Consumer Price Inflation Hotter Than Expected Despite Goods Deflation

After jumping in December, analysts expected a modest acceleration in headline consumer prices and small slowdown in core prices, but the headline CPI printed hotter than expected at +2.5% YoY (despite only rising 0.1% MoM) – that is the hottest since oct 2018.

Source: Bloomberg

Under the hood, Energy commodities and Used Car prices slowed while Apparel and Energy Utilities rose the most…

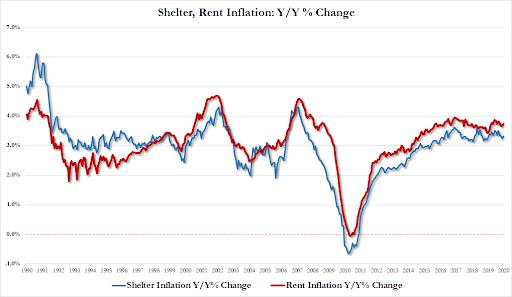

Shelter and Rent inflation ticked up in January…

From the top-down, Services inflation is running at +3.1% YoY (the last time it was hotter was August 2016) while goods prices are deflating YoY…

Source: Bloomberg

Finally we note that Real Average Weekly Earnings are flat year-over-year…

Source: Bloomberg

So take your pick Jay Powell.

Tyler Durden

Thu, 02/13/2020 – 08:36![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com