Powell Speech Preview: Will Jerome Go Full ‘Jackson Hole’-Tard?

At 9am ET, Powell will be speaking at a Riksbank panel on “central bank independence and the mandate – evolving views”, and accordingly, some believe that there is a risk that he disappoints those who are looking for fresh insight on the current monetary policy outlook. The stream is below (and also here, scroll down on the page to view the video).

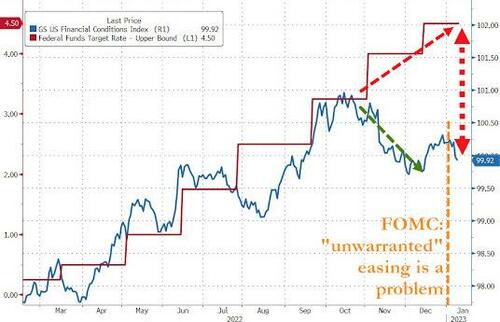

Stocks slumped ahead of Powell’s speech yesterday on fears that Fed chair will talk stocks down as financial conditions have once again eased notably since the FOMC even though Powell explicitly warned that “unwarranted easing is a problem.”

Courtesy of Newsquawk, here’s what to look for in Powell’s comments:

“PEAK INFLATION” HAS BEEN DISCOUNTED: The start of 2023 has been characterized by data that continues to allude to cooling inflation pressures combined with softening activity data that alludes to deteriorating growth dynamics Judging by traders’ reactions to last week’s ISM reports {weak activity in both manufacturing and services) and non-farm payrolls {wage growth cooling), there is a feeling that the ‘peak inflation’ narrative has now been fully discounted and traders are increasingly fretting about the challenging growth situation These dynamics will again be put to the test this week with the release of various inflation reports out of the US. Ahead of Thursday’s December US CPI data, the NY Fed’s survey of consumer inflation expectations for that month was mixed with the lyr ahead expectation easing to 5% from 5.2%. expectations for 3yrs ahead was steady at 3%. while the 5yr rose to 2 4% from 2.3%. Participants will also be eyeing the Preliminary January University of Michigan survey on Friday particularly the inflation expectations

WHEN WILL FED PIVOT FOCUS ONTO GROWTH: If these inflation data continue to show a cooling in price pressures, traders will gain confidence in the notion that the Federal Reserve will need to pivot its focus to support the growth side of the equation, which may involve easing up on some of its hawkishness Fed Chair Powell’s remarks on Tuesday will also be eyed in this context although the Fed is expected to continue its hawkish messaging on inflation until they see substantial evidence that inflation has indeed peaked and that its price target is back within sight.

TERMINAL RATE: Despite the Fed’s December Staff Economic Projections penciling in a peak Federal Funds Rate of 5 1% {5.00-5 25% FFR target), and warnings by some officials that if inflation doesn’t behave then 5.4% could also be seen (5.25-5.50%). money markets continue to see the peak at between 4 75-5.00 from March onwards, and expects rates will stay there until November when markets begin to price rate cuts Fed officials – burned by their incorrect pandemic view that inflation was transitory – are trying to re-establish their inflation-targeting credentials so are unlikely to relent on their hawkishness any time soon, out of fear of causing credibility issues. Analysts note that, historically, the Fed has stayed at terminal for between 3-15 months, with the average being around 6.5 months

LAYING THE GROUNDWORK FOR A PIVOT:

While the Fed may not explicitly pivot its policy until it has seen substantial evidence that inflation has peaked there are some elements that officials could introduce that suggests that its focus is moving.

“SUBSTANTIAL PROGRESS”: At the December FOMC. Powell suggested that the Fed wants to see “substantially more evidence” that gives confidence that inflation is on a sustained downward path and while inflation has been cooling, at around 6% it is still three times the Fed s 2% inflation target.

“ONGOING” RATE HIKES: Although the Fed s December meeting statement was little changed it still ‘anticipates that ongoing increases in the target range will be appropriate’ : there were some outside expectations for the Fed to tweak this guidance in December to something to the effect that it sees some further’ rate hikes ahead. Accordingly, if officials begin using language like this, it might hint that the last rate hike of the cycle is in sight.

GROWTH CONCERNS: Many consider the ISM’s reports on business to be a more forward-looking indicator than releases like the jobs report Last week, the ISM data showed that the headline and new orders components for both the manufacturing and services sectors were sub-50 in contractionary territory. Analysts note that, historically, when this happens the Fed is usually easing policy to support the economy However. Fed officials’ base case, for now. is only a growth slowdown, and many are not predicting a recession, instead citing the labor market strength. If officials do begin expressing concerns about slowing growth, and backing away from their previous baseline views, traders might use that as part of the case that shows the Fed is realigning its focus onto growth

FINANCIAL CONDITIONS: Some argue that the Fed’s concerns about loosening financial conditions (read lower yields, higher stock prices) is second only to inflation and currently ranks above growth concerns Powell in December said that the Fed’s tightening had engineered tighter financial conditions but added that these conditions fluctuate in the short term in response to many factors, but it was important that over time these conditions reflect the policy restraint that the central bank is putting in place to return inflation back to the 2% The latest minutes also revealed that participants were wary of an “unwarranted” easing in financial conditions. If Powell continues to express concerns about easing financial conditions, it would not be a sign that he was preparing us for a policy pivot (and vice versa).

Tyler Durden

Tue, 01/10/2023 – 08:38

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com