Futures Slide As Recession Fears Trump China Reopening

US futures slumped for a fifth day as investors faded the latest China reopening news – which saw Beijing move definitively away from its long-held Covid Zero approach as it eased a range of restrictions – as the latest dismal Chinese trade data reaffirmed the risk of a global recession. Contracts on S&P 500 futures dumped 0.7% at 7:20 a.m. ET with selling picking up US traders came to their desks after trading unchanged for much of the overnight session, and after the underlying gauge fell Tuesday for a fourth straight day and closed at the lowest level in nearly a month. Nasdaq 100 futures were down 0.8%

US futures are weaker as part of a global risk-off tone; MegaCap tech is again driving weakness, with Apple sliding after a key supplier warned of weaker demand. US/Global recession concerns seemingly outweighing the positivity surrounding China’s growth prospects. US lawmakers proposing an easing of restrictions on Chinese-made chips. SPX sits at its 100dma after falling below its 200dma this week; do we see follow-on selling from CTAs? Oil weakness continues and WTI sits ~11% above its 52-week low. EIA increased its 2023 oil production forecast. In politics, Warnock defeated Walker, giving Dems a 51-49 Senate majority; no immediate market impact. Today’s macro data include mortgage applications (-1.9%, vs -0.8% last week), labor costs, nonfarm productivity, and consumer credit.

In premarket trading, Apple dropped more than 1% as mobile industry bellwether Murata Manufacturing expects the firm to reduce iPhone 14 production plans further in the coming months because of weak demand with the company’s president saying that handset stock in stores suggests slow demand. Last month, Bloomberg reported that Apple expects to make at least 3 million fewer iPhone 14 handsets than originally expected. Here are the most notable premarket movers:

- Chinese stocks listed in the US fall in Wednesday’s premarket trading, as Beijing’s new measures to ease Covid restrictions presented an opportunity for traders to lock in profit after recent rallies. Alibaba (BABA US) -4.5%, Baidu (BIDU US) -3.4%, Pinduoduo (PDD US) -4.1%, Bilibili (BILI US) -5.2%, Nio (NIO US) -4.5%, XPeng (XPEV US) -5.9%

- MongoDB (MDB US) shares rallied 28% after the database software company reported third-quarter results that beat expectations and gave a fourth-quarter revenue forecast that analysts see as strong.

- Toll Brothers (TOL US) shares advance 1.2% after the luxury home builder’s adjusted home sales gross margin forecast for 2023 beat estimates, with Citi positive on the better visibility for next year amid a difficult housing market.

- Pinterest gains 1.8% after the social media company added a board seat for Elliott Investment Management as part of a cooperation agreement with the activist investor.

- Carvana shares rise as much as 3% before paring gains after Bloomberg reported that some of its largest creditors, including Apollo and Pimco, signed a cooperation agreement to prevent the creditor fights that have complicated other debt restructurings in recent years.

- Summit Therapeutics fell, reversing earlier gains in premarket trading. On Tuesday, the shares soared 194% following the announcement of a partnership deal with Akeso to in-license ivonescimab, its breakthrough bispecific antibody.

- Watch Illumina stock as it was initiated at RBC with a recommendation of outperform, with the brokerage citing the biotech company’s competitive advantage in the next generation sequencing market.

- Keep an eye on Autoliv stock after UBS downgraded it to neutral, saying that the shares now offer limited valuation upside, while the airbag maker’s medium-term profitability targets look ambitious.

- Watch shares in US oil explorers as Citi says it does not foresee a further re-rating for the sector in 2023 for a number of reasons, in a note double-downgrading its rating on Comstock to sell, cutting Coterra to sell and moving EQT and Southwestern Energy down to neutral.

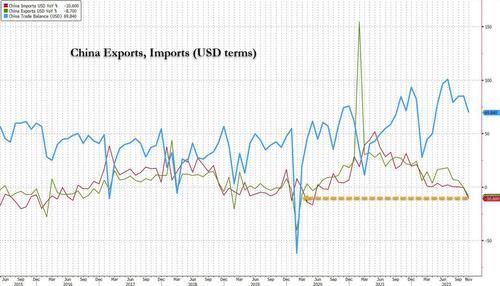

Traders are also monitoring developments in China. The Asian country eased a range of Covid restrictions Wednesday in a sharp change in national strategy to quell public discontent and fire up the economy again. Meanwhile, statistics showed that the nation’s exports and imports both contracted at steeper paces in November – and absent the covid crash in early 2020, the fastest pace since 2016 – as external demand weakened and a worsening Covid outbreak disrupted production and cut demand at home.

