Prolonged US Manufacturing Slowdown Barely Dents Energy Use

By John Kemp, senior market analyst

U.S. manufacturers reported that business activity declined for the 10th month running in August, though declines are becoming less widespread implying the trough in the cycle may be approaching.

The Institute for Supply Management’s purchasing managers index increased slightly to 47.6 (16th percentile for all months since 1980) in August up from 46.4 (13th percentile) in July and 46.0 (11th percentile) in June.

Despite the improvement, the manufacturing index has been below the 50-point threshold dividing expanding activity from a contraction for ten months since November 2022.

The length of the downturn has more in common with a cycle-ending recession (which have generally lasted 11 months or more) than a mid-cycle slowdown (generally lasting eight months or fewer).

If the slowdown proves to be a “soft landing”, it will be the longest since the Second World War, matched in duration only by the slowdown in 1995/96, which also lasted 10 months.

The forward-looking new orders component remained weak which indicates the downturn is likely to persist for at least several more months, which would make it the longest mid-cycle slowdown on record.

The new orders index was just 46.8 (12th percentile) in August down from 47.3 (14th percentile) in July and down from 51.3 (26th percentile) a year ago.

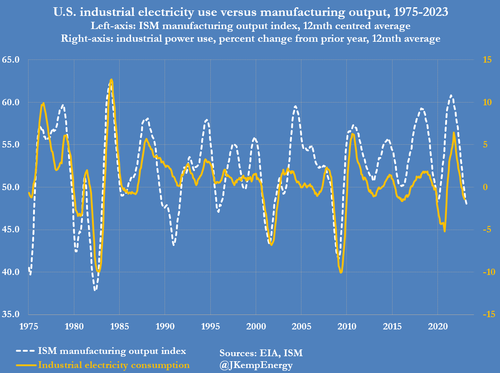

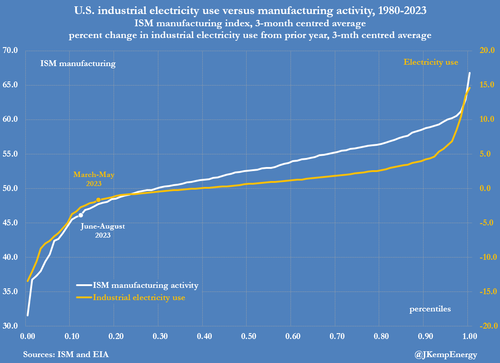

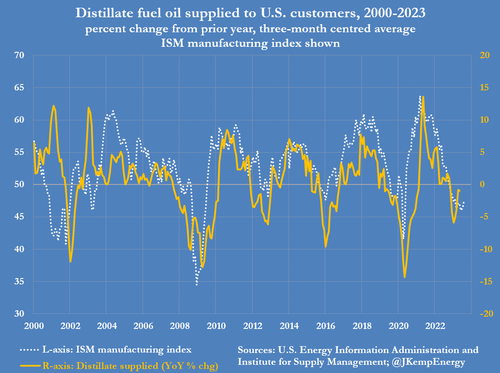

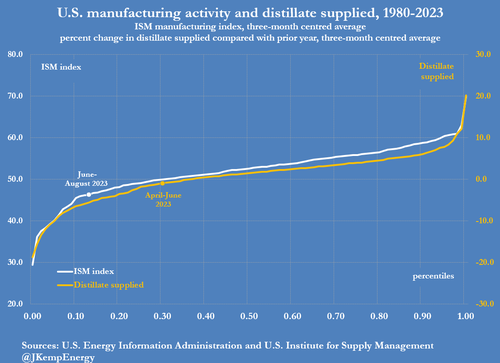

Industrial electricity use and distillate fuel oil consumption are both correlated with the manufacturing and freight cycle and therefore with the purchasing managers index.

Both have fallen a bit less than expected given the length and apparent depth of the downturn in industrial activity, especially in the case of diesel and other distillate fuel oils.

Based on the most recent data available, industrial electricity consumption was down by 1.7% in the three months from March to May compared with the same period a year earlier.

The change in electricity use was in the 16th percentile for all overlapping three-month periods since 1980, according to data from the U.S. Energy Information Administration (“Monthly energy review”, EIA August 31, 2023).

Distillate fuel oil consumption fell by 1.0% in the three months from April through June compared with the same period a year earlier.

The change in distillate consumption was in the 31st percentile for all three-month periods since 1980, which suggests that any downturn in industrial activity has been long but shallow.

Confirming the unexpected resilience in distillate consumption, the EIA has revised its estimate for distillate supplied up by a total of 23 million barrels (+1.6%) or roughly 63,000 barrels per day over the course of 2022.

The strength of domestic distillate consumption helps explain why fuel oil inventories have remained well below the prior ten-year seasonal average.

Resilient electricity and diesel consumption, and the correspondingly low levels of spare generating capacity and distillate inventories, imply the energy system is operating close to its maximum capacity.

In the event of a soft landing followed by a re-acceleration of the business cycle, capacity constraints will re-emerge quickly and likely lead to an early resurgence of inflation.

Tyler Durden

Wed, 09/06/2023 – 09:45

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com