Fed’s Favorite Inflation Signal Slows As Savings Rate Hits 1-Year High

The Fed’s favorite inflation indicator – Core PCE Deflator – was expected to remain ‘sticky’ at 4.7% (but instead it came in modestly lower at 4.6% YoY – lowest since Oct 2021). Headline PCE fell to 5.00% – lowest since Sept 2021…

Source: Bloomberg

However, while acyclical core inflation slipped, cyclical core inflation continued to march higher, which is a greater problem for the Fed. Cyclical core PCE inflation, which tracks inflationary pressures that are linked to the current economic cycle, is at the highest on record going back to 1985.

Source: Bloomberg

Americans’ Personal Income rose 0.3% MoM (slightly more than expected) while spending rose 0.2% (slightly less than expected)…

Source: Bloomberg

Both spending and income growth slowed on a YoY basis…

Source: Bloomberg

Inflation-adjusted we note that (real) spending declined 0.1% MoM in Feb (the 3rd monthly drop in the last 4 months)

Source: Bloomberg

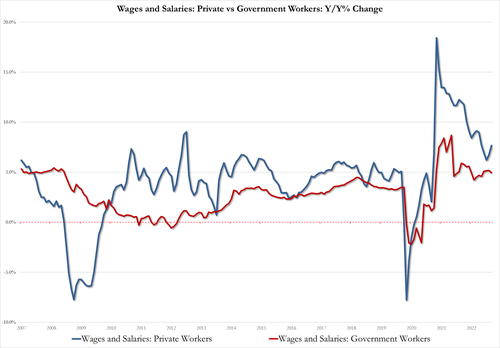

So while there is some positive news on the inflation front (Core PCE slipping lower), the ugly black lining to that cloud is that private wages bounced big from 6.7% Y/Y to 7.7%; govt worker salaries dropped from 5.2% to 5.0%

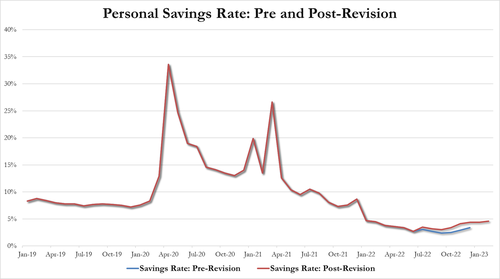

As a result of all that, in Feb the savings rate rose to 4.6%, highest since Jan 22…

Finally we note that while the market’s inflation expectations have dropped in March – thanks to credit tightening fears from the banking crisis – it remains well above The Fed’s target level…

Source: Bloomberg

With last night’s Fed data potentially signaling a slowing in deposit outflows, this morning’s PCE suggests The Fed may have more to do than the hopeful doves in the equity market believe.

Tyler Durden

Fri, 03/31/2023 – 08:42

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com