US stocks have started unwinding recent gains after strong jobs data and an unexpected increase in a US service-sector gauge stoked concerns the Fed will remain aggressive in tightening policy. Investors are growing wary that higher-for-longer interest rates will curb growth and corporate earnings.

“We’re still in for a fairly rough period,” Shane Oliver, head of investment strategy and economics at AMP Services Ltd told Bloomberg Television. “Monetary conditions have gone from super easy to super tight. That is going to have economic consequences, with a sharp slowing in growth and possibly a mild recession.” Oliver expects a year-end rally after next week’s Fed meeting is out of the way before stocks test new lows in the first half of 2023. A recovery is likely to take place in the second half as monetary policy starts to ease again, he said, echoing Michael Wilson almost verbatim.

The S&P 500’s worst selloff in a month was sharp enough to reverse the rally that followed Fed Chair Jerome Powell’s comments on a possible downshift in the pace of tightening, leaving the benchmark where it was a week ago just before he spoke.

“Recent economic data has highlighted the uncertainty over the economic outlook and the Fed’s response,” Mark Haefele, UBS Global Wealth Management’s chief investment officer wrote in a Wednesday note. “We expect further volatility and maintain our defensive exposure.”

European stocks fell for a fourth consecutive day, the longest run in almost two months. Energy, miners and telecoms are the worst-performing sectors, dragging most European stocks lower. Euro Stoxx 50 falls 0.4%. FTSE MIB outperforms peers. Here are the biggest European movers:

- Russia is considering either imposing a fixed price for its oil or stipulating maximum discounts to international benchmarks at which it can be sold, according to two officials familiar with the plan, as a response to a cap that the G-7 nations set out last week.

- France’s Engie (ENGI FP +0.1%) agreed to a 15-year contract to buy liquefied natural gas from Sempra Infrastructure as companies increasingly look for long-term supply from the US to avoid shortages.

- Salzgitter and Engie have concluded a power purchase agreement with volumes of about 250 GWh of electricity per year.

- ERG gains in Milan to be among the best performers on the FTSE MIB index, which it joined on Nov. 29. Intesa Sanpaolo notes positive stance on the stock is backed by “solid” fundamentals and a dividend yield above the sector average.

- French renewable- energy company Voltalia drops after an offering of 35.8m shares priced at €13.70 apiece, representing a discount of about ~26% to Monday’s close.

- Oil and gas firm Mol has restarted its Danube refinery in Hungary and is gradually ramping up capacity, though won’t be able to meet market demand as the supply situation has become “critical,” Gyorgy Bacsa, managing director of Mol Hungary says in emailed statement

- Credit Agricole SA said it would stop new financing for oil extraction immediately, as part of bank’s efforts to cut the carbon emissions caused by its lending to fossil-fuel companies by a third by the end of the decade.

European equities have been outperforming their US counterparts since the lows of late September. As Bloomberg notes, the Stoxx Europe 600 moved beyond its 2022 downtrend and crossed the much-watched 200-day moving average a month ago, while its US counterpart is struggling to overcome that resistance level. The difference in technical setups might further widen the performance gap as it suggests a bearish view for the US and a bullish one for Europe.

Earlier in the session, Asian stocks widened losses in the late afternoon as renewed concerns about China’s growth were revived by weak trade data, offsetting optimism as the nation moves away from its Covid-Zero policy. The MSCI Asia Pacific Index slumped as much as 1.4% on Wednesday, its biggest drop in more than a week, led lower by consumer discretionary and information technology shares. Benchmarks in Hong Kong plunged more than 3% in volatile trading as a selloff deepened following reports that mainland authorities are set to allow home quarantine and relax testing requirements. Weak trade data underscoring sluggish demand at home and abroad also hurt sentiment. The market has already priced in the easing of Covid policy announced today, “so investors are selling on news,” said Banny Lam, head of research at CEB International. The Philippine stock benchmark was among notable losers in the region, dropping 2.2% amid profit taking.

