When The Rate-Hiking Tide Turns, It Does So Quickly

Authored by Simon White, Bloomberg macro strategist,

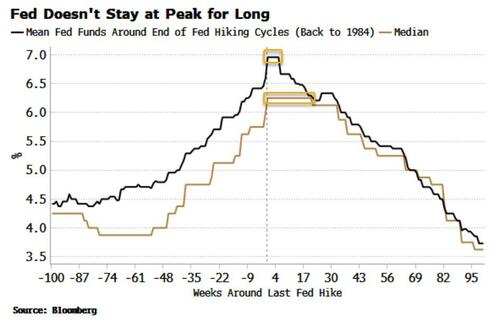

The Fed could be cutting rates sooner than expected given the historically short period between the last rate hike and the first rate cut.

“Higher for longer” is a neat phrase, but it rarely plays out like that in practice.

Rapid rises in borrowing costs invariably lead to something going wrong, which typically has to be put right by cutting rates.

In fact, the median time between the last Fed hike and the first cut is only four months, while the average time is only six weeks.

Some will say “this time is different” and such caveats should always be noted. But this argument is generally applied incorrectly. One should anchor one’s view with the long-term picture, and then tweak it using today’s information. “This time is different” thinking is an inversion of this, starting with the current outlook and then seeing if agrees with the historical outlook.

In a sign of how quickly things can turn, it wasn’t long ago when the market was pricing in several more Fed rate hikes. Suggesting a pause or an early cut back then was somewhat heretical. But fast-forward to today, in the wake of the SVB failure, and the market barely sees a 50% chance of another hike, while pricing in a cut of more than 25 basis points by September.

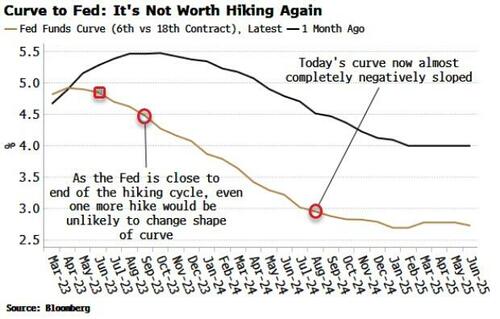

Things could change again of course, but there is a lower cost-benefit for the Fed in hiking again while the short-term interest-rate curve (STIR) is so inverted.

As we saw in this cycle, the curve barely responded to the Fed’s hawkish message. Yet with the central bank now close to the end of its rate-hiking cycle, the curve is even less likely to react to another hike. The curve would remain inverted, and become even more so if the market were to deem the hike would do more harm than good to the economy.

Thus another hike would risk only more downside, while the curve would do little to transmit its inflation-cooling effect. So it’s lose-lose situation.

I still lean towards this Fed hiking cycle being over, with the first cut coming as early as June.

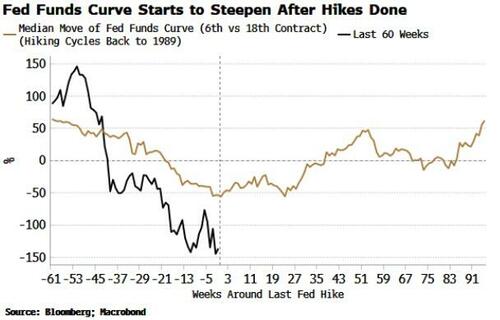

What we need to watch now is the latter part of the STIR curve. Once the Fed has stopped hiking, that typically starts to steepen.

We could see come giveback in short-term yields in the coming days as they are very oversold, but the prospect of a renewed upward trend is looking increasingly distant.

Tyler Durden

Fri, 04/07/2023 – 07:15

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com