Europe Is Buying Record Amounts Of Refined Russian Fuels Through India, And Paying A Huge Markup

Last August, we were the first to show how Russia was bypassing Europe’s so-called commodities embargo: it was selling LNG to China which was then re-selling it to Europe at a substantial mark up. And while we also frequently reported that Russia was using a similar sanctions bypass for oil, this time using India instead of China, few were willing to confirm as much: after all, it would seem very shortsighted if European consumers were paying an extra surcharge to India, while Russia was not suffering any adverse consequences from Europe’s laughable “sanctions.”

Not any more: on Friday, Bloomberg reported that for all of Europe’s fire and brimstone about an embargo (which has gotten decidedly quieter in recent months), “Russian oil is still powering Europe just with the help of India.“

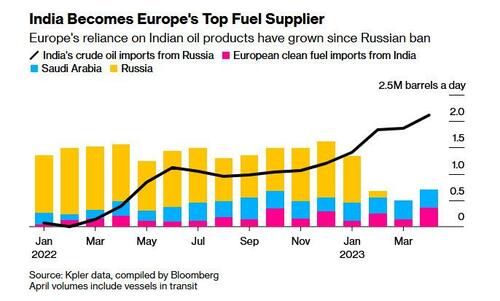

As we reported at the time, last December the EU barred almost any seaborne crude oil imports from Russia. It extended the prohibition to refined fuels two months later. However, the rules didn’t stop countries like India from snapping up cheap Russian crude, turning it into fuels like diesel, and shipping it back to Europe at a big markup: as shown in the chart below, just the Brent to Urals price differential, a byproduct of the Russian sanctions, is about $25/bbl, almost a third of the price of a barrel of crude. The markups on Russian product are even greater when dealing with refined products such as gasoline or diesel.

In fact, India has become so good at reselling Russian oil to the same Europeans who refuse to buy it directly from Moscow for a much lower price, that the Asian country is on track to become Europe’s largest supplier of refined fuels this month while simultaneously buying record amounts of Russian crude, according to data from analytics firm Kpler.

In other words, Europe is still buying Russian oil, keeping Putin’s military machine well-funded, but because of the virtue signaling exercise of buying Russian oil though a mediator, the transaction ends up costing Europeans billions more than if they simply had purchased the oil directly.

— Derek J. Grossman (@DerekJGrossman) April 29, 2023

“Russian oil is finding its way back into Europe despite all the sanctioning and India ramping up fuel exports to the west is a good example of it,” said Viktor Katona, lead crude analyst at the firm. “With India taking in so much Russian barrels, it’s inevitable.”

As Bloomberg notes, “the development is double-edged for the EU. On the one hand, the bloc needs alternative sources of diesel now that it has cut off direct flows from Russia, previously its top supplier. However, it ultimately boosts demand for Moscow’s barrels, and means extra freight costs.” In other words, Europe achieves none of its embargo goals (i.e., keeping Russian oil out of the market, preventing Putin from using oil to finance the war in Ukraine), while being hit with far higher energy prices.

It also means more competition for Europe’s oil refiners who can’t access cheap Russian crude, and comes amid wider market scrutiny about where the region’s diesel imports are coming from.

Repsol SA’s CEO Josu Jon Imaz said on Thursday that Russian diesel is entering Europe illegally and called on authorities to clamp down on the activity. He wasn’t talking about the trade via India but flows of diesel that originated in Russia… which of course is the same thing.

Hilariously, a preliminary inquiry into the matter by Spanish authorities didn’t find evidence that Russian diesel was entering the country, a government official said Friday, adding that a probe is ongoing. Of course, nobody in Europe wants to admit that they are indirectly funding Putin, so expect many more such “discoveries” as all other countries try to find if they are importing Russian oil only to find that everyone but them is using it.

Meanwhile, Europe’s refined fuel imports from India are set to surge above 360,000 barrels a day, edging just ahead of those of oil exporting titan Saudi Arabia, Kpler’s data show.

And the cherry on top: Russian crude oil arrivals to India are expected to surpass 2 million barrels a day in April, representing almost 44% of the nation’s overall oil imports, according to Kpler data. India then quickly re-exports the oil or processes it first into diesel and gasoline, and then sells it to European customers.

More than half of Russia’s seaborne oil shipments were to the European Union and Group of Seven nations before the bloc began to cut purchases in response to the nation’s invasion of Ukraine in early 2022.

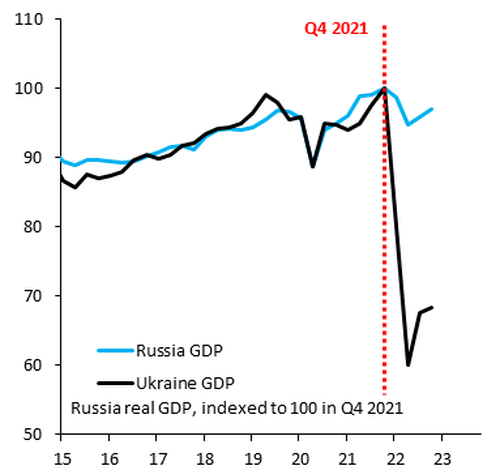

Finally, the question of what the point is of continued Russian “sanctions” remains, as the IIF’s Robin Brooks explains in the following twitter thread, which once again makes clear that western sanctions against Russia have been a catastrophic failure… perhaps as was intended all along.