Japanese stocks also declined, following US shares lower as downbeat warnings from bank chiefs deepened concerns over the global economy. The Topix fell 0.1% to close at 1,948.31, while the Nikkei declined 0.7% to 27,686.40. Tokyo Electron Ltd. contributed the most to the Topix decline, decreasing 3.8%. Out of 2,164 stocks in the index, 1,202 rose and 816 fell, while 146 were unchanged. “With the comments from U.S. banks, there is increasing negative sentiment toward the global economy, and market participants are watching the shift of economic trends closely,” said Hirokazu Kabeya, chief global strategist at Daiwa Securities.

Shares in Australia, Taiwan, Singapore and Indonesia also declined. Asian stocks have been relatively shielded from recession woes that hurt US stocks this week as investors expected China’s reopening moves could bolster its recovery. Wednesday’s selloff highlighted how volatile the path for recovery could be. The key Asian stock benchmark has risen more than 15% from its October low amid expectations for China’s full reopening and the Fed’s pivot from its aggressive tightening. The gauge’s rally has paused in recent days, stopping short of entering a technical bull market.

India’s benchmark stock gauge declined after the central bank raised borrowing costs in line with expectations but surprised investors with a trimmed outlook for growth. The S&P BSE Sensex fell 0.3% to 62,410.68 in Mumbai, its lowest level since Nov. 25. The NSE Nifty 50 Index dropped 0.4%. Both initially rose after the Reserve Bank of India raised its key rate by 35 basis points to 6.25%. Reliance Industries and mortgage lender HDFC dragged the Sensex the most, as 22 out of its 30 stocks traded lower while the rest advanced. All but four of the BSE’s 19 sector sub-indexes declined, led by utilities. “For stocks, it’s important to note that the RBI continues to take out liquidity,” said Amit Kumar Gupta, a chief investment officer at New Delhi-based Fintrekk Capital. Stocks will face pressure on the RBI’s comments about consumption and commodity prices, he added. India is Asia’s best-performing stock market so far this year. Foreign investors have resumed buying on expectations that corporate earnings will improve despite inflationary pressures. In the five months through November, they have bought more than $11 billion in local shares, lifting benchmarks to a record. Some investors are concerned that economic growth is peaking. The “growth narrative looks rather weak,” Kotak Institutional Equities analysts led by Sanjeev Prasad wrote earlier this month

In FX, the Bloomberg Dollar Spot Index steadied after earlier rising to a one-week high as the greenback traded mixed against its Group- of-10 peers. JPY underperforms G-10 FX, trading around 137.46/USD. The term structures in the major currencies retained inversion mode as next week’s US CPI print and meetings by the Fed, the BOE, the SNB and the ECB are in focus.

- The euro snapped a two-day drop against the dollar after recovering in the European session. The common currency neared $1.05 after earlier touching a low of $1.0443. Bunds and Italian bonds twist-steepened as yields inched lower through the 10-year tenor while rising further out on the curve.

- The pound inched up against the dollar to trade at around $1.2150. Gilt yields crept higher. Concern over a protracted downturn in the housing market persisted after data showed that UK house prices fell at the sharpest pace in 14 years in November.

- The Norwegian krone and the Canadian dollar were among the worst G-10 performers amid a decline in oil prices. The yen also fell as a Bank of Japan board member said a wage hike alone may not lead to an immediate change in policy. The yield curve twist-flattened.

Recession fears were palpable in the bond market, where demand for longer-dated bonds drove a yield inversion to a four-decade extreme, sending 10-year rates below those on 2-year notes by the most since the early 1980s. The Federal Reserve rate decision and inflation data due next week loom as pressure points for a market governed by central banks. Bunds, USTs and gilts 10-year yields fairly muted with less than a basis point move within Tuesday’s range. The US Treasury curve bull steepened slightly. The two-year yield fell 2bps to 4.35% while the 10-year yield shed one 1bp to 3.52%. Gilts lag with the UK curve bear-steepening while Treasuries 5s30s spread extends flattening, dropping as low as -22.7bp, tightest since start of November. The UK 10-year cheaper by 1.6bp; 2s10s steeper by ~2.5bp on the day with front- end yields richer by 1bp on outright basis while 5s30s spread is flatter by ~1.5bp

