Goldman Finds “Most Accurate” Reading Of Current CRE Conditions, Predicts 25% Drop In Office Building Prices

There are increasing concerns about the severity of the downturn in the commercial real estate market. This week, Moody’s Analytics reported the first quarterly drop in CRE prices in over a decade. The most pressing issue at the moment is determining the extent to which these prices will drop.

Shedding more color on the potential depth of the downturn is Goldman Sachs chief credit strategist Lotfi Karoui. He told clients on Thursday that there are many ways to track CRE prices, though “the most accurate portrayal of current market conditions” is data via the Green Street Commercial Property Price Index, which suggests trouble ahead.

Here’s part of Karoui’s note explaining why Green Street data foretells the coming price plunge in office and apartment property values.

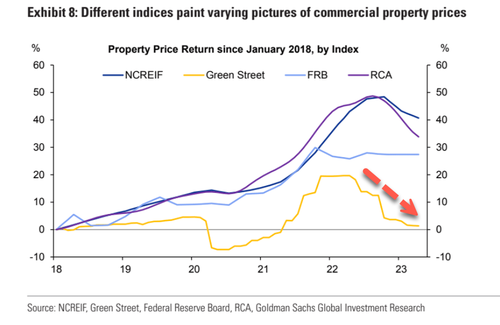

Over the past few months, we have been arguing the sizeable valuation gap between public and private real estate markets will start to close through a catch-down in property prices. Taking stock of the catch-down is, however, not that straightforward. There are many ways to track commercial property prices, often offering divergent pictures.

We show the performance of four popular commercial property price indices in Exhibit 8, suggesting price depreciation from peak levels anywhere between 15% and 2%. The two main methods of index construction are transaction-based such as RCA and NCREIF’s repeat sales indices, and appraisal-based such as the Green Street Commercial Property Price Index and the Federal Reserve Board Commercial Real Estate Price Index. Each methodology has its own shortcomings.

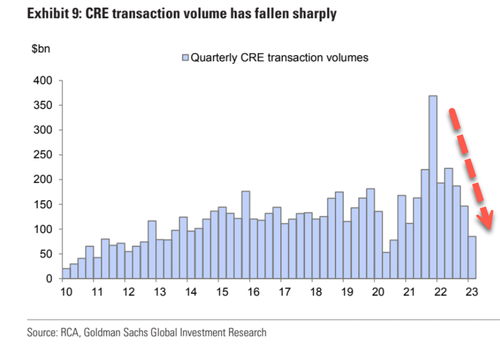

Repeat sales transaction indices often provide the most unbiased estimate of prices as they control for changes in the market’s composition. But the paltry level of transaction volume at present has shrunk the sample size of these indices (Exhibit 9). Appraisal-based indices can also be noisy at times. That said, at the current juncture, they likely provide the most accurate portrayal of current market conditions with Green Street indicating a 25% year-over-year drop in office property values and a 21% drop in apartment property values.

In Karoui’s view, Green Street’s data seems to be the most precise, forecasting a forthcoming price drop in office and apartment buildings. The index is weighted heavily towards retail, office, and apartments.

Also, the slide in CRE transaction volumes shows the entire sector might be headed for a deep freeze as lending conditions tighten.

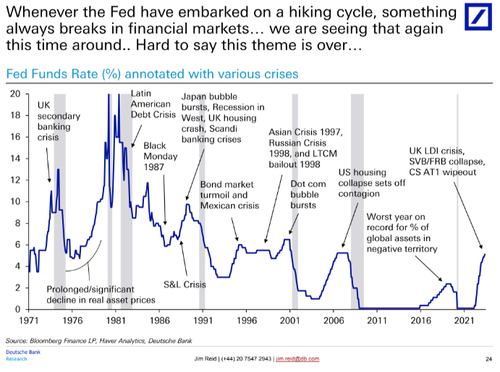

Meanwhile, Deutsche Bank veteran strategist Jim Reid painted an ominous outlook for the US economy in a note to clients. He pointed to aggressive central bank interest rate hikes breaking parts of the economy as the end of the hiking cycle usually ends with a bang.

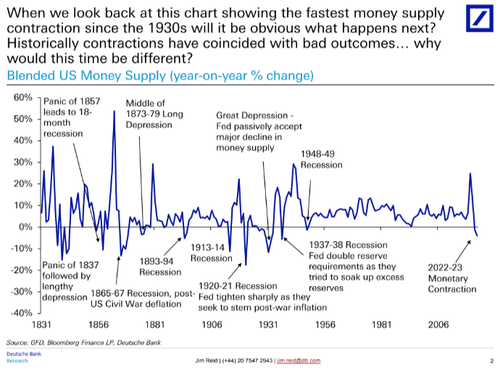

Reid also showed nearly two centuries of US money supply (year-on-year % change) data that shows the fastest collapse since the 1930s. This is a major red flag for the economy and capital markets, and past collapses have led to panics, recessions, and depressions.

It appears as though a downturn has arrived, with the regional banking and CRE sectors bearing the brunt of the Fed’s tightening over the past year.

There is more in the Goldman note from Lotfi Karoui, available to pro subscribers in the usual place.

Tyler Durden

Fri, 05/19/2023 – 20:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com