China’s Credit Monster Is Back: Beijing Injects Nearly $1 Trillion In New Money In One Month

One month ago, when looking at the latest Chinese credit data, we said that Beijing’s credit flood is coming, even if the December data was a disappointment.

China’s Credit Flood Is Coming, But December Was A Disappointment https://t.co/M9qmJRm0KX

— zerohedge (@zerohedge) January 11, 2023

Then two weeks later, we got confirmation that this was indeed coming, when a local news paper said that “China Bank Lending in Jan. May Hit Record at Over 4T Yuan”, to which our response was that China had just wasted 3 years in another pointless deleveraging experiment to get back where it started: with massive credit injections as the only means for growth.

China just wasted 3 years in another pointless deleveraging experiment to get back where it started: with massive credit injections as the only means for growth. https://t.co/nDrAaUHYJA

— zerohedge (@zerohedge) February 1, 2023

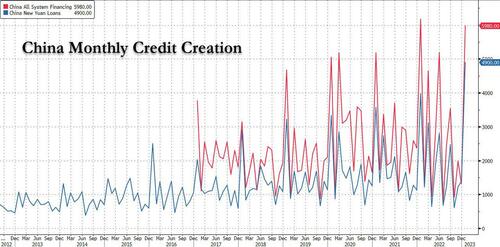

Fast forward to today when just as we previewed a month ago, the Chinese Credit Flood arrived with a bang, and a record 4.9 trillion in new loans, which smashed expectations as did the Total Social Financing which came at a near record 6 trillion yuan, or almost $1 trillion in total new credit (i.e., new money) in just one month!

The big picture: Total RMB loans surprised the market to the upside mainly on stronger corporate loans – corporate loan growth accelerated to 23.7% month-over-month annualized in January from 16.9% in December, although short-term corporate loans grew faster than medium to long term loans. Household loan growth slowed in contrast – medium to long term loans to households (mostly mortgages) contracted in January vs December last year amid weak property transactions and early repayment of mortgages. Total social financing and M2 beat expectations as well on the back of stronger loan growth.

The key numbers:

- New CNY loans: RMB 4900BN in January (RMB loans to the real economy: RMB 4930BN) vs. Bloomberg consensus: RMB 4200BN.

- Outstanding CNY loan growth: 11.3% yoy in January (+12.7% mom sa ann, estimated by GS); December: 11.1% yoy (+12.1% mom sa ann).

- Total social financing: RMB 5980 billion in January, vs. consensus: RMB 5400bn

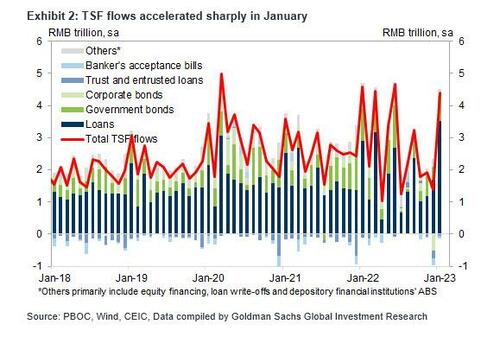

- TSF stock growth: 9.4% yoy in January, vs. 9.6% in December. The implied month-on-month growth of TSF stock: 11.5% in January (seasonally adjusted annualized rate), more than double the 4.8% December rate.

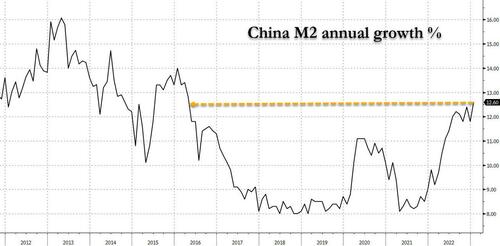

- M2: 12.6% yoy in January (21% mom sa ann estimated by GS) vs. Bloomberg consensus: 11.7% yoy, December: 11.8% yoy (+2.5% mom sa ann).

Courtesy of Goldman’s Maggie Wei, here are the main points from the report:

- 1. January total social financing (TSF) came in above market expectations, mainly on stronger loan growth. The sequential growth of TSF stock accelerated to 11.5% mom sa annualized in January from 4.8% in December, and in year-on-year terms, TSF stock growth slowed to 9.4% from 9.6% in December. Among major TSF components, new CNY loans rose strongly after seasonal adjustment, and shadow banking credit turned less negative as well. Trust loans, entrusted loans and undiscounted bankers’ acceptance bills combined contracted by RMB 140bn in January, vs a contraction of RMB 453bn in December last year. Corporate bond showed net issuance of RMB 91bn, vs net redemption of RMB 505bn in December, and government bond net issuance rose to RMB 794bn, from RMB 425bn in December.