In commodities, oil fluctuated after touching the lowest level since last December on Tuesday as investors pared back crude positions amid a broader market sell-off. The decline for West Texas Intermediate, which settled near $74 on Tuesday, erased all of this year’s gains as sentiment remaining fragile on signs that tighter interest rates could be needed for longer. WTI rebounded back into the green, trading at $74.37 last after earlier dropping as low as $72.75. A Russian price cap coalition official said nearly all 20 tankers waiting to cross Turkey’s straits are loaded with Kazakh oil and not subject to the G7’s Russian oil price cap, while the delays in tanker traffic from Russia’s Black Sea ports to the Mediterranean stem from the Turkish insurance rule and not the price cap, according to Reuters. Chinese nickel buyers are seeking to use Shanghai Future Exchange contracts not London Metal Exchange for 2023 pricing, according to Reuters sources; participants write this is due to the decline in liquidity and low stocks which has resulted in persistently high prices within London this year, which have not reflected market fundamentals. Spot gold is contained around USD 1775/oz, while base metals are mixed but with an underlying downward bias.

Looking to the day ahead, from central banks we’ll get the Bank of Canada’s latest policy decision, along with remarks from the ECB’s Lane and Panetta. Otherwise, data releases include German industrial production and Italian retail sales for October.

Market Snapshot

- S&P 500 futures down 0.2% to 3,937.00

- STOXX Europe 600 down 0.5% to 436.56

- MXAP down 1.3% to 155.60

- MXAPJ down 1.5% to 506.31

- Nikkei down 0.7% to 27,686.40

- Topix little changed at 1,948.31

- Hang Seng Index down 3.2% to 18,814.82

- Shanghai Composite down 0.4% to 3,199.62

- Sensex down 0.1% to 62,535.48

- Australia S&P/ASX 200 down 0.8% to 7,229.39

- Kospi down 0.4% to 2,382.81

- German 10Y yield down 0.7% to 1.79%

- Euro up 0.1% to $1.0481

- Brent Futures down 1.7% to $78.02/bbl

- Gold spot up 0.1% to $1,772.93

- U.S. Dollar Index little changed at 105.56

Top overnight news from Bloomberg

- Senator Raphael Warnock defeated Republican challenger Herschel Walker in their hotly contested runoff for Georgia’s US Senate seat, giving Democrats a 51-49 edge in the upper chamber

- Mexico’s central bank may start to slow the pace of interest-rate increases, Reuters reported

- A sense of calm that has narrowed the gap between German and Italian debt yields will embolden policymakers next week as they announce principles for so-called quantitative tightening. But whatever they devise under such placid conditions must accommodate the danger of renewed volatility

- Foreign investors are positioning for Japan’s sovereign yields to rise as quickening inflation increases the pressure on the BOJ to alter its accommodative stance. Overseas funds are sticking to their guns even as central bank chief Haruhiko Kuroda has vowed repeatedly to keep easing to spur price gains

- China moved definitively away from its long-held Covid Zero approach Wednesday, easing a range of restrictions that it has persisted with long after the rest of the world moved on to living with the virus

- Senior Chinese officials are debating an economic growth target for next year of around 5%, according to people familiar with the discussion, as Beijing shifts gears toward bolstering the recovery

- The EU will proceed with two cases against China at the World Trade Organization on Wednesday after talks to resolve the issues with its largest trading partner failed to yield results

A More detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks were mostly subdued after the losses on Wall St where risk sentiment was dampened by tech sector woes and recession concerns, while participants also digested weak trade data and an easing of restrictions in China. ASX 200 was pressured after Australian GDP data for Q3 missed forecasts and with the declines in the index led by tech and energy following similar weakness in US counterparts. Nikkei 225 was lacklustre but with downside limited by a lack of domestic catalysts and with BoJ’s Nakamura reiterating that the central bank must patiently maintain monetary easing. Hang Seng and Shanghai Comp were indecisive as the announcement of an easing of COVID restrictions was offset by the dismal trade data from China.

Top Asian News

- China’s Politburo said China will maintain its prudent monetary policy and that monetary policy should be targeted and forceful, while it urged coordinating COVID controls and economic development. China will also fine-tune COVID control measures and allow home quarantine, as well as ease testing, according to Xinhua.

