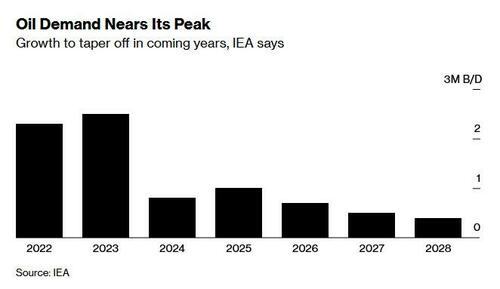

IAEA Sees Higher 2023 Oil Demand Offsetting Higher Non-OPEC Supply, Then Sharp Drop In Oil Consumption

In the latest downbeat outlook on the oil market, which lately has gotten nothing but bad news despite the ongoing collapse in energy capex spending which will come back to buy oil prices… but not yet… overnight the IAEA predicted that global oil demand is nearing its peak and will taper off over the next few years as high prices and Russia’s invasion of Ukraine speed up the transition from fossil fuels (spoiler alert: that won’t happen, since the resulting flood of Russian oil which recently hit a record high has removed all incentives, especially by India and China, to spend on expensive transition technology). Meanwhile, in the shorter term, the IAEA was more constructive, expecting higher 2023 demand to offset higher non-OPEC supply, resulting in crude markets that may tighten “significantly” as China’s consumption rebounds.

“Growth in the world’s demand for oil is set to slow almost to a halt in the coming years,” said the agency, which advises major economies, and which in the past has been accused of pushing Biden’s low oil price agenda.

“The shift to a clean energy economy is picking up pace, with a peak in global oil demand in sight before the end of this decade.”

Below is a summary of the latest IAEA report (courtesy of Goldman):

Bottom line:

- The IEA kept its 2023 balance unchanged as stronger-than-previously-expected EM demand (especially China) offsets lower OECD demand and higher non-OPEC supply.

- The IEA and we expect a return to large deficits averaging 2.1mb/d (IEA) and 1.3mb/d (GS) in 2023H2.

- We see the report as neutral for oil prices given the roughly unchanged 2023 balance, the bearish upwards revisions to OECD commercial stocks, roughly offset by the bullish new 2024 balance.

Demand:

- The IEA upgraded global oil demand by 0.2mb/d for 2023, which it expects to rise rapidly by 2.4mb/d this year (GS: 1.1mb/d) but then slow to 0.9mb/d in 2024 (GS: 1.4mb/d).

- Following a 0.2mb/d upgrade, the IEA now expects China demand to grow by 1.5mb/d in 2023 (GS: 0.9mb/d) and by 0.5mb/d in 2024 (GS: 0.7mb/d).

- Non-OECD exc. China demand was again revised up (+0.1mb/d) for 2023 and is expected to grow by 0.7mb/d in 2023.

Supply:

- The IEA projects world oil supply to rise 1.4mb/d in 2023 (GS: 0.9mb/d) and by 1.0mb/d in 2024 (GS: 1.5mb/d).

- The IEA upgraded US supply by 0.2mb/d in 2023, which it now expects to grow by 1.1mb/d this year and by 0.5mb/d in 2024 (GS: 0.3mb/d).

- The IEA again upgraded Russia supply in 2023 (+0.1mb/d).

Stocks:

- OECD commercial stocks built by 20mb (seasonally adjusted, SA) in April, and are 4% below their 2015-2019 SA average (vs. 10% below at the February 2022 SA low), and preliminary May data showed a further rise in OECD commercial stocks.

- OECD commercial stocks have been revised up by 4 and 8mb for both February and March, respectively.

IEA Outlook Through 2028

- The IEA expects oil demand to slow to just 400kb/d in 2028, partly reflecting rapid projected electric vehicle (EV) growth.

- The IEA expects global oil demand to grow by 5.9mb/d in 2022-2028 with much of the growth coming from LPG and naphtha demand (+3.2mb/d), and jet/kerosene (2.0mb/d).

- The IEA forecasts that supply growth will meet demand growth as net oil production capacity is estimated to rise by 5.9mb/d in 2022-2029 (with growth dominated by the US Brazil, Guyana, and Saudi Arabia).

- The IEA projects that total refining capacity will rise by 4.4mb/d in 2022-2028, with much of the increase coming from China, and a shift from road transportation fuels to middle distillate products (incl. jet fuel), and petrochemical feedstocks.

Tyler Durden

Wed, 06/14/2023 – 10:30

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com