Core CPI Rises 32nd Straight Month, Headline Inflation Hotter Than Expected YoY Driven By Lagging Shelter

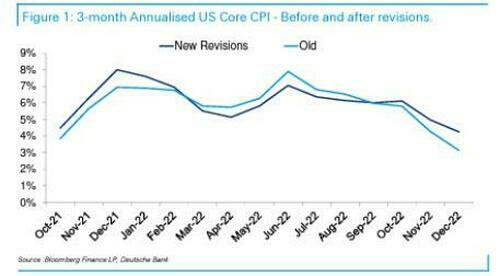

As a reminder, CPI revisions hit Friday – rewriting the entire last twelve months higher by an average of around 0.1% per month – so while the trend going into today’s much-anticipated CPI is The Fed’s friend, we are further away from their target before we see today’s print.

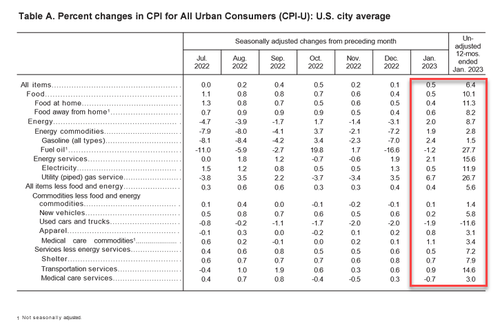

And so, after rising 0.1% MoM last month (up from the initial -0.1% print), consensus was for a reaccleration to +0.5% MoM in January and that is what it printed, prompting a hotter than expected +6.4% YoY CPI print (+6.2% exp)…

Source: Bloomberg

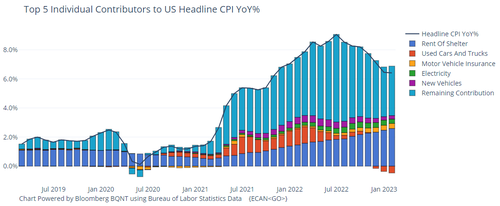

These are the Top 5 contributors to headline CPI…

Core CPI was expected to rise 0.4% MoM and printed in line – the 32nd month in a row of rising Core CPI

Source: Bloomberg

Services CPI soared to its highest since July 1982 and Goods inflation continues to slow…

Source: Bloomberg

Breaking it down, the index for shelter was by far the largest contributor to the monthly all items increase, accounting for nearly half of the monthly all items increase.

The food index increased 0.5 percent over the month with the food at home index rising 0.4 percent. The energy index increased 2.0 percent over the month as all major energy component indexes rose over the month. The indexes for used cars and trucks, medical care, and airline fares were among those that decreased over the month.

Finally, the rise in Americans’ cost of living outpaced their income gains for the 22nd month in a row (down 1.5% YoY)…

Source: Bloomberg

Just don’t forget the economy is “strong as hell”.

Tyler Durden

Tue, 02/14/2023 – 08:37

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com