- China’s Health Commission said asymptomatic patients and cases with mild symptoms can undergo home quarantine, while it will accelerate vaccination of the elderly against new coronaviruses. Furthermore, China bans COVID movement restrictions in non-high-risk zones and scraps COVID test rules in most public venues nationwide, according to Reuters and Bloomberg.

- “Latest optimized measures against COVID do not represent a full re-opening or relaxation, but rather show that the country’s anti-epidemic measures are becoming more scientific, more active and more accurately targeted”, according to Global Time

- China is said to be considering a 5.0% GDP target for next year, according to Bloomberg.

- Shanghai Disneyland (DIS) to reopen on Thursday, December 8th.

- US Senators scaled back a proposal that placed new curbs on the use of Chinese-made chips by the US government and its contractors, according to a draft seen by Reuters.

- EU will proceed with two cases against China at the World Trade Organization on Wednesday after talks to resolve the issues with its largest trading partner failed to yield results, according to Bloomberg.

- RBI hiked the Repurchase Rate by 35bps to 6.25%, as expected, through 5-1 vote, while the Standing Deposit Facility was raised by 35bps to 6.00% and the Marginal Standing Facility was raised to 6.5%. RBI Governor Das said that inflation remains high and broad-based, as well as noted that the MPC will remain focused on the withdrawal of accommodation with 4 out of 6 in the MPC voting in favour of retaining the policy stance. Das added that further calibrated monetary policy is warranted to anchor inflation expectations and that they stand ready to act as necessary from time to time, while the focus on inflation continues and there will be no let-up in efforts to bring inflation to more manageable levels.

European bourses are somewhat mixed after a predominantly soft cash open, Euro Stoxx 50 -0.5%; though, the breadth of the market remains narrow. Stateside, futures are in relative proximity to the unchanged mark and are yet to meaningfully deviate from overnight ranges, ES -0.2% at circa. 3935. In Europe, Health Care outperforms following Zantac updates for GSK (9.0%) & Sanofi (+5.5%) while Energy & Basic Resources lag given benchmark pricing. Key Apple (AAPL) supplier expects iPhone orders to drop on weak demand, via Bloomberg; “Mobile industry bellwether Murata Manufacturing Co. expects Apple Inc. to reduce iPhone 14 production plans further in the coming months because of weak demand, which would force the supplier to again cut its outlook for its handset-component business.”

Top European news

- UK PM Sunak is reportedly under pressure from Tory MPs to speed up anti-strike legislation, according to FT.

- ECB Consumer Expectations Survey (October): Consumer expectations for inflation 12 months ahead increased further, while expectations for inflation three years ahead remained unchanged.

- Europe Gas Rises as Cold Weather and China Shift Fuel Demand

- Prosus Valued at $31 Billion Excluding Tencent Stake

- Credit Agricole Stops New Oil Extraction Financing

- ECB Says 12-Month Consumer Inflation Expectations Rose Further

- Saxo Bank Shelves $2 Billion IPO After Dutch SPAC Deal Dropped

- UK Tones Down ‘Big Bang’ Finance Plan to Avoid Backlash

FX

- USD is mixed vs G10 peers, though the DXY itself remains underpinned above 105.50.

- Overall, peers are narrowly mixed with EUR modestly outpacing and testing 1.05 while JPY lags as USD/JPY rebounds to near 138.00

- CAD remains pressured given benchmark crude pricing with attention turning to the BoC with expectations split between 25bp and 50bp.

- NOK knocked on crude and domestic data, SEK gleaned limited traction from significantly better than forecast GDP.

- PBoC set USD/CNY mid-point at 6.9975 vs exp. 6.9941 (prev. 6.9746)

Fixed income

- Overall, fundamentals little changed for the complex. Core benchmarks have drifted slightly down from intraday peaks.

- Bunds holding around 142.00 vs 142.65 peak, with USTs similarly at the bottom of a 114.03 to 114.13+ band yields marginally firmer, as such.

Commodities

- Crude benchmarks are softer intraday given the cautious tone and resilient USD impacting the complex, despite further constructive China COVID updates.

