Coup In Niger Could Derail This Strategic Pipeline

By James Durso of OilPrice.com

Almost twenty years to the day after Ambassador Joseph Wilson wrote his op-ed “What I Didn’t Find in Africa” about his visit to Niger to confirm if the country was supplying Saddam Hussein with uranium yellowcake, the U.S. found itself again focused on the African country.

On 26 July, Niger’s president, Mohamed Bazoum, was ousted by his presidential guard, and the guard commander and coup leader, General Abdourahmane Tchiani, was named president of the National Council for the Safeguard of the Homeland. It was the seventh coup in the region since 2020, not including a previous attempt in Niger in 2021 that was put down by the same presidential guard.

The coup was condemned by the U.S., France, the UK, the United Nations, the European Union, the African Union, numerous African governments, and ECOWAS, the Economic Community of West African States.

The ECOWAS deadline to reinstate President Bazoum was ignored by the generals, and Niger’s new leaders closed the country’s airspace and accused foreign powers of preparing to attack. ECOWAS leaders will now meet in Nigeria on Thursday to discuss next steps.

Last week, the ECOWAS military leaders prepared a plan to reinstate President Bazoum, which will probably be discussed at the Thursday meeting. However, the Nigerian Senate has rejected military intervention in Niger and without Nigeria, which has a 1,600 kilometer border and the largest military in the region, nothing will happen.

Last week, the deputy leader of the military government visited Mali to request the “rapid deployment of Wagner forces to [Niger]” to help the military regime. And Wagner leader Yevgeny Prigozhin said his troops would be able to help Niger – what one researcher called a “nightmare scenario” for the U.S. in Africa’s Sahel region.

The military government in Niamey received pledges of support from neighbors Burkina Faso, Mali, and Guinea. Algeria condemned the coup, and Libya said the takeover was “not acceptable.” However, last week the chief of staff of the Algerian Army visited Moscow for a meeting with Russian defense minister Sergey Shoigu and Niger was surely discussed.

According to the BBC, Wagner Group appeared in Libya in 2019, backing General Khalifa Haftar, a longtime U.S. asset. Libya, whatever it said last week will be focused, first and foremost, on avoiding another surge in refugees that followed the 2011 NATO attack on the Ghaddafi government. If Wagner can revive its network in Libya, Russia may have a secure overland route and air corridor to Niger.

If Algeria and Libya allow the transshipment of material to Niger – possibly to restore order and prevent another exodus of refugees to Europe – the coup government would garner significant relief and access to the sea lanes.

Media concern has focused on the fact that Niger is a supplier of uranium, and is a key supplier to France, though France also buys uranium from Kazakhstan. The French nuclear fuel cycle company, Orano, which operates a uranium mine in Niger reported its operations were not hindered or endangered.

Though uranium attracts more news coverage, Niger’s biggest export is gold, which accounted for over 70% of exports in 2021.

The military government reportedly halted uranium and gold exports to France, though Reuters later reported that Niger, Mali and Burkina Faso not halting exports of uranium and gold.

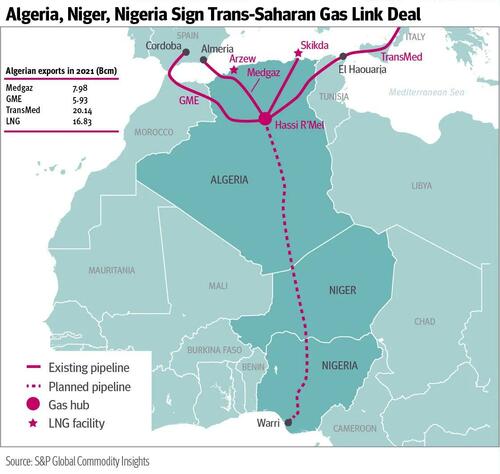

One thing that got halted, however, is the $13 billion USD, 5,600-kilometer Trans-Saharan Gas Pipeline (TSGP) which was slated to deliver 30 billion cubic meters (bcm) of natural gas to Europe. The pipeline would run from Warri, Nigeria, via Niger, to the Hassan R’Mel gas hub in Algeria where it would connect to existing gas pipelines to Europe.

