What If The Whole Point Is To End “The Fed Put”?

Authored by Charles Hugh Smith via OfTwoMinds blog,

Choose one, and only one: a stock market that inflates and pops in an endless series of ever-more destructive bubbles, or a real economy that is no longer in thrall to the engines of wealth inequality and speculative frenzy.

“The Fed Put”–the implicit Federal Reserve policy of bailing out the stock market as soon as it swoons by unleashing a flood of monetary stimulus–is now accepted as a guarantee not unlike financial gravity. Regardless of the bleatings of Fed officials, “everyone knows” the Fed will quickly “pivot” should the market swoon, slashing interest rates and ramping up liquidity via Quantitative Easing (QE).

Recall the definition of excess liquidity: the difference between real money growth and economic growth. The Fed juices excess liquidity not to further expansion in the real economy but to force-feed new money into the stock market and other risk assets.

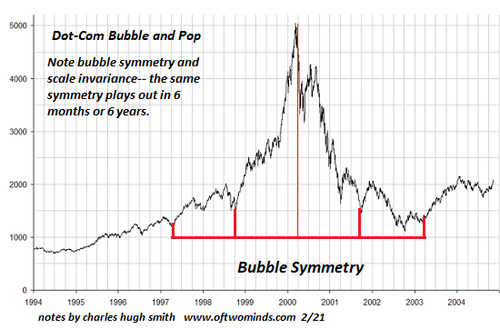

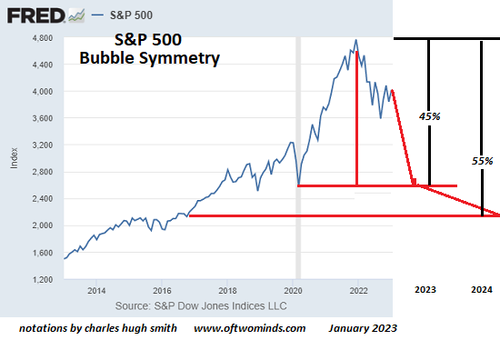

The only possible result of “The Fed Put” is a credit/asset bubble, which is why we’re currently experiencing the third such monumental speculative bubble in 23 years.

“The Fed Put” is the logical endpoint of neoliberalism, which places “markets” (and thus finance) at the core of the real economy. The neoliberal fantasy is that “markets” solve all problems via the magic of “the invisible hand” and so everything becomes subservient to the gyrations of “markets.”

The second part of the fantasy is that “markets” are self-regulating, meaning there’s no need for a moral order or government regulations; the magic of markets includes a godlike ability to restrict its own motivations, i.e. greed and exploitation to maximize gains by any means available.

As has been proven time and again, any means available reliably includes fraud, embezzlement, malfeasance, destroying competition with cartels and monopolies, and so on. (Look at how perfectly unregulated crypto-markets have self-regulated themselves. It’s a wonder to behold such perfection, isn’t it?)

Neoliberalism conveniently ignores Adam Smith’s insight that markets require a strict moral order to avoid collapsing into savage exploitation. The neoliberal fantasy is that “markets” don’t need no stinkin’ moral order, greed and maximizing gains by any means available generate their own self-regulating structure via magic.

Let those who lost fortunes in the FTX debacle explain how perfectly this magic functions in the real world.

The Fed has taken on the role of Savior of the stock markets as a means of cementing its pre-eminence over the real economy. Fed apologists claim goosing the stock market promotes “the wealth effect” in which fatter stock valuations encourage the wealthy to spend more and borrow more than they would have otherwise done.

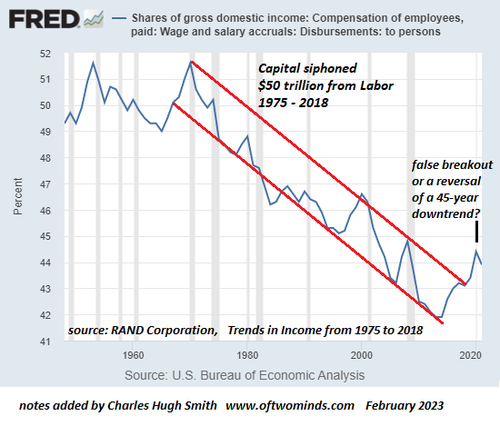

This happy story overlooks the fact that goosing the stock market vastly increases wealth inequality, in effect making the already-rich much, much richer while leaving all those who didn’t or couldn’t own big stakes in equities mired in the swamps of the real economy, where labor’s share of the economy has declined as capital’s share has soared.

Making the real economy subservient to all-powerful markets and finance has destabilized the economy and society. Elevating markets to supremacy has created an endless series of credit-asset bubbles, each of which furthers wealth inequality (see chart of the top 1%’s wealth below) even as they devastate the real economy when they inevitably pop.

Elevating markets and finance to supremacy was all fun and games until some of the loot leaked into the global economy at an inopportune time when supply and geopolitical constraints emerged from a decades-long slumber to transform a deflationary hyper-globalization / hyper-financialization into an inflationary era of unhinged, destabilizing financial excess.

In other words, “The Fed Put” has completely distorted the real economy, and these structural distortions are now bearing the bitter fruit of the Fed’s delusional embrace of neoliberal fantasies.

Few if any seem to think the Fed might have awakened to the destructive potential of their delusion. Few if any ponder the possibility that the entire exercise of “fighting inflation” is also a backdoor policy of ending “The Fed Put”, but doing so without generating mass hysteria in all those betting the farm on the Fed “pivoting” to save the stock market yet again from its excesses.

If we read between the lines, the abandonment of “The Fed Put” is already clearly visible. No Fed official is going to say explicitly that “we’re no longer going to rescue the stock market every time it swoons.” That would crash the market as every punter who counted on the Fed panics.

The Fed’s implicit policy is to let all the True Believers in “The Fed Put” become bagholders, holding stocks all the way down to a “Fed-Putless” reality. The Fed will continue to issue statements about “being supportive” of this and that, and they may well “pause” raising rates, unleashing a temporary euphoria. But they won’t drop rates back to zero or boost their balance sheet by another $4 trillion just to keep an overvalued stock market plumply overvalued.

While speculators focus on the destruction of stock market valuations, they overlook the destruction of the real economy wreaked by “The Fed Put.” Choose one, and only one: a stock market that inflates and pops in an endless series of ever-more destructive bubbles, or a real economy that is no longer in thrall to the engines of wealth inequality and speculative frenzy.

For the past 25 years, the Fed has conflated the stock market and the real economy. This fantasy is no longer affordable. Either the Fed devotes itself to supporting the real economy, or it hastens the demise of the real economy by continuing to goose ever-more destructive speculative bubbles. It can no longer do both, and in choosing the real economy over the stock market, it is finally choosing wisely.

Perhaps “fighting inflation” is providing much needed cover for the ultimate goal of ending “The Fed Put.”

That the Fed has chosen the real economy over the stock market is “impossible,” of course, just as inflation was “impossible.” What’s possible and impossible may well change rather dramatically in the years ahead.

Please note that no one needs to “be in the market.” There are plenty of ways to invest in yourself without owning a single share (or zero-day to expiration option). This is the path of Self-Reliance.

New Podcast: Turmoil Ahead As We Enter The New Era Of ‘Scarcity’ (53 min)

* * *

My new book is now available at a 10% discount ($8.95 ebook, $18 print): Self-Reliance in the 21st Century. Read the first chapter for free (PDF)

Become a $1/month patron of my work via patreon.com.

Tyler Durden

Mon, 03/06/2023 – 08:20

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com