Ken Griffin Overtakes “Greatest Trade Ever” With Record $16 Billion Profit For Clients In 2022

Two weeks ago, when we amended our list of the best and worst performing hedge funds of 2022, we added what we said was the most important one: after a stellar 2021, when it generated $16.2 billion in revenue, in 2022 Ken Griffen’s Citadel hedge fund – which had $54.5 billion in AUM as of Jan 1 – had a blowout year, and according to the WSJ, had generated about $28 billion in revenue. The impressive number, driven by a 38.1% return at the company’s flagship multi-strategy fund Wellington, far outpaced the hedge fund’s prior record of $16.2 billion the year before.

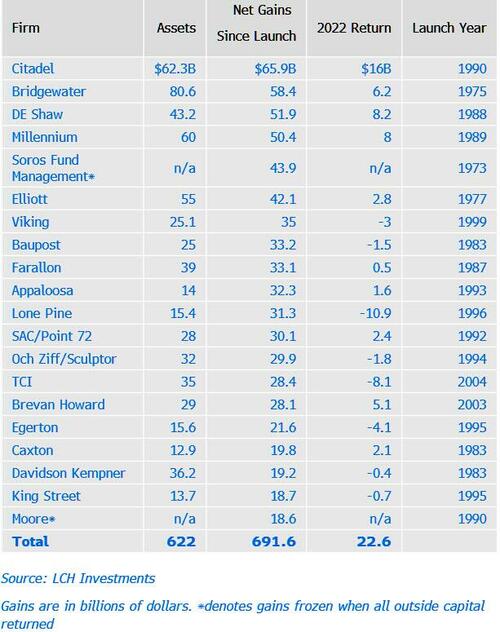

Today, in a follow up take of Citadel’s hedge fund performance, Bloomberg writes that Ken Griffin’s hedge fund printed a record $16 billion in profit for clients last year, not only outperforming the rest of the industry but also eclipsing one of history’s most successful financial plays, Paulson’s “greatest trade ever.” Adding Citadel’s $16 billion return to its previous profits effectively makes it the world’s most successful hedge fund, having generated more than $65 billion in net gains for clients since its launch and surpassing such titan as Bridgewater and DE Swah (although it may trail RenTec in terms of lifetime client returns).

Then again when one straddles both sides of the Chinese wall, with a $62 billion hedge fund on one side, and arguably today’s most important market making operation – Citadel Securities (which generated $7.5 billion in revenue in 2022) on the other, how difficult is it to print money? We don’t know, but it’s clear that in addition to Sam Bankman-Fried – who was eager to become the world’s biggest market-maker and principal investor when it comes to crypto – Ken Griffin has also figured out that such a “fusion” may be most profitable indeed.

According to estimates by FoF LCH Investments, Citadel’s 2022 gain was the largest annual return for a hedge fund manager, surpassing the $15 billion that John Paulson generated in 2007 on his bet against subprime mortgages. This was described as the “greatest trade ever” in a subsequent book of the same name by Gregory Zuckerman. However, unlike Paulson, who turned out to be a one-trick pony and has seen his hedge fund shrink dramatically in the years since the financial crisis amid a flood of outflows, Citadel is going from strength to strength, and of course, countless non-competes with its pod-based PMs.

Also unlike Paulson, Citadel’s performance wasn’t about one trade: the flagship Wellington fund gained a whopping 38% last year by trading everything from equities to commodities. The firm made money in each of its five core strategies, which also include fixed income and macro, quant and credit. Citadel returned about $8.5 billion in profit to investors at the end of last year.

And while Citadel success was tracked – if not matched – by its supersized peers, with the top 20 hedge fund firms collectively generating $22.4 billion in profit after fees, few other fund generated similar returns or were even in the same ballpark. Indeed, in a time when macro and huge, multi-strat, “pod”-based hedge funds (such as Millennium, Citadel, Balyasni and Point72) generate most of the profits, it’s a different story outside the industry giants with hedge funds overall losing $208 billion last year as many managers found themselves on the wrong side of global market turmoil. To get a sense of the dispersion, consider that the top 20 managers generated returns of 3.4% according to LCH, while the rest of funds it studied suffered losses of 8.2%!

As Bloomberg adds, while falling stock markets hit the performance of many equity-focused funds, plenty of the biggest macro funds benefited from bets on rising rates and volatile currencies. And major hedge funds that have dozens of trading teams across assets showed the upside of such diversification.

“The largest gains were once again made by the large multistrategy hedge funds like Citadel, DE Shaw and Millennium,” LCH Chairman Rick Sopher said in a statement. “The strong gains they have generated in recent years reflect their increasing dominance in strategies which do not depend on rising asset prices, and their substantial size.”

LCH’s annual ranking is just one way to look at the performance of hedge funds, where managers are typically measured by their overall gains since inception. The ranking, which was first published in 2010, excludes newer or smaller hedge funds that outperformed on a percentage basis (a list of some of the best and worst funds can be found here) .

The findings also reflect the growing clout of multistrategy hedge fund firms, which are on the cusp of taking over equity-focused funds to become the dominant strategy in the industry. Their growing assets and higher fees are helping them win an expensive battle to hire and retain top traders.

LCH has estimated that the industry has produced gains in excess of $1.4 trillion for clients since inception. The top 20 managers, which oversaw almost 19% of the industry assets, produced $692 billion of that profit, or 49% of the total.

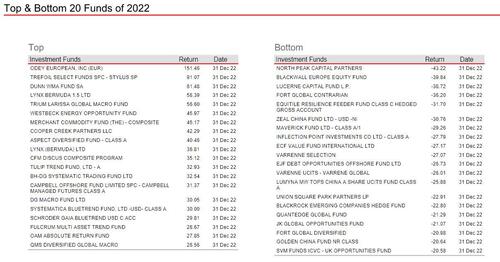

A summary of the top and bottom 20 hedge funds of 2022 broken down in performance return terms is shown below, courtesy of the HSBC hedge fund tracker.

Tyler Durden

Mon, 01/23/2023 – 16:40

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com