Central Bankers’ “Big Dodge”

Authored by Sven Henrich via NorthmanTrader.com,

In life you can always tell when someone has something to hide by the way they try to avoid answering a direct question, when they dance, skirt and try to dodge the answer.

In this regard something important happened yesterday, it’s been missed by many, I posted in on my twitter feed, but I wanted to highlight this in a post so at least people can see it here.

As many of you know I’ve been very much concerned about the possibility that the massive rally since October has been a giant policy mistake by the Fed. Yes they wanted to prevent a recession and yes they reacted to the swoon in December of 2018 by flipping policy and cutting rates 3 times. But each of these 3 rate cuts were actually sold in 2019.

The rally didn’t really take off until the repo crisis forced the Fed into treasury bill buying and repo in October of 2019.

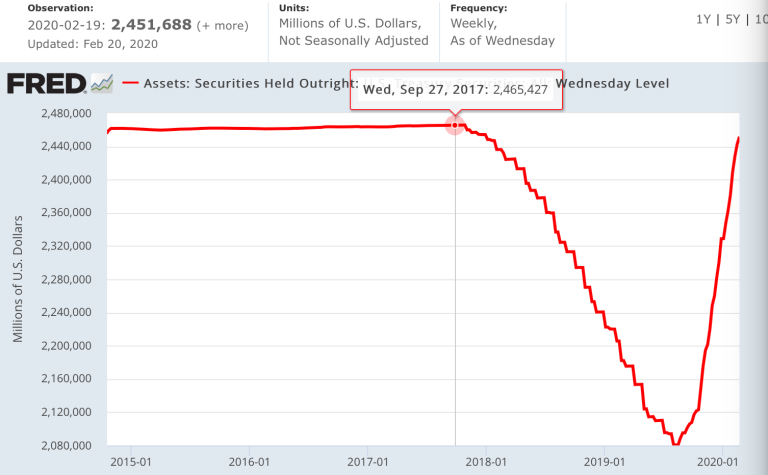

Everything exploded higher, far above any fundamental basis, and markets, already on a multiple expansion train in 2019, just went into the stratosphere continuing this run into February of this year while the Fed continued to go wild:

As of this week the Fed’s holdings of treasuries is now a mere $14B from all time highs and looks to make a new record in March.

Let’s be absolutely crystal clear: This policy was originally born out of a criss, the great financial crisis. The panic of 2008/2009, whatever you want to call it.

The Fed went into panic mode with QE to try to save markets and the economy. And they built that balance sheet for years. It was not until 2018 that they started a process of normalization and it blew up in their face as markets dropped 20% in Q4 of 2018. So then they flipped, started jawboning about stopping the normalization and dangled rate cuts and markets obliged and followed the Fed put like puppies to the morning feeding.

But now look at what happened sine October. An absolute vertical move on the balance sheet. This is panic. This is not orderly buying. They went back in faster then they went out.

And it’s all predicated on a big Fed lie as I called it. “Not QE”. Bullshit. This here has had precisely the same effect, people piling TINA head first into stocks.

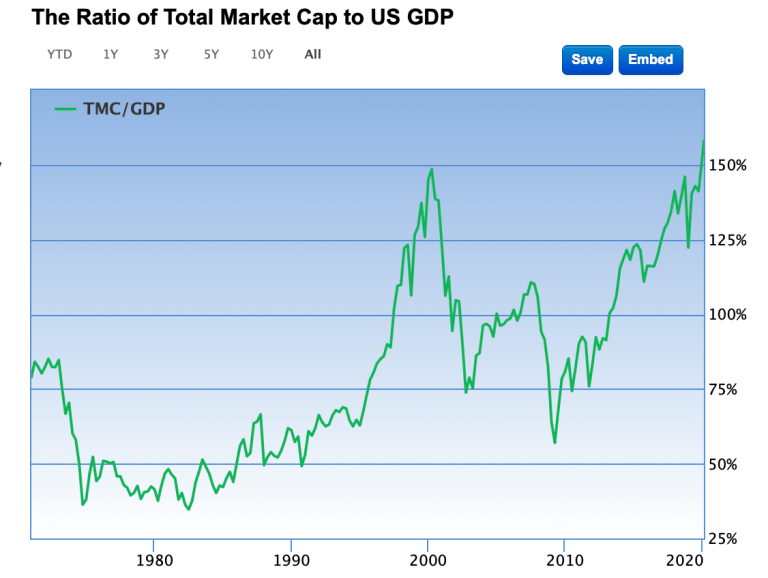

We can all see what has happened:

And THIS has been the result:

The largest disconnect in asset prices above underlying GDP in history.

