Stock Market’s Rise Is Looking Less Like A Bear Market Rally

Authored b y Simon White, Bloomberg macro strategist,

The current bounce in equity markets from October continues to outpace historical rallies in bear markets, bolstering the case that the low may be in for this cycle.

It always pays to remember that the path of least resistance for stock markets is up. Bear markets are the exception, not the rule, but they are, as Thomas Hobbes described life without government, “nasty, brutish and short”.

While the current bear market is longer than most, it is still nonetheless a risk for investors wondering whether the current rally is really the beginning of the end of the downturn, or merely the prelude to a nasty sell-off ahead, with new lows plumbed.

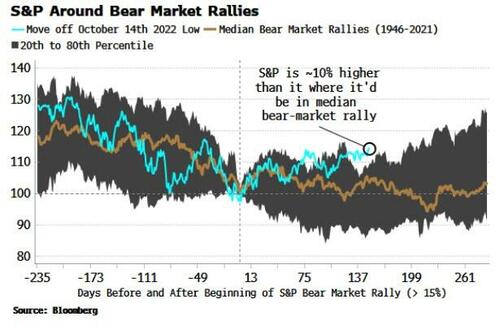

No-one knows for sure of course, but the current rally has remained more robust than perhaps most would have expected. We can see this if we look at the median behavior of the S&P in a bear-market rally (here defined as an at least 15% counter-trend rally within a bear market).

As the chart below shows, the S&P is diverging further away from historical bear-market rallies.

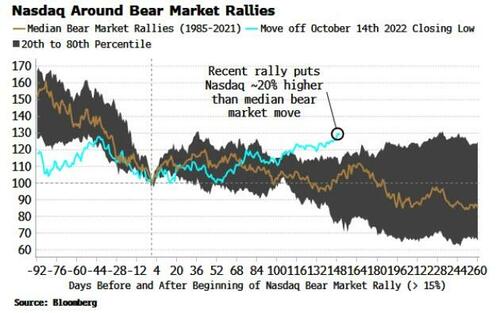

It is even more apparent when we look at the Nasdaq, with the recent AI-catalyzed rally taking the index well above its historical bear-market rally range.

Of course, this is a bit like looking for white swans to prove black ones don’t exist: it would only take one abrupt sell-off to confirm this is a bear-market rally.

A debt-ceiling resolution is one of the biggest short-term risks facing stocks, as the resulting increase in Treasury issuance would wick liquidity out of the system, leaving the equity market vulnerable to potentially sharp downside.

But it would also be remiss not to pay attention to the recent constructive price action, and the increasing right-tail risks from underweight investors and speculators chasing the market higher.

We shouldn’t forget that in addition to the adage that bull markets are born on pessimism, they can also be born on optimism, even if it is misplaced. Price often creates its own reality.

Tyler Durden

Tue, 05/23/2023 – 14:25

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com