Beige Book Finds “Little Growth” Ahead”, Increasing Difficulty For Retailers To Pass Cost Increases

There wasn’t too much excitement in the latest Fed Beige Book report which was based on information collected on or before January 9, 2023: it found that overall economic activity was relatively unchanged since the previous, Nov 30, 2022 report: five Districts reported slight or modest increases in overall activity, six noted no change or slight declines, and one cited a significant decline. Looking ahead, there wasn’t much excitement (or hope) either, with contacts expecting “little growth in the months ahead.”

That said, if one reads the components of the report, one doesn’t get the impression that the economy was “relatively unchanged” – if anything, it sounds like the economy is sliding into a recession, especially for the low and moderate-income households:

- Consumer spending increased slightly, with some retailers reporting more robust sales over the holidays. These would be retailers targeting the 1%.

- Other retailers noted that high inflation continued to reduce consumers’ purchasing power, particularly among low- and moderate-income households.

- Auto sales were flat on average, but some dealers noted that increased vehicle availability had boosted sales.

- Tourism contacts reported moderate to robust activity augmented by strong holiday travel.

- Manufacturers indicated that activity declined modestly on average, and, in many Districts, reported that supply chain disruptions had eased.

- Housing markets continued to weaken, with sales and construction declining across Districts.

- Commercial real estate activity slowed slightly, on average, with more notable weakening in the office market.

- Nonfinancial services firms experienced stable demand on balance. Most bankers reported that residential mortgage demand remained weak, and some said higher borrowing costs had begun to dampen commercial lending.

- Energy activity continued to increase moderately, and agriculture conditions were generally unchanged or improving.

Turning to labor markets we find a far stronger underlying picture, although one wonders how much of this is still a kneejerk response to the chaos in the immediate aftermath of the covid lockdowns:

- Employment continued to grow at a modest to moderate pace for most Districts. Only one District reported a slight decline in employment, and one other reported no change in employment levels.

- While some Districts noted that labor availability had increased, firms continued to report difficulty in filling open positions.

- Many firms hesitated to lay off employees even as demand for their goods and services slowed and planned to reduce headcount through attrition if needed.

- With persistently tight labor markets, wage pressures remained elevated across Districts, though five Reserve Banks reported that these pressures had eased somewhat. Some employers noted they have continued to offer bonuses and enhanced benefits to attract and retain workers.

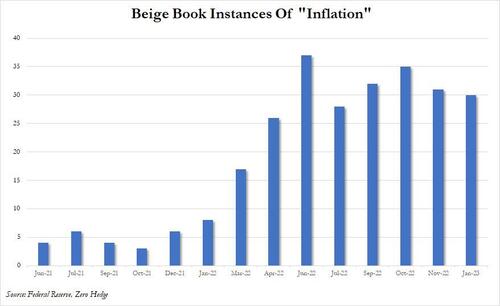

There was better news when looking at inflation: here the Beige book found that selling prices increased at a modest or moderate pace in most Districts, though many said that the pace of increases had slowed from that of recent reporting periods.

- Manufacturers in many Districts reported continued easing in freight costs and prices for commodities, including steel and lumber, though some said input costs remained elevated.

- Many retailers noted increased difficulty in passing through cost increases, suggesting greater price sensitivity on the part of consumers.

- On the other hand, and in keeping with the reverse bullwhip effect, “some retailers offered more discounts and promotions than they had a year ago in order to move merchandise and clear out excess inventories.”

- Most importantly, however, contacts across Districts said they expected future price growth to moderate further in the year ahead.

Two charts to end with: first, peak inflation is now comfortably in the rearview mirror…

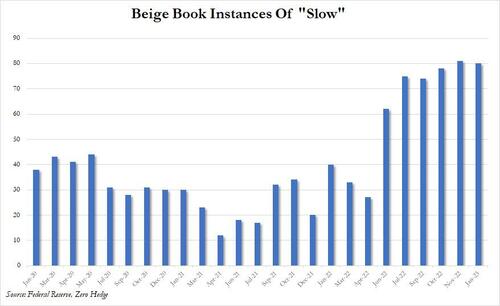

… although the risk of stagflation remains with mentions of “slow” sticky near record highs.

Source: Federal Reserve

Tyler Durden

Wed, 01/18/2023 – 14:27

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com