Why is this all so important? Because it’s not sustainable, it’s a bubble, and if the Fed’s policy to fix repo caused all this then the Fed is entirely responsible for what happens when the bubble pops.

Hence I thought it was so important to get a Fed speaker on the record on all this and see what the response would be.

When I heard that Steve Liesman was going to interview Fed Vice Chair Clarida I posed this question on twitter:

Hi @steveliesman can you please ask Clarida what would happen to equity markets if they stopped repo and the treasury bill buying tomorrow?

I’d like to see them go on the record.— Sven Henrich (@NorthmanTrader) February 19, 2020

https://platform.twitter.com/widgets.js

The point was to see if Clarida would acknowledge the correlation between the Fed’s treasury bills buying and repo and the impact on asset prices.

I don’t know if Steve saw my question, but I was very pleased to actually seem him ask a derivative of the question.

“Do you worry that with what the Fed has done in terms of inserting a lot of liquidity into the market (Treasury bill buying & repo) has created the recent boom in the stock market?”

Thank you Steve Liesman.

And the response was hugely telling, I call it the big dodge, watch Clarida do everything possible to not answer the question.

You can see the exchange here about 7:00min in:

[youtube https://www.youtube.com/watch?v=yNQg-xn3e2w]

Clarida’s answer: Tries to skirt/dance with technicals, intent, blah blah, then Steve Liesman pushes him on it when he tries to evade and then Clarida:

“I’ll leave that for others to judge”.

Please. He didn’t want to answer. He can’t. The same way Powell dodged the question. And I tell you why.

If there was no impact on stock prices he could just come out and say it. But since that would be a bold face lie, he can’t deny it. So he hides in a generality, “I’ll leave that for others to judge”. Oh, I’m judging.

And I’m judging that he knows fully well the policy has impacted asset prices. The problem for the Fed is that stocks have reacted much more extremely than they probably expected. And now they have a big fat bubble on their hands.

The Fed created the 2000 bubble with Y2K liquidity injections, they laid the foundation for the housing bubble with easy money policies and then were in denial about that until it blew up in everybody’s face and I submit they are making the same mistake again.

They caused another bubble and now they are in denial mode again. Why? Because they can never admit that the Fed is behind the financial asset bubbles that benefit the few and hurts the most when the bubbles pop.

For if this is true then:

Central banks are the danger.

— Sven Henrich (@NorthmanTrader) February 15, 2020

https://platform.twitter.com/widgets.js

…then the core question perhaps then is this: Why are societies putting up with these organizations that have so much power yet to little accountability to the public, the very public that has absolutely ZERO input as to who runs these organizations whose credibility is highly questionable, who can’t even answer a direct question!!

The general public has zero clue about what central banks are, what they do, and how they impact their lives. The general perception may be that central bankers are heroes who save the economy, a perception propagated by the media:

No, the mathematical truth presents a very much different alternative view: The top 10% keep reaping all the wealth benefits associated with artificially propped up asset prices while the bottom 90% gets settled with all the debt that will hang like a chain around everybody’s neck when the bubble pops.

No, central bankers are not heroes. Rather:

I will say again, for emphasis, amongst the many villains of the 21st century, central bankers, specifically our federal reserve, will go down as some of the most destructive

— Guy Adami (@GuyAdami) January 30, 2020

https://platform.twitter.com/widgets.js

And once the general population figures this out the resulting outcry will challenge the power status quo of central bankers around the world.

Perhaps this explains why central bankers are so desperate trying to avoid the next recession, because as far as bubbles are concerned they’ve created an absolute beast here. They are afraid and rightly so. They are so afraid they can’t even answer a simple question: “Do you worry that with what the Fed has done in terms of inserting a lot of liquidity into the market (Treasury bill buying & repo) has created the recent boom in the stock market?”

The big dodge tells you everything you need to know.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Fri, 02/21/2020 – 08:44![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com