Supreme Court Strikes Down Student Loan Relief — Here’s Who’s Most Affected

In a largely anticipated decision, the Supreme Court on Friday ruled in two separate cases that the Biden administration exceeded its authority with its $400 billion student loan forgiveness plan. The court ruled 6-3 along ideological lines.

The first case, Department of Education v. Brown, was brought by two student loan borrowers who didn’t qualify for relief sued to vacate the program on the basis that Biden’s invocation of the post-9/11 HEROES Act constitutes executive overreach. The Court ruled unanimously that the borrowers did not have standing to sue – but that the Biden administration also doesn’t have the authority to forgive the debt.

“The HEROES Act allows the Secretary to ‘waive or modify’ existing statutory or regulatory provisions applicable to financial assistance programs under the Education Act, but does not allow the Secretary to rewrite that statute to the extent of canceling $430 billion of student loan principal,” reads the opinion.

Proponents of cancellation have warned of dire consequences, such as Persis Yu – deputy executive director of the Student Borrower Protection Center.

“If payments are to resume without cancelation, we can expect a tremendous increase in defaults and forbearance,” said Yu, adding “There absolutely must be a plan to avoid the economic devastation.”

Who will be most affected?

According to the Wall Street Journal, citing a Wells Fargo report, typical student loan payments will be between $210 and $314 per month once payments resume.

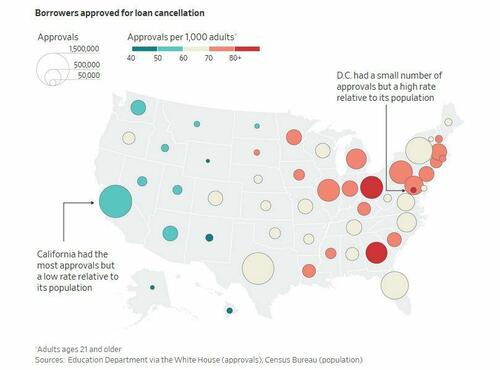

Overall, more than 40 million borrowers would have qualified for loan forgiveness through a required application. Before legal challenges halted the plan, borrowers in every state were approved for loan cancellation. Big states such as California, Texas, Florida and New York had the most approvals overall. The District of Columbia had the most approvals in proportion to its adult population, followed by Georgia and Ohio.

According to the Department of Education, over 43 million people collectively owe $1.6 trillion in student-loan debt. These loans include Direct Loans, Federal Family Education Loans and Perkins Loans. Around half of these borrowers owe less than $20,000.

When broken down by age, borrowers 24 and younger owe $103.4 billion in federal student-loan debt. Less than 4% owe over $40,000. The largest cohort of borrowers is those aged 25-34, of which nearly a quarter owe more than $40,000. Of those aged 35-49, more than 1/3 owe more than $40,000.

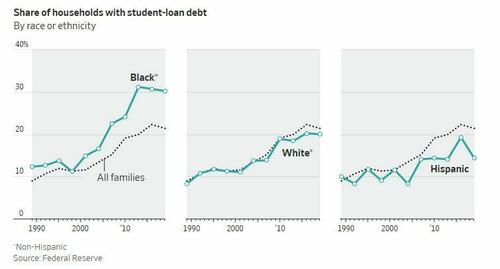

By race, around 30% of black households had student-loan debt in 2019, vs. around 20% of white households and 14% of hispanic households.

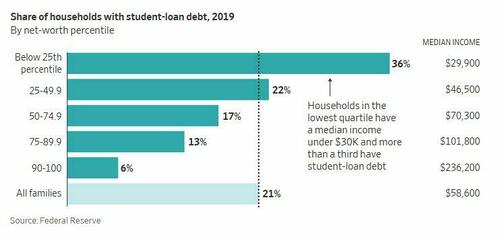

By household net worth, of those who are in the bottom 25%, more than 1/3 hold student debt, vs. 6% of those in the top 10%, per the Federal Reserve.

As noted last week at Real Clear Education, the administration’s plan to transfer up to $20,000 in student loan debt per borrower – from individuals who voluntarily took out loans to finance their college education to unsuspecting taxpayers – was one of the most audacious examples of executive overreach in American history.

Despite its $400 billion price tag, the action is only a small piece of the administration’s strategy to create a massive new public subsidy for higher education. A cynic might wonder whether the headline-grabbing but legally dubious bailout now before the Court was conceived as a decoy to distract public attention from the real centerpiece of the debt-transfer agenda.

With public attention focused on the blanket forgiveness plan (and the pleas of those demanding more), the Department of Education was busy crafting an ambitious plan to bail out future borrowers in perpetuity by changing the rules governing income-driven repayment.

Currently, multiple income-based repayment programs exist. All would cap the payments of enrollees at a percentage of their current income and then wipe away debt that remains after many years of repayment. When income-based repayment plans are designed properly, they align the timing of repayment with career earnings trajectory, such that borrowers pay the loans back faster as their incomes increase. (It is reasonable for doctors with very large loans to have smaller payments in their residency years when salaries are modest).

But the design principle should be that most loans are eventually paid off, including interest, except in cases of manifest hardship.

With its proposal to phase out several existing income-based repayment programs in favor of a much more generous version of a specific program called REPAYE (Revised Pay as You Earn), the Department of Education is abandoning this expectation to create an ongoing bailout.

REPAYE’s extravagant new terms are a bad deal for taxpayers. Undergraduate borrowers will be required to pay only 5% of their disposable income toward their student loan debt, with disposable income defined as income above 225% of the federal poverty line ($32,805 for an individual or $67,500 for a family of four). Balances will not grow when a borrower’s monthly payment is smaller than the interest accrued. (To accomplish this benefit, the Secretary of Education claims the power to cease charging interest owed to the U.S. Treasury.)

Tyler Durden

Fri, 06/30/2023 – 10:40

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com