Stocks Sink As ‘Appulus’ Fails To Impress; Gold Up, Crypto Down, Oil Flat

Eurozone PPI plunged overnight, but ugly US Services PMI data and slumping factory orders sent yields dramatically lower. For context, this was the worst day for the US macro surprise index since the first week of January…

Source: Bloomberg

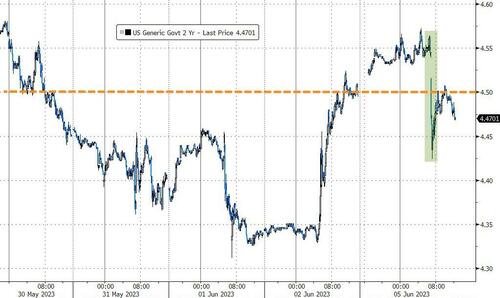

The overnight extension of Friday’s yield surge (pushing yields up by 6-8bps before the data hit) was cut short by the weakness in US macro data, plunging yields 10-14bps lower, leaving yield lower on the day by 1-2bps…

Source: Bloomberg

But the big story going into today was Apple’s WWDC event. Apple Surged up to an all-time high in the morning session but as they released the VR/AR headset, the price plunged into the red for the day. ‘Appulus’ starts at $3499 and won’t be released until 2024..

And that weighed on the broader market. Small Caps had been lagging all day, not helped by chatter of much higher capital requirements for ‘mid’-sized banks. Nasdaq was leading the day until AAPL shit the bed. The S&P and Dow ended red…

S&P pushed into a ‘bull market’, up 20% off the October lows intraday, finding resistance at a key level though…

Source: Bloomberg

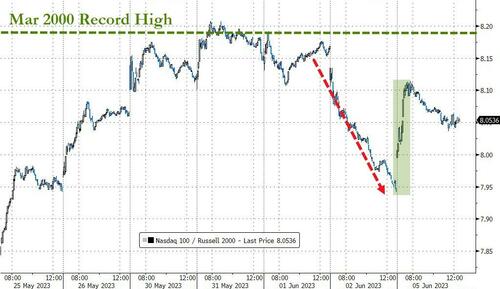

It is worth noting that the Nasdaq/Russell2000 ratio rebounded today but was unable to recover its record highs from March 2000…

Source: Bloomberg

Bank stocks tumbled on the Basel III Endgame headlines…

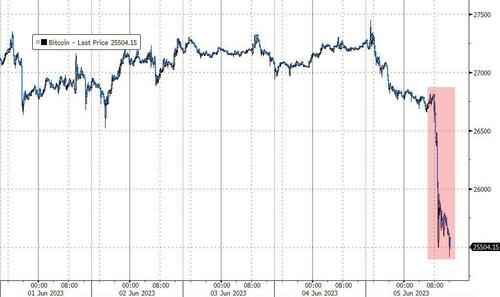

Additionally, early in the day, the SEC sued Binance – the world’s largest crypto exchange – and that sent all cryptocurrencies lower with Bitcoin back down to $25,500…

Source: Bloomberg

The dollar ended basically flat on the day, erasing overnight gains as the weak US data hit…

Source: Bloomberg

2Y yields broke back below 4.50%…

Source: Bloomberg

Oil prices surged higher on Sunday night after Saudi’s production cuts, with WTI topping $75. But as the day wore on WTI slipped lower to end basically unchanged…

Get back to work MbS!

Gold rallied on the bad econ news, ripping all the way up to pre-payrolls levels…

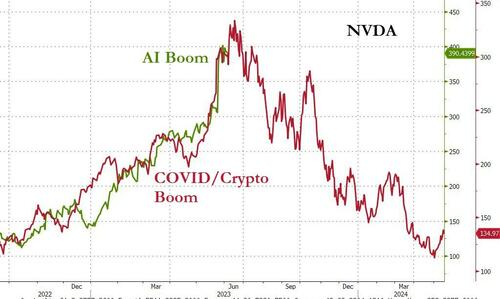

Finally, tick tock on the latest bubble-fest?

Source: Bloomberg

Did ‘Appulus’ just distract the world from AI long enough for some rational thought to return?

Tyler Durden

Mon, 06/05/2023 – 16:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com