2000 vs. 2020: The Role Of Monetary And Fiscal Policies In Stock Market Cycles

Submitted by Joe Carson, former Chief Economist & Director of Global Economic Research for Alliance Bernstein

The equity market of 2020 has some of the lofty valuation features that showed up at the peak of 2000 cycle. Yet, a key difference is the accommodative stance of monetary and fiscal policies nowadays versus the restrictive stance of 2000. So, the key question for investors is how does the monetary and fiscal policy backdrop influence the investment outlook? Do friendly policies create the potential for even more elevated valuations, to last longer, or is it merely a mirage shifting the focus of investors attentions to the upfront benefits and away from the longer term fundamentals of earnings and portfolio risks?

Equity Markets 2020 vs. 2000

There are a number of macro measures that are often used to assess how expensive or cheap the equity markets are at any point in time. None of these are hard barriers that can’t be exceeded – as all records in finance (like in sports) tend to get broken eventually – but they do offer a perspective on the market valuation relative to past cycles.

For example, the S&P 500 price to sales ratio hit a record high of 2.16 at the beginning of 2000 and has now been exceeded for the first time by the current reading of 2.25X.

Similarly, the market valuation of domestic companies to Nominal GDP – a metric that compares equity prices to overall economic growth – stood at a record 1.85X in 2000 and at the start of 2020 it is estimated that this metric has matched or slightly exceeded the highs of 2000.

Both of these measures suggest that the equity market is expensive. But, critics would argue that favorable monetary and fiscal backdrop makes these measures less excessive than they appear at first glance.

To be fair, there is evidence to support their case. In 2000, for example, monetary and fiscal policies were draining liquidity, the lifeblood of all equity cycles. At the start of 2000, the fed funds rate stood at 5.5%, well above the underlying inflation rate suggesting a restrictive policy, and policy became even more restrictive as policymakers raised official rates three times, by a total of 100 basis points to 6.5% by the end of Q2.

The fiscal stance in 2000 was also restrictive as the federal budget was in surplus, an indication that the federal government was taking more money away from the economy than it was adding.

In 2020, monetary and fiscal policies are stimulative, evident by very low interest rates and a trillion dollar budget deficit. Moreover, these policies directly and indirectly spurred a demand and supply imbalance in finance, favoring equities relative to cash and fixed income assets.

For example, the 2017 tax cut for corporations triggered a windfall in cash flow enabling a number of companies to fund a large share buyback reducing the supply of equities. At the same time, the policy of low official rates along with the promise of low rates for the foreseeable future directly increased the demand for equities by the increasing the value of the future stream of potential earnings and at the same time diminished the current and expected returns on fixed income assets.

So it is fair to say that monetary and fiscal policies nowadays have created a more favorable environment, at least temporarily, for the equity markets. But has these policies fundamentally altered the long-term investment outlook and eliminated valuation and portfolio risks? The answer is no.

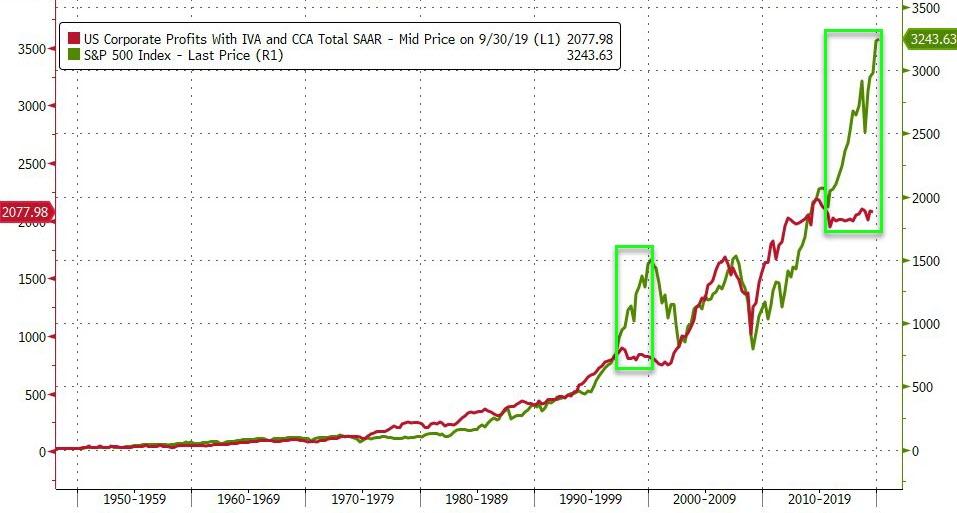

First, the operating profits of companies have not improved. The GDP measure of operating profits (before tax) has not increased for the past 5 consecutive years, and that’s one more than the 4 years of flat profit growth before the run-up of the equity markets in 2000.

