozsar explained back in March, adding to buyers’ concerns is that banks that finance crude purchases are wary of the looming sanctions and soaring freight rates. Service providers are weighing their possible exposure to the EU penalties and how best to navigate restrictions when they take effect in less than two weeks.

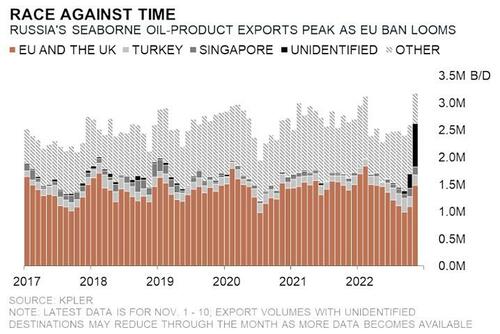

Ahead of the price cap, Russian seaborne fuel exports soared to the highest since at least 2017 as the nation’s refiners rushed to do deals before EU restrictions on imports and shipping come into force. The nation’s average daily exports of oil products from Nov. 1 to 10 jumped 22% from the prior month to around 3.17 million barrels, according to estimates from data and analytics firm Kpler.

Ironically, Bloomberg also reported previously that the largest oil companies in China – whose dependence on cheap Russian oil has soared this year – are seeking help from Beijing to keep Russian imports flowing after new sanctions on Moscow that are set to kick in next month. State-owned oil refiners are worried about their ability to work out the payment channels, logistics and insurance needed to keep buying from the OPEC+ producer after Dec. 5.

China and India have become key outlets for Russian crude after most other buyers shunned the OPEC+ producer following its invasion of Ukraine. Both China and India have, in turn, become major sources of Russian oil to Europe, only instead of calling it Russian oil they sell it as – drumroll – China and Indian oil. And that allows Europe’s virtue signalers to sleep at night.

Tyler Durden

Tue, 11/22/2022 – 18:40

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com