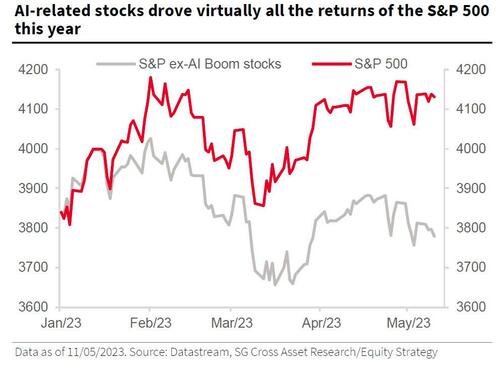

The S&P Is Up 8% In 2023; Without AI It Would Be Down 2%, Below 3,800

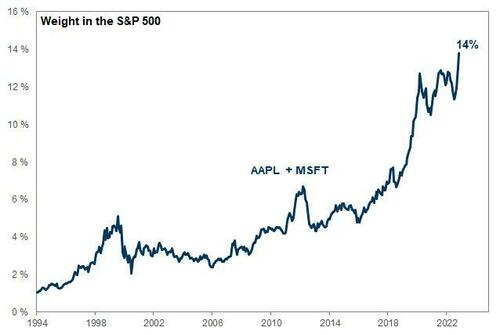

In the past month we have discussed on multiple occasions the unprecedented collapse in market breadth, driven by a record outperformance of a handful of tech names…

… which has seen the Nasdaq’s advance/decline line plunge to all time lows even as the Nasdaq is up more than 21% YTD…

… and where JPM recently observed that “Market Breadth Is The Weakest Ever” with Goldman’s David Kostin adding that there is elevated risk of a sharp market drawdown as a result of the collapse in market breadth.

Today, we get a new perspective on the market’s performance when normalized for the record collapse in breadth. According to SocGen it’s not so much a handful of stocks that has carried the entire market this year: it’s just one specific trade, Artificial Intelligence (which will soon spark hundreds of millions in margin-boosting layoffs across western countries).

As SocGen’s Manish Kabra writes, “the AI boom and hype is strong. So strong that without the AI-popular stocks, S&P 500 would be down 2% this year. Not +8%.”

Kabra reports that his update on SocGen’s AI sentiment news indicator keeps rising exponentially and more extended than when he first talked about it just a few weeks ago.

What is remarkable is that AI is nothing new: as a theme, Artificial Intelligence has been with us for decades (SocGen suggested being long SG Robotics and AI Equity as a secular theme last year), but what is going on now is unprecedented, and it is virtually impossible to fight against a very strong hype on a very short-term, and according to Kabra, what one can own is the defensive-Growth stocks with the top-20 most AI-held stocks within the top 15 AI ETFs.

Which brings us back to the topic of 2023’s record narrow leadership: The narrow performance is seen across the S&P 500 sectors with 8/11 broader sector groups seeing market-cap weighted indices outperforming equal-weighted indices. According to ScoGen calculations, the S&P 500 ex-AI boom stocks would be below 3800.

Yet despite this seemingly unsustainable collapse of market leaders, SocGen concludes that narrow leadership should continue: “We do see the narrow performance in the US equities to persist as the backdrop stays unfavorable for leveraged, Small-caps, Value stocks, and companies that have carried out unsustainable buybacks.“

More in the full note available to pro subs in the usual place.

Tyler Durden

Fri, 05/12/2023 – 14:15

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com