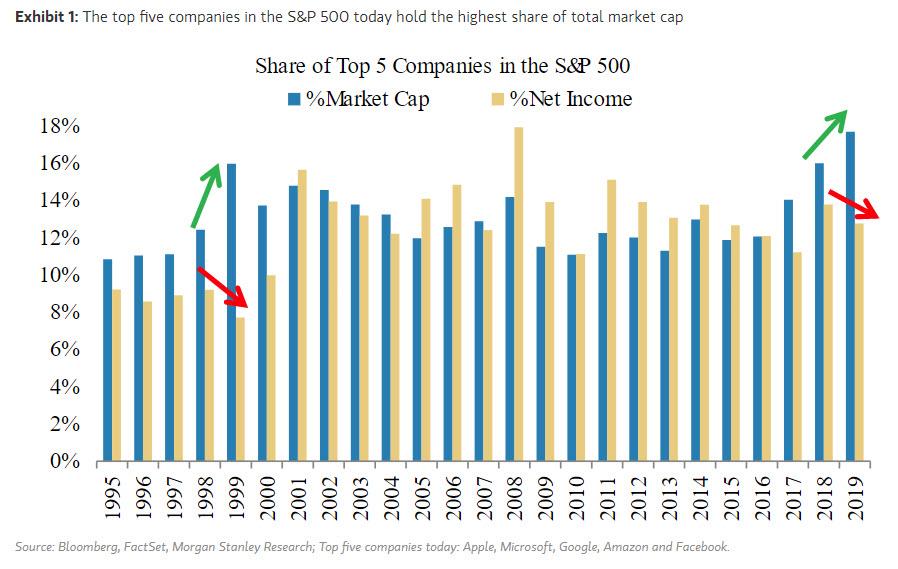

Second, the equity markets nowadays shows a more concentrated form of excessive valuation. For example, there are four trillion dollar companies, Apple, Google, Microsoft and Amazon, and when combined these companies market valuation account for roughly 13% of all domestic companies (the top five companies account for a record 18% of the S&P’s market cap). Moreover, the combined price to sales ratio of these 4 companies is over 5 – more than double than the overall market.

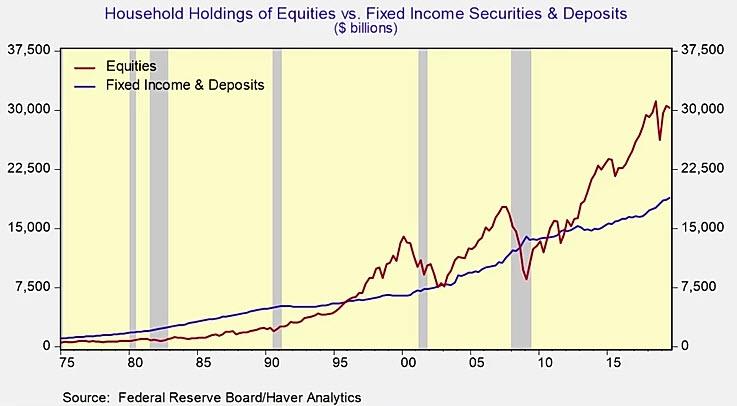

Third, the direct and indirect effects of these policies have greatly increased household portfolio risks by elevating the share of equities. In each of the last two finance/asset driven recessions households holdings of equities dropped below the levels of cash deposits and fixed assets – and if that happened again the wealth loss would be greater than equity declines of the tech and housing bubbles combined.

The final script of the role of monetary and fiscal policies in the current equity market cycle has not been written. The upfront benefits of these policies are clearly visible in equity market valuations, but the concentrated form of excessive valuations and its direct link towards household large exposure of equities does create new risks in the outlook.

In 2000, the draining of liquidity sank the equity markets.

In 2020, it could well be that the inflow of liquidity from policies became too concentrated that the equity market fell under its own excess weight triggering negative ripple effects through all segments of finance and the economy.

Tyler Durden

Tue, 01/28/2020 – 08:00

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com