“The Outlook Is Dismal” – Dallas Fed Surveys Signal Stagflation Threat In September

September was an ugly month for Texas with both Manufacturing and Services surveys chock-full of disappointment and stagflationary signals.

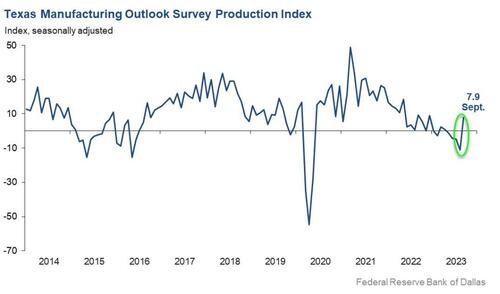

The goods news – growth in Texas factory activity resumed in September, according to the Dallas Fed Manufacturing survey, with the production index rebounding a somewhat shocking 20 points to +7.9 – its highest reading of the year.

The bad news – everything else…

As one respondent put it: “The summer funk has not relented.”

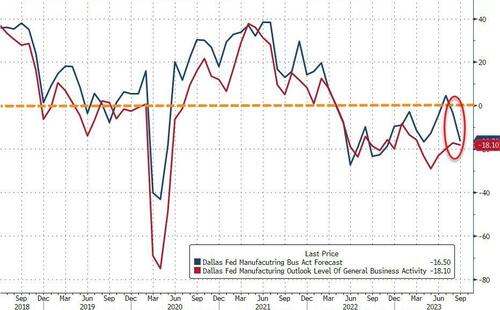

Perceptions of broader Manufacturing business conditions continued to worsen in September. The general business activity and company outlook indexes remained largely unchanged at -18.1 and -17.5, respectively.

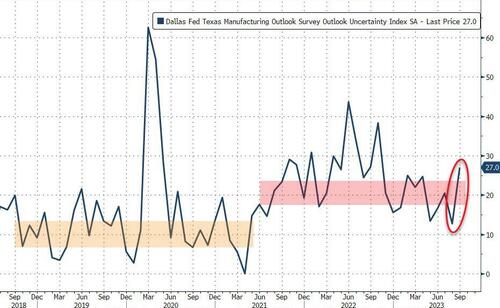

Uncertainty regarding outlooks picked up notably, with the corresponding index pushing up 14 points to 27.0, its highest reading in nearly a year.

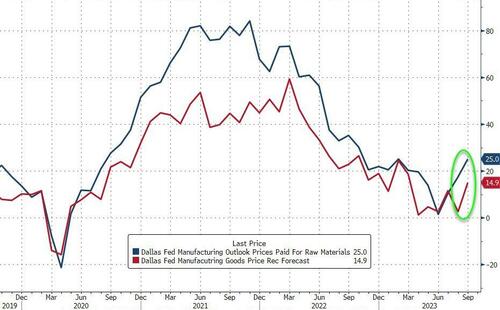

And more exciting still, prices paid (current) and expectations for prices received (i.e. expected price pressures for end clients) are both on the rise…

Respondents were mixed but 3 themes were evident:

1: China weakness

-

China’s economic woes are believed to be much worse than reported, driving down exports, while internal pressures on building and construction, automotive and general merchandise through inflationary pressures and particularly the cost of financing is slowing growth domestically. As a basic materials company, this is hitting us on all fronts and slowing business dramatically.

-

China remains very weak, with no uptick post-COVID. All markets have weakened except auto, which has built inventory over the last several quarters. We expect that market to roll over, too; perhaps the UAW [United Auto Workers] strike will be the impetus.

2. Taxes & Regulation

-

We continue to see weakening demand in the primary metals sectors. This is in part due to uncertainty on many fronts, but especially with federal regulations and taxes.

-

September will be as good if not better than August, but then it seems our world will get slower and see greater uncertainty.

3. Interest rates

-

The outlook is dismal with oil prices increasing and interest rates strangling many sectors, including ours.

-

Uncertainty related to economy, fiscal policy and the ability to renew our line of credit on favorable terms in early 2024 [are issues affecting our business].

Finally, this one respondent summed things up very well:

As a member of the industrial production segment, we have had a very hard time hiring qualified personnel. For the last three years, we as a country are trying to reshore our manufacturing back to the U.S. and become more independent of China and Taiwan. The federal government is doing very little to incentivize bringing manufacturing back to our country.

Our capital equipment customers are telling us that they are looking for specific manufacturing capabilities, and they are not finding them here at home. They have all moved to China in the last 30 years.

I don’t have to say that raising interest rates to this level does affect the capital equipment purchases in a big way, obviously.

Most of them are sold in leases, and over the last 35 years in this industry, our company has experienced the same every time interest rates go up beyond 5 percent. Hiring in the industrial production environment is a lot more difficult and costly than in the consumer industry.

We are living under completely different economic circumstances to have high interest rates.

Isn’t it time to start lowering interest rates and have the country’s backbone manufacturing industry become more confident in the economy?

Good question!

And more problematically, there is continued weakness in the Services sector (which had briefly trended stronger).

The Texas Service Sector General Business Activity Outlook index tumbled to -8.6 in September (in contraction for the 16th straight month)…

Labor market indicators pointed to slower growth in employment (the employment index fell from 9.3 to 2.7, its lowest level in six months).

Looking forward, respondents’ expectations regarding future service sector activity fell from 3.9 to -3.4.

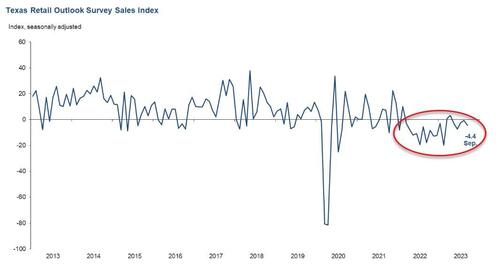

And finally piling on on… Retail sales declined in September, according to business executives responding to the Texas Retail Outlook Survey. The sales index, a key measure of state retail activity, fell from -0.6 to -4.4, marking its fifth consecutive month in negative territory.

Respondents in the Services sector echoed the Manufacturing business fears: “Inflation, uncertainty about China and the U.S. political situation are the three largest distractions for business development.”

-

Most new business opportunities have dried up; work with existing clients is shrinking or moving to near-shore partners.

-

A possible federal government shutdown is very concerning.

-

Things are not getting better. We wrote the fewest number of proposals in a seven-year period─even worse than during the pandemic. High interest rates and construction pricing are really hurting new construction starts. Developers are leery of starting new projects. We are seeing no signs of things improving.

-

Inflation is eating up all our planning costs, and I see nothing but increasing costs.

-

We are expecting a softening real estate market for the next 12 to 18 months.

-

Increased interest rates have definitely killed deals, and the next 12 to 18 months look like a huge slowdown in development and real estate deals. It’s time to stop the interest rate increases.

And finally, this seemed to sum things up succinctly: “We do not believe the Federal Reserve has navigated a soft landing. We think they have delayed the recession. We say that because it seems business is more difficult in the last 45 days.”

Tyler Durden

Tue, 09/26/2023 – 10:55

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com