- WTI has dipped under USD 73/bbl (vs USD 74.82/bbl high) while Brent Feb had lost the USD 78/bbl handle (vs USD 79.93/bbl high).

- US Energy Inventory Data (bbls): Crude -6.4mln (exp. -3.3mln), Cushing +0.0mln, Gasoline +5.9mln (exp. +2.7mln), Distillate +3.6mln (exp. +2.2mln)

- Price cap coalition official said nearly all 20 tankers waiting to cross Turkey’s straits are loaded with Kazakh oil and not subject to the G7’s Russian oil price cap, while the delays in tanker traffic from Russia’s Black Sea ports to the Mediterranean stem from the Turkish insurance rule and not the price cap, according to Reuters.

- Hungarian government is to scrap its fuel price cap, according to PM Orban’s chief of staff cited by Reuters.

- Chinese nickel buyers are seeking to use Shanghai Future Exchange contracts not London Metal Exchange for 2023 pricing, according to Reuters sources; participants write this is due to the decline in liquidity and low stocks which has resulted in persistently high prices within London this year, which have not reflected market fundamentals.

- Spot gold is contained around USD 1775/oz, while base metals are mixed but with an underlying downward bias.

Crypto

- A new proposed amendment under National Defense Authorization Act (NDAA) could require the US Department of State to justify crypto rewards and disclose any crypto payouts within 15 days of making it, according to a document via CoinTelegraph.

Geopolitics

- US Secretary of State Blinken said the US has neither encouraged nor enabled Ukraine to strike within Russia, according to Reuters.

- US Defense Secretary said the US military will increase the rotational presence of bomber task forces and other forces in Australia, according to Reuters.

- US State Department approved the sale of aircraft spare parts worth around USD 300mln to Taiwan and the sale of non-standard spare parts worth an estimated USD 98mln, according to the Pentagon, while Taiwan’s Defence Ministry said the aircraft parts sale will help air force operations in the face of China’s military activities, according to Reuters.

US Event Calendar

- 07:00: Dec. MBA Mortgage Applications, prior -0.8%

- 08:30: 3Q Unit Labor Costs, est. 3.0%, prior 3.5%; Nonfarm Productivity, est. 0.6%, prior 0.3%

- 15:00: Oct. Consumer Credit, est. $28b, prior $25b

DB’s Jim Reid concludes the overnight wrap

It’s all crept up fast but today I’m taking an hour away from my desk to hobble to watch my 5-year-old twins in their nativity play. One of the twins has the lead role of Joseph and the other has just one line which is “I’m not a cow, I’m an Ox”! Ironically, I’m equally worried about both as although the latter has far less to do, he’s shown little evidence at home that he understands his cue or how to say his line properly. With regard to the former, I will wince when he tells the innkeeper that “My wife is pregnant”, and hope it’s not a line he uses again for at least 20 years. Assuming we get over this, tomorrow it’s Maisie’s turn for her play.

As thoughts turn to Xmas and year-end, today we’re launching our final EMR survey of 2022 aimed at market participants (link here). This December edition is a special 2023 one with lots of easy-to-answer questions about the year ahead, with a few longer-term ones thrown in for consistency with prior surveys. It’ll close on Friday and will only take a few minutes to complete. Many of the questions look forward to the year ahead, including where you see the biggest market risks, the likelihood of stagflation, and where central banks will take their policy rates to. We have some seasonal ones as well, such as what’s your favourite Christmas song, and who you expect to win the football World Cup. All responses are very gratefully received, and everything is anonymous.

Last year we had over 750 responses for our year-end survey, and it’s revealing what readers did and didn’t get right. A good call was that the two biggest risks were “Higher than expected inflation” and “an aggressive Fed tightening cycle”, both of which surprised well to the upside of consensus. But even then, very few saw quite how aggressive it would prove in the base case, with just 2% of respondents thinking US CPI would be above 7% by 2022 year-end, whilst the median estimate on Fed hikes was for 50bps this year. In reality, we’ll end up with 425bps if they go ahead with a 50bps move next week. Other interesting snippets were that just 19% thought the S&P 500 would post a negative return in 2022, and the average estimate for the 10yr Treasury yield by year-end was 1.9% with just 0.54% thinking they’d end this year above 3.5%. If you were any of those 4 people out of 750 please email me to tell me your predictions for the next 12 months.