- 2. Overall CNY loans came in well above market expectations, and the sequential growth of RMB loans accelerated to 12.7% mom sa annualized from 12.1% in December. Year-on-year growth of RMB loans was 11.3% in January, edging up from 11.1% in December. Based on loan breakdown by different sectors after our seasonal adjustment, corporate loan growth accelerated while household loan growth slowed. In particular, household short-term loan growth slowed to 3.4% month-over-month annualized from 5.7% in December, and household medium to long term loans, which are mostly mortgages, contracted by 2.2% in January from 5.2% expansion in December last year, on the back of slow property transactions and early repayment of mortgages, despite on-going property policy easing.

- 3. M2 growth accelerated to 12.6% yoy in January from 11.8% in December, above market expectations and the highest since 2016. FX inflows have likely been quite strong in January, adding to the overall M2 growth in the month, besides the contribution from faster RMB loan growth.

- 4. January loan and credit data were stronger than expectations, mostly on higher RMB loans to the corporate sector. The acceleration in corporate loans reflected policy support and some improvement in credit demand – policymakers urged commercial banks to accelerate loan extensions and market color suggests faster loan growth in infrastructure and manufacturing sectors. However, corporate short-term loans grew faster than long-term loans – short-term loans expanded by 39.3% month-over-month annualized, vs 5.4% in December last year, and medium to long term loans expanded by 28.2% month-over-month annualized, vs 24.4% in December. Whether the fast speed of corporate loan growth could be sustainable thus remains to be seen. In contrast, the weak household loans and in particular household medium to long term loan growth highlighted the challenges in the property sector – despite the on-going policy easing in the sector, households chose to repay mortgages early amid falling mortgages rates and relatively conservative expectations on future property prices.

- 5. PBOC revised the statistical standards for money and credit data this month by including credit extensions from consumer credit companies, wealth management companies, and financial asset investment companies to the loan and TSF data, though this impact is relatively small. According to the PBOC, total loan extensions by these companies stood at RMB 841bn in January, around 0.4% of outstanding RMB loan stock.

Bottom line, the January loan and credit data came red hot as we expected and as China warned, clearly expecting this outcome and hinting that there is much more to come (no surprise that the PBOC released more than 1trillion yuan in new liquidity in just the past three days). The acceleration in bank loans reflected policy support – commercial banks extended more loans to property developers after the “property 16 measures”, and policy banks’ credit facility targeting at infrastructure investment in recent months likely also added to overall RMB loan growth. At the same time, the sharp upward reversal in TSF growth indicates that Beijing has fully capitulated when it comes to new containing the next credit bubble and is now pursuing it wholeheartedly as it hopes to reverse three years of subdued growth by China’s economy during its Zero Covid nightmare.

The question is how soon and how extensively China’s massive credit impulse reboot will flood the world. One thing is clear: the burst higher in credit will lead to an even more powerful bounce in Chinese stocks in the near term.

The chart below basically summarizes my take on the credit data Beijing just released. pic.twitter.com/Tpd0mtcD8T

— Shanghai Macro Strategist (@ShanghaiMacro) February 10, 2023

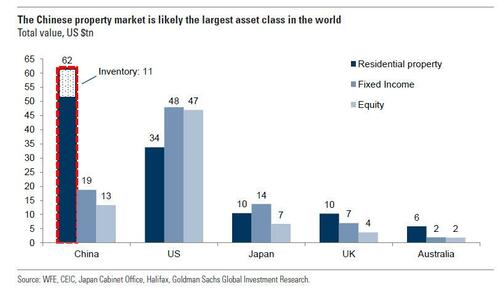

How widely that spreads across the globe remains to be seen and will be a function of how much inflation China manages to export to the world in the next year. This a topic we discussed in “Nikileaks Spooks Markets That Chinese Reopening May Be Inflationary, But Wall Street Disagrees.” But what is perhaps most important is that the wobbly foundation of the world’s biggest asset bubble – China’s property market..

… is about to be reinforced with monetary concrete, as discussed in “In Huge Policy Reversal, China Will Ease “Three Red Lines” Rule To Kickstart World’s Biggest Asset Bubble“, and not long after expect all global “high beta” asset classes to follow suit.

Tyler Durden

Fri, 02/10/2023 – 11:55

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com