Hawkish FedSpeak Batters Bonds & Bullion; Tech Melt-Up Accelerates

‘Positive’ jobless claims data (which simply unwound last week’s farce in MA) and ‘not pretty’ existing home sales data were dominated today by some notably more-hawkish-than-recent-norms FedSpeak to start the day:

Dallas Fed’s Logan: “The data in coming weeks could yet show that it is appropriate to skip a meeting…”

“As of today, though, we aren’t there yet… We haven’t yet made the progress we need to make. And it’s a long way from here to 2% inflation.”

Fed Gov Jefferson: “Inflation is too high, and we have not yet made sufficient progress on reducing it,” he said.

“Outside of energy and food, the progress on inflation remains a challenge… a year is not a long enough period for demand to feel the full effect of higher interest rates.”

St.Louis Fed’s Bullard warned that “it may warrant taking out some insurance by raising rates somewhat more to make sure that we really do get inflation under control…”

“Our main risk is that inflation doesn’t go down or even turns around and goes higher, as it did in the 1970s.”

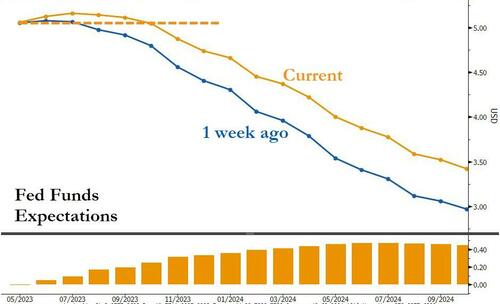

So, a pause at best, more hikes possible, no signs of cuts at all, and the curve is adjusting that way…

Source: Bloomberg

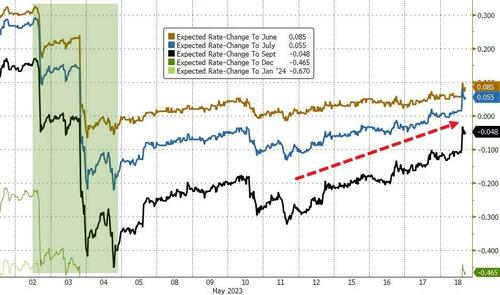

Rate-change expectations continued to trend hawkishly higher (removing more cut expectations)…

Source: Bloomberg

Overall, Treasury yields soared higher with the short-end monkeyhammered (2Y +12bps, 30Y +5bps)…

Source: Bloomberg

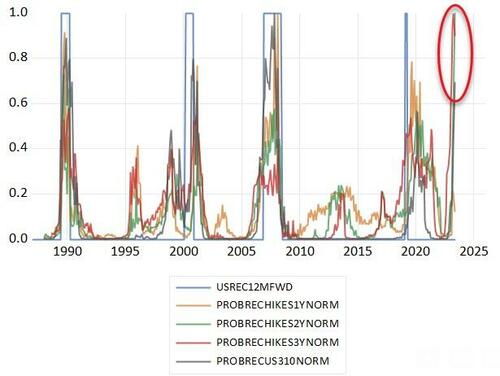

And the yield curve flattened (inverted) further, shouting recession…

Source: Bloomberg

In fact, as Goldman notes, the 2y and 3y segments of the money market curves price substantially higher probability of recession compared to all four cycles since 1990…

…and then the rate-cuts?

Tech stocks saw more panic/safe-haven/momo/AI-fomo flows today with Nasdaq handily outperforming while The Dow and Small Caps underperformed and the S&P danced in the middle. The last two hours saw everything melt-up…

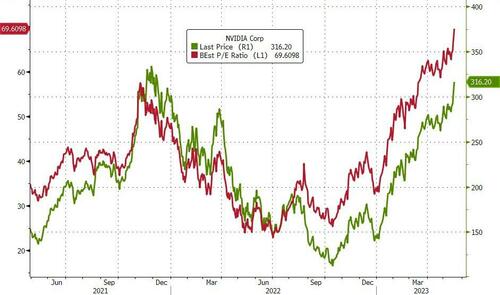

NVDA continued its melt up (another upgrade), rallying 5% today (AI God mode)…

As we reflected earlier, for NVDA to grow into its market cap, not only does AI have to put everyone out of work by 2030 but humans will be daytrading in zoos entertaining the algos…

NFLX also surged after reports that its ad-supported subs had hit 5 million…

Regional bank stocks bobbed and weaved between gains and losses…

The Dow is unch YTD, Nasdaq is not…

Source: Bloomberg

After all that, The Nasdaq is outperforming The Dow by an entire bull market…

The Nasdaq is outperforming the Dow this year by an entire bull market. pic.twitter.com/EdrKat1Urr

— Bespoke (@bespokeinvest) May 18, 2023

Tech valuations are at extreme levels relative to the broad market now…

Source: Bloomberg

The equal-weighted S&P is unchanged YTD…

Source: Bloomberg

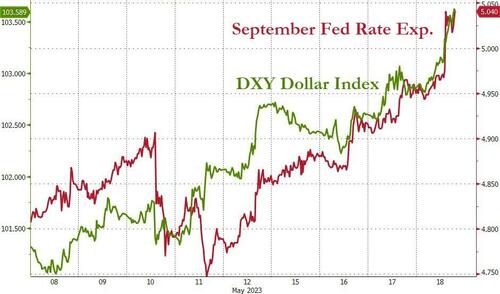

The dollar continued to rise tick for tick with the Sept Fed rate expectation (implying only marginal gains from here for the dollar)…

Source: Bloomberg

Bitcoin was rug-pulled again at $27,000…

Source: Bloomberg

Gold extended its losses after breaking $2000

Oil prices dipped lower again today with WTI back at a $71 handle

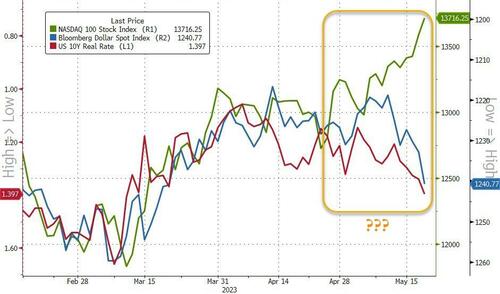

Finally, Goldman points out The Confusing Triangle: the dollar, tech stocks and real rates into a recession.

The dollar rallies (fact) on higher real rates (check) OR rising risk aversion (not present), tech rallies (fact) on lower real rates (not present) OR higher risk appetite due to US exceptionalism (check).

Source: Bloomberg

One of these would be wrong if real rates and US exceptionalism are equally weighted but it is hard to say which one as both are expensive and due for a meaningful correction given the probability of recession.

Goldman suggests that given that equities are at odds with oil in terms of pricing the probability of an adverse growth outcome, we would think that in the past week or so the dollar is right and equities aren’t.

Tyler Durden

Thu, 05/18/2023 – 16:01

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com