Before we get to 2023 we still have to survive 2022. The Santa Claus rally has struggled of late with last night continuing a streak of four successive losses for the S&P 500 (-1.44%) and seven down sessions out of eight. In fact, the latest moves for the S&P mean it’s now unwound the entirety of the rally following Fed Chair Powell’s speech last week, which makes sense on one level given he didn’t actually say anything particularly new. That said however, there hasn’t been a great deal of newsflow coming through, with markets still in something of a holding pattern ahead of next week’s bumper calendar of events, which includes the US CPI print as well as the Fed and ECB decisions.

This gloomy outlook was evident from a number of indicators, not least the 2s10s Treasury curve which closed at its most inverted of this cycle yet, after falling -2.1bps on the day to -84.1bps, something we haven’t seen in over four decades. In the meantime, the prospect of weakening global demand led to a further slump in oil prices, with Brent Crude falling -4.03% on the day to $79.35/bbl. That’s its lowest closing level since January, and means that Brent Crude is now up by just +2.24% on a YTD basis, whilst WTI is actually now down -1.27%. One upside for policymakers is this is continuing to filter through to consumers, with average US gasoline prices now down to $3.38 per gallon, having been just above $5 back in mid-June.

Elsewhere yesterday, the combination of moves made it a classic risk-off performance, with equities and HY credit struggling, whereas safe havens such as sovereign bonds and gold both advanced. For equities, the losses were led by the more cyclical sectors, with few strong performers as nearly 80% of the S&P 500 moved lower on the day. Tech stocks struggled in particular, with larger declines for the NASDAQ (-2.00%) and the FANG+ index (-2.33%). And over in Europe there were also broad-based declines, with losses for the STOXX 600 (-0.58%), the DAX (-0.72%) and the CAC 40 (-0.14%).

In spite of the equity declines, the 60/40 portfolio didn’t have such a bad day yesterday thanks to a sovereign bond rally on both sides of the Atlantic. The moves were particularly pronounced in Europe, with yields on 10yr bunds (-8.4bps), OATs (-6.7bps) and BTPs (-10.0bps) all seeing sharp moves lower, including the lowest 10yr bund yield in a couple of months. That comes as market pricing continues to inch towards expecting a 50bps ECB hike next week, with the 53.6bps priced in for the December meeting being the lowest in nearly three months now. Meanwhile in the US, the moves were somewhat smaller and yields on the 10yr Treasury fell -4.2bps to 3.53%.

Asian equity markets are mixed this morning. The Hang Seng (+1.38%) and CSI (+0.78%) jumped after China announced a significant loosening of Covid restrictions, saying it would allow home quarantine for some Covid patients and close contacts and would ditch Covid testing requirements in most public venues. This came hot on the heels of reports that officials are considering a growth target of around 5% for next year and offset disappointing early morning data showing that exports and imports in November fell to the lowest since early 2020. Exports dropped -8.7% y/y (v/s -3.9% expected) following a decline of -0.3% in the previous month while imports contracted -10.6% (v/s -7.1% expected) against October’s decline of -0.7%.

Meanwhile, the Nikkei (-0.54%) and the KOSPI (-0.14%) are trading in negative territory. Outside of Asia, US stock futures are indicating a rebound with contracts tied to the S&P 500 and the NASDAQ 100 (+0.19%) edging higher.

Elsewhere in the States, Democrat Raphael Warnock beat his Republican challenger in Georgia’s runoff to determine who they will send to the Senate. The outcome gives the Democrats a narrow 51-49 seat majority in the upper house.

There wasn’t much in the way of data yesterday, although we did get the US trade balance for October, which showed a $78.2bn deficit (vs. $80.0bn expected). Elsewhere, the German construction PMI came in at a 20-month low of 41.5 in Germany, whilst the UK construction PMI just about remained in expansionary territory with a decline to 50.4 (vs. 52.0 expected).

To the day ahead now, and from central banks we’ll get the Bank of Canada’s latest policy decision, along with remarks from the ECB’s Lane and Panetta. Otherwise, data releases include German industrial production and Italian retail sales for October.

Tyler Durden

Wed, 12/07/2022 – 08:06

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com