“Bull Market Has Reversed” – NYC Multifamily Building Sales Plunge

A new report from PropertyShark, a real estate data provider, said the New York City multifamily market shifted from “bull to bear in 2019.”

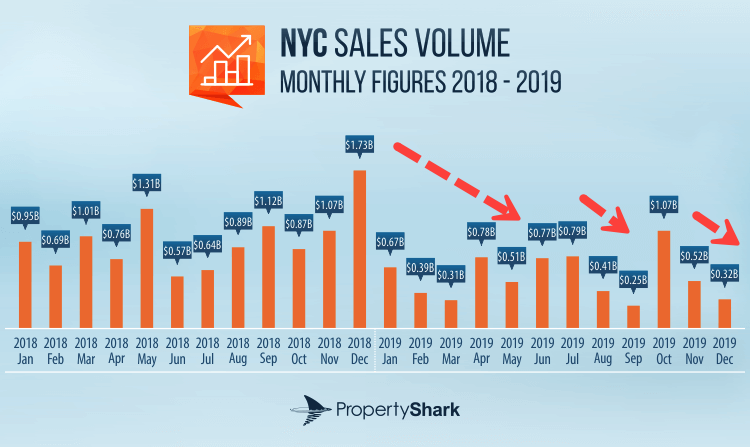

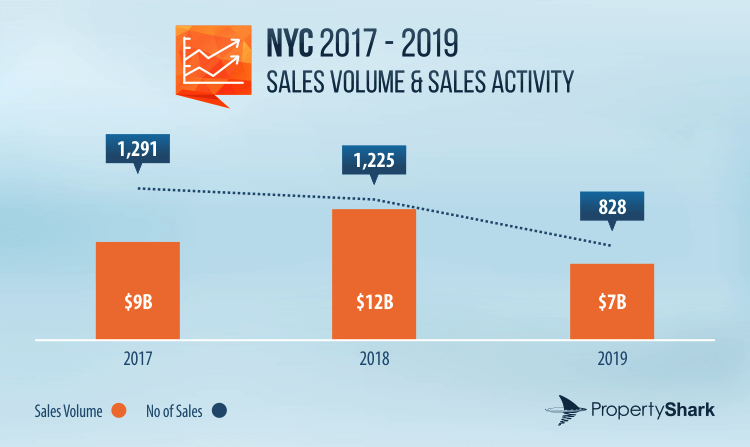

PropertyShark said multifamily sales in Manhattan, Brooklyn, the Bronx, and Queens significantly cooled in 2019, and sales plunged from 1,225 in 2018 to 828 in 2019, a 32% drop. Total deal flow volume in terms of dollar amount fell 41%, from $11.6 billion to $6.8 billion over the period.

Summarizing New York City’s 2019 downtrend in the multifamily market is Greg Corbin, executive managing director at Besen Associates, said: “The slowdown in investment sales transactions has been a product of the perfect storm: rising interest rates, concern about new rent regulation laws and fear that the near decade-long bull market has reversed.”

A tailwind for the New York City multifamily market in 2020 could be record-low mortgage rates, but what could push the market lower is an outbreak of Covid-19. As of Friday, 22 confirmed cases were seen, with about 2,800 people under observation. A virus outbreak would cause spending patterns to shift among investors/consumers, sending the local economy into a tailspin.

Tyler Durden

Fri, 03/06/2020 – 22:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com