Goldman Expects Nearly 1 Million Drop In Tomorrow’s Job Openings

In his most hawkish speech since Jackson Hole, Fed Chair Powell made it very clear: if economic data keeps coming in as hot as February, the Fed will not only hike higher for longer, but may revert back to 50bps rate hikes (or even higher) at the next FOMC. Which begs the question: what will the barrage of economic data that starts with tomorrow’s ADP and JOLTs reports, goes through Friday’s Nonfarm Payrolls, and culminates with next week’s CPI, PPI and retail sales, show?

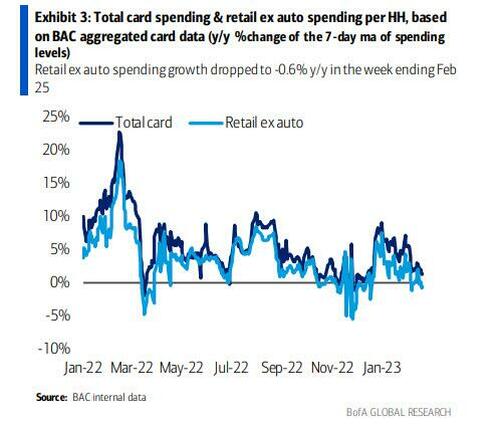

Well, as we have previously noted, January’s data was a one-time outlier across the board: not just jobs and inflation, but also retail sales. In fact, last Friday we showed that the latest BofA card data indicated a sharp slowdown in retail spending after the January splurge.

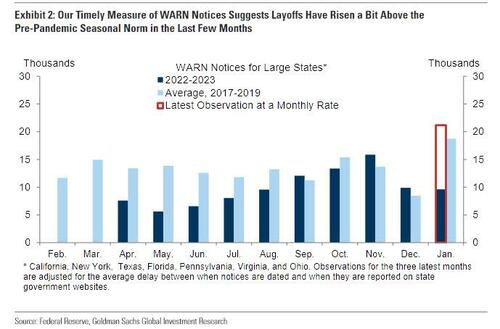

Also, three weeks ago we reported that Goldman found the layoffs/initial claims data is also artificially propped up, because when looking at state-level WARN notices which were coming in far hotter than expected…

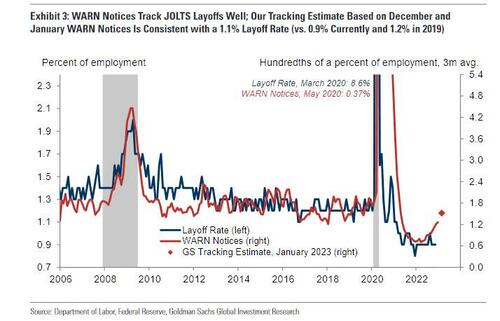

… the layoffs rate translated into a far higher number than that indicated by the November JOLTS report.

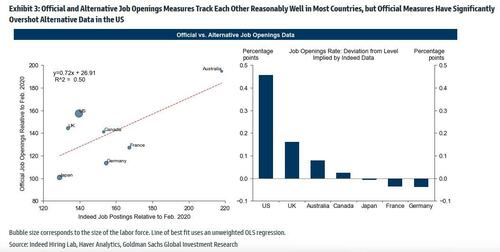

Now, in a follow up analysis, Goldman has also found that the number of job openings signaled by the JOLTS report is also delayed in showing the true state of the labor market (at best), or simply rigged, and in a report by the bank’s chief economist Jan Hatzius (available to pro subs in the usual place), he writes that while “timelier alternative measures of job openings track official data reasonably well in most countries, but the official JOLTS job openings measure looks relatively high in the US.”

Some more details:

Given the importance of labor demand to the wage growth, inflation, and monetary policy outlook, timelier alternative measures of job openings have recently become useful metrics for tracking labor market rebalancing progress. These alternative measures generally track official job openings data reasonably well (left chart, Exhibit 3), although the official job openings measure from the Job Openings and Labor Turnover Survey (JOLTS) currently looks relatively high in the US (right chart, Exhibit 3).

Almost as if there is a political mandate under the Biden administration to fabricate data with the purpose of making the labor market appear stronger than usual. Of course, Goldman would never admit that political apparatchiks planted in the Dept of Labor and BLS have been tasked with “seasonally adjusting” numbers to make Biden look good. Instead it offers the following two explanations why the official data no longer represents reality:

We see two explanations for why the most recent JOLTS report likely overstates job openings.

- First, the spurious evolution of seasonal factors during the pandemic likely biased JOLTS job openings upwards by 300-400k in December, but should have a negligible effect on the level of job openings in January.

- Second, the response rate to the JOLTS survey collapsed from just below 60% in 2019 to 31% in December 2022. We see no reason why the lower response rate should imply a directional bias, but it does imply increased volatility that argues for discounting the recent JOLTS report, especially because it is so far out of line with timelier job openings indicators.

Goldman’s conclusion: since the BLS will find it difficult to rig the data any longer various adjustments fall out in the latest dataset, the bank sees “scope for a large pullback in official job openings in the US and forecast that job openings will fall by 800k to 10.2mn in next week’s January JOLTS report.”

A nearly 1 million drop in JOLTS will quickly reprice much of the recent tightening driven by expectations of “no landing” which has sent the terminal rate to 5.65% and the 2s10s below -100bps.

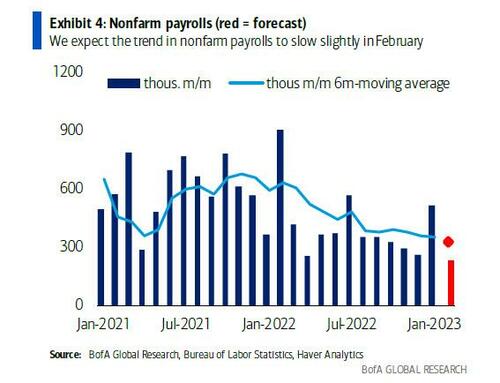

And once the JOLTS report confirms that the recent trend was spurious (at best) expect Friday’s jobs report to also come in far below the January level, and an extension of the previous downward sloping trendline, something which BofA already expects…

… as does Morgan Stanley, which writes that it expects “re-normalization of the economic data, starting with the payrolls print. Seasonal factors, warmer weather, and underlying changes in corporate behavior due to labor hoarding likely gave the January print a substantial boost. In non-seasonally adjusted terms, the economy will need to add close to 800k jobs in February for seasonally adjusted payrolls to net to zero, while in January, anything less than 3mm job losses would have delivered a positive number.”

Much more in the full reports available to professional subs.

Tyler Durden

Tue, 03/07/2023 – 14:50

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com