Evaluation of our sanctions policy

1. Only 2 questions matter. First, have our sanctions meaningfully curtailed Russia’s ability to wage war? Second, are our sanctions a deterrent to countries that may wage war in the future? Unfortunately, the answer to both questions is: “No!”

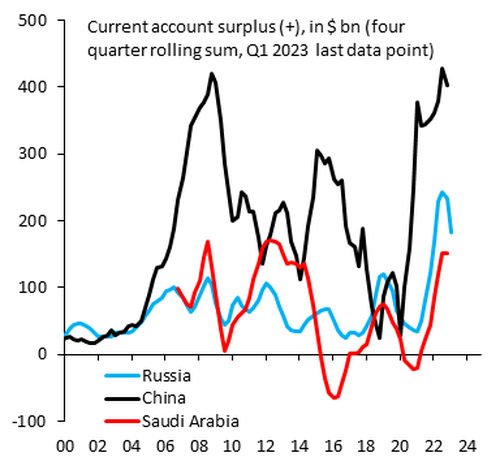

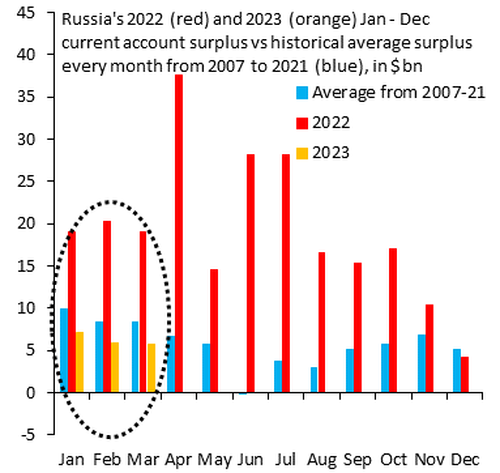

2. Root problem is an infatuation with financial sanctions. These can be effective when used on current account deficit countries – Turkey in 2018 is an example – but they don’t work on current account surplus countries. This is a key point that cannot be emphasized enough.

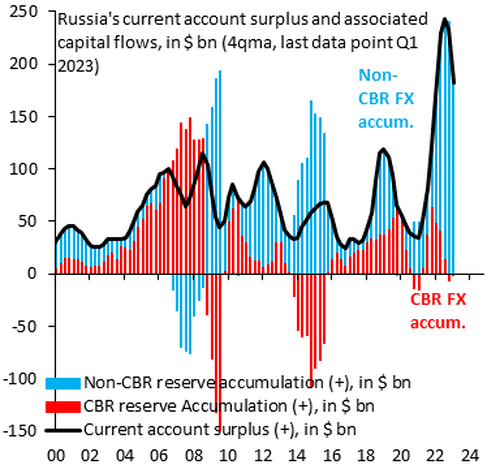

3. Russia shows how our financial sanctions failed. We sanctioned some banks, including the central bank (red), but not all. This meant that all the cash from Russia’s current account surplus got routed through non-sanctioned Russian banks (blue). Putin still got all his cash…

4. So our financial sanctions did not prevent Putin getting all his cash in return for energy exports. All this cash just got routed through different banks than before. As a result, financial conditions in Russia eased back to pre-war levels, a big plus for Russia’s war economy.

5. We could have avoided this, but it would have required sanctioning ALL Russian banks. That’s the same as a trade embargo, since Putin no longer gets paid and stops exporting. This shows what’s needed to hurt c/a surplus countries: a trade embargo! Not financial sanctions…

6. Number one lesson from Russia is that our infatuation with financial sanctions must end. They don’t work on c/a surplus countries, unless we sanction all banks, in which case we’re just doing a trade embargo. We need to be doing trade embargos instead of financial sanctions…

7. Had we done a hard energy embargo on Russia, this would have come at a cost to the West, but Russia would have gone into financial crisis, making the war harder for Putin to fight. An embargo would have also scared other potentially hostile current account surplus countries.

8. It’s not too late. First, the West needs to end its focus on financial sanctions. Second, we need to start talking about hard trade-offs that are needed to confront c/a surplus countries. We need to stop giving them cash, which means we need to stop buying their stuff…

9. A footnote on the G7 oil price cap. The cap is recognition of the fact that Russia’s current account surplus needs to be cut. But – thanks to Greek shipping oligarchs – the cap was set at $60 and wasn’t binding. A mistake that can be fixed now by lowering the cap…

Tyler Durden

Sat, 04/29/2023 – 18:30

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com