The pipeline is a joint effort by Algeria, Nigeria, and Niger, and in July 2022 the countries signed a Memorandum of Understanding for the implementation of the pipeline. The delay of the project comes at a bad time for Europe as it recently lost gas from the Nord Stream pipelines due to sabotage, and the East Med pipeline after the U.S. government killed it by raising environmental objections. The two pipelines were expected to deliver 120 bcm of gas per year.

After the loss of Nord Stream, Europe was forced to import liquified natural gas (LNG) from the U.S. at a higher price than it was paying the Russians.

The presence of Wagner troops in Niger is enough to stop the pipeline unless someone steps in, a country like China for example, which is typically risk averse, but has a long history in Africa, but may be interested in scooping up another 30 bcm of gas every year. The three founding governments haven’t foreclosed additional partners but a previous Algerian energy minister said, “only partners that can bring something to the project, not just money, should be there.” Of course, it might be easier for China to just add capacity in Nigeria where it is a major investor, but Nigeria is also unstable due to an ongoing insurgency in the Niger Delta.

And Russia may get a vote, or a piece of the action, as the military government in Niger has aligned itself with Moscow with its request for the intervention of Wagner PMC, and Moscow will want to capitalize on the goodwill from the Russia-Africa Summit in July, which ended with no revived grain deliveries (yet) but Russia did cancel $23 billion in debt.

On the other hand, sending the gas north will allow Beijing to deepen relations with Morocco, Algeria, and Libya, the latter of which has agreed to coordinate its national development plans with Beijing’s Belt and Road Initiative via the Five Year Plan for China Arab Comprehensive Strategic Cooperation (2022-2026) in recognition of China’s long-term economic involvement in Libya.

China is now developing Algeria’s El Hamdania Central Port, Algeria’s largest and first deep-water port. China also helped complete the 750-mile East-West Highway connecting Algeria to Morocco and Tunisia, and about 1,000 Chinese companies operate in Algeria, their way eased by the wavier of the “51/49” requirement that required majority Algerian ownership of all new businesses with the exception of “strategic sectors.”

According to the U.S. Congressional Research Service, “Algeria has the world’s 11th – and 16th -largest proven reserves of natural gas and oil, respectively, and was the 10th-largest natural gas producer as of 2019. It is also estimated to have the world’s 3rd -largest recoverable shale gas reserves.” The country exports 85% of its gas to Europe.

Algeria has the fourth-largest economy in Africa with a 2021 GDP of $167.98 billion. Oil and gas income increased by 70% in the first half of 2022, and energy income is expected to total $50 billion by end of year. The World Bank reported Algeria’s economy “expanded by 3.9% year-on-year during the first nine months of 2021, after contracting by 5.5% in 2020,” largely due to increased European gas demand. Hydrocarbons account for 95 percent of export revenues and about 40 percent of government income.

If China doesn’t take the gas but agrees to deliver it to Europe it will increase its influence there, just as the U.S. did by increasing deliveries of LNG after it stopped the Nord Stream and EastMed pipelines.

The European Union seeks a “long-term strategic partnership” for natural gas and electricity with Algeria. And France is seeking to repair relations via economic cooperation, though China is now Algeria’s biggest trade partner. If Europe expects more energy from Algeria or elsewhere in Africa, though, it may have to pay up to finance expansion of production, or participate in the TSGP, though that may be opposed by Washington if it will dent lucrative U.S. liquified natural gas sales to Europe or offer relief to Niger. And France may find it cramped in the cockpit if it has to share participation with China.

Ideally, the U.S. should be interested in anything that brings more oil and gas online and stabilizes the market. But it also has to consider if its involvement in Niger would help prop up France’s troubled colonial empire in Africa, or to give China entrée to more opportunities in Africa, a region it has habitually ignored and will again as soon as Niger is sorted out or at least fades from the front page.

Tyler Durden

Thu, 08/10/2023 – 05:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com