Commodity Traders Gross Record $115 Billion In 2022 Profit Margin

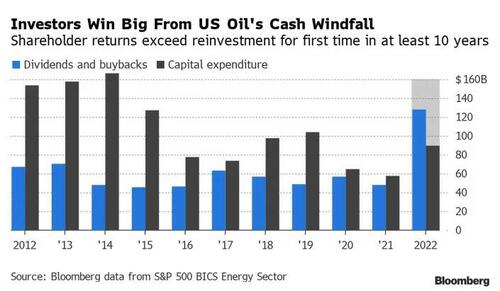

Yesterday we reported that for the first time ever, US drillers spent more on share buybacks and dividends – some $128 billion – than on capital projects (understandably so, courtesy of a clueless administration which has sought to demonize and alienate the very corporations it needs to push key energy prices lower, while vowing to end energy demand as we know it: almost as if Hunter Biden is in charge of US energy policy).

Of course, energy companies would not have been able to return that kind of money to shareholders unless they generating comparable profits, and sure enough. according to a new report from Oliver Wyman, commodity traders – perhaps the most profitable subset of commodity companies – saw record gross margins of about $115 billion last year.

If confirmed by trading companies’ annual profit figures, this would reflect an increase of about 60% over the previous year.

Where did the record profits come from? In a nutshell, the Kremlin: the Ukraine invasion sent commodity prices from energy to metals and grains on a tear while sparking a record burst of volatility; that volatility, along with sanctions and export restrictions, created arbitrage opportunities for traders as the world’s energy and food supply maps were redrawn.

“Trading firms that spent years developing their portfolios, agile culture and expertise were well positioned to handle the disruption and keep commodities flowing,” the study said without listing individual firms.

According to the report, industry gross profit margins have roughly tripled from $36 billion in 2018, with those of independent trading houses now far outstripping others in the sector.

And, as Bloomberg notes, for the first time, the consultancy’s analysis split out hedge fund numbers into their own section, having merged them with others previously.

“Hedge funds more or less left commodities after 2010-2011, but over the last two to three years they’ve really built up their capabilities in a return to the market, and quite successfully so,” said Ernst Frankl, who leads Oliver Wyman’s global commodity trading and risk practice.

Tyler Durden

Wed, 03/08/2023 – 04:15

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com