US Existing Home Sales Decline Re-Accelerates As Rates Rebound

After February’s ridiculous pumpfest, US existing home sales have continued to trend lower with March down down and now April dropping 3.4% MoM (worse than the 3.2% drop expected)…

Source: Bloomberg

Existing home sales are down 14 of the 15 months, leaving them down just over 23% YoY.

“Home sales are bouncing back and forth but remain above recent cyclical lows,” Lawrence Yun, NAR’s chief economist, said in a statement.

“The combination of job gains, limited inventory and fluctuating mortgage rates over the last several months have created an environment of push-pull housing demand.”

This should surprise no one given that mortgage rates rebounded higher…

Source: Bloomberg

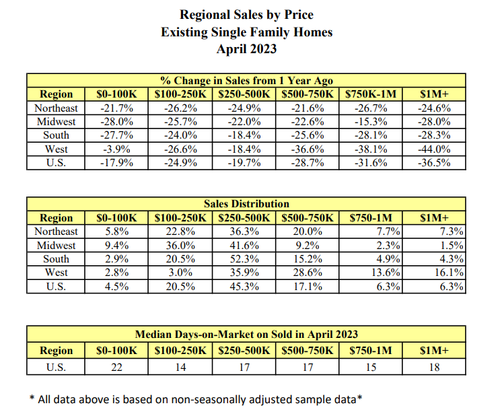

The median selling price of a previously owned home fell 1.7% from a year ago, the biggest drop since 2012, to $388,800. However, prices rose in the Northeast and Midwest.

“Even in markets with lower prices, primarily the expensive West region, multiple-offer situations have returned in the spring buying season,” Yun said.

The number of homes for sale rose to 1.04 million, up 1% from a year ago. Still, inventory was nearly double that in April 2019. At the current sales pace, it would take 2.9 months to sell all the properties on the market. Realtors see anything below five months of supply as indicative of a tight market.

Tyler Durden

Thu, 05/18/2023 – 10:10

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com