“Outsized Headaches & Disappointment” – T Rowe Price Trounces “Terrible” WeWork Investment

T Rowe Price trounced WeWork in a Securities and Exchange Commission (SEC) filing on Thursday, calling its investment in the shared office space startup a “debacle.”

The filing said WeWork is a “terrible investment” and has been nothing more than “outsized headaches and disappointments.”

T Rowe’s Mid-Cap Growth Fund, with offices in Baltimore City and Owings Mills-Reisterstown, Maryland, said their investment with WeWork began in 2014.

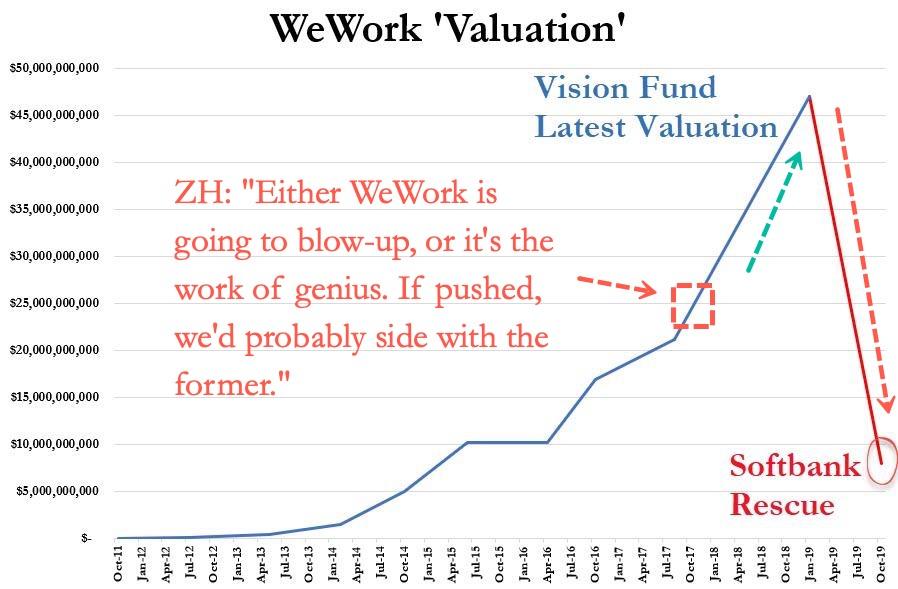

It noted that SoftBank made aggressive investments in the startup and pushed valuations higher, which ignored its advice on decreasing the startup’s growth expansion across the world.

“They took our advice for a few months, but new investors soon arrived who convinced management to put its foot back on the accelerator,” T Rowe said in the filing.

It appears T Rowe figured out that something was amiss with the startup, even dating back to 2017. The investment bank started offloading its shares, but when it came to selling a large block, WeWork’s management rejected the sale in 2019. Shortly after, the startup’s valuation collapsed, and here is what the bank said in response:

“Massive losses soon followed, but the CEO promised profitability was just over the horizon. We did not take him at his word, and we communicated to WeWork’s management and board our displeasure with its eroding corporate governance. In 2017 and again in 2019, we sold stock in tenders totaling about 16% of our shares and 50% of our initial investment. We also had a tentative deal to sell our remaining shares to a large investor in early 2019. Unfortunately, WeWork’s management had to approve the transaction, and they refused. In the wake of intense public scrutiny, WeWork abandoned its IPO plans this fall, leaving our remaining shares worth a fraction of their earlier valuation.”

“While it’s possible that WeWork’s new management will improve operations somewhat, we are ready to declare this a terrible investment,” the filing said.

And it’s stunning that a top investment bank has voiced so much of their frustration with WeWork on the public domain:

“We seek to learn from our missteps, and it is clear that we misread the motivations of WeWork’s management and our investment partners. Fortunately, our cautious approach toward the private market limited the damage. We have invested in more than a dozen private companies over the past decade, and many of them have performed quite well. These investments often provide us with useful insight into the changing dynamics of industries, the impact of technological disruption, and future competition facing our existing holdings that we need to consider in the management of our portfolio. Each investment has been small, however, and we ended 2019 with just 0.58% of our portfolio in non-listed securities. In short, we believe the WeWork debacle was an error in judgment, not in process.”

WeWork’s rapid late-cycle expansion is nothing short of a miscalculated move by the startup’s management and the investment bank, who had an abundance of liquidity from central banks that blinded every one of the positioning of the business cycle.

And here’s what we said in 2017: “Either WeWork is going to blow-up, or it’s the work of genius. If pushed, we’d probably side with the former.”

Tyler Durden

Fri, 02/14/2020 – 13:05![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com