Double Whammy Of Shocks Plagues Companies Across World As Virus Spreads

As Covid-19 grinds the world’s economy to a halt and supply-chains break, anxieties flourish among multinationals, AP news reports.

Millions of businesses are reeling from virus impacts as supply-chain disruptions have triggered one of the most massive economic shocks since the last financial crisis.

Jay Foreman, CEO of the toy company Basic Fun in Boca Raton, Florida, told AP that his Chinese suppliers have dramatically reduced output because of the shutdowns, and this means his imports are significantly reduced. Foreman said he would layoff 10% of his 175-person global staff.

“I am getting vendors who are actually encouraging me to (make smaller) orders because they’re trying to spread out the capacity,” Foreman said. “I don’t want lower orders. I want higher orders.”

Sondra Mansfield, who owns Chalk of the Town in New York City, which makes T-shirts and tote bags, told AP that the “virus is going to go on, and it’s going to impact a lot of countries and economies.”

Mansfield stressed her access to foreign suppliers has come to a pause, and that could start affecting US operations.

“I think it will get worse before it gets better,” she warned.

Jacob Kirkegaard, a senior fellow at the Peterson Institute for International Economics, said the fast-spreading virus is now becoming a global issue.

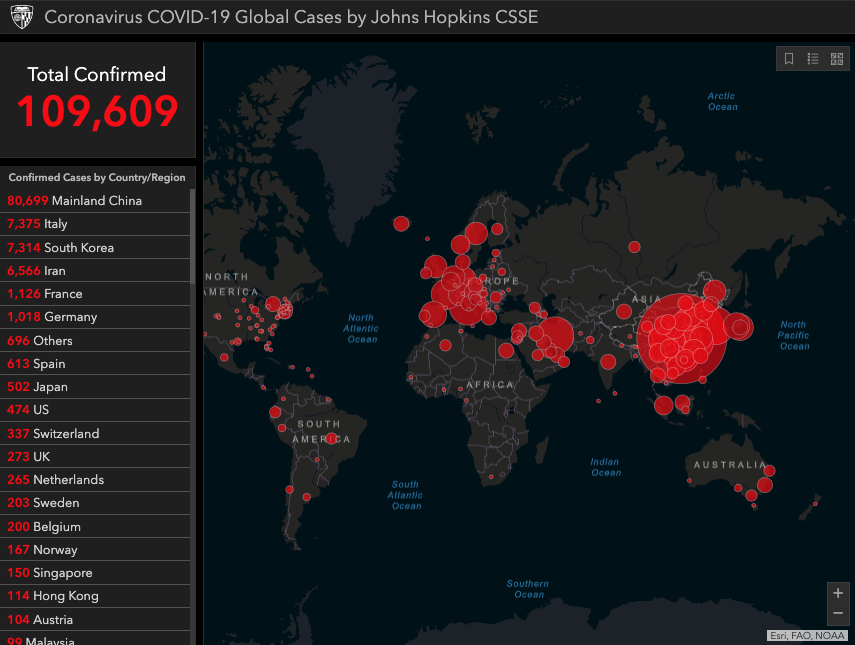

The virus has now spread across South Korea, Japan, Iran, Italy, other countries in Europe, and the Americas, with the possibility of a “global pandemic” in the near term.

Last month Michael Every of Rabobank laid out his four scenarios for the virus’ economic and market impact: “The Bad,” “The Worse,” “The Ugly,” and “The Unthinkable.”

In an updated post on March 4, Every said, “It’s Getting ‘The Ugly,'” as this scenario foresees “the US, UK, and Europe were infected too. Naturally, this implied a deep global recession.” It appears the world is just one step away from “The Unthinkable,” Every describes this scenario as a global pandemic that has only been seen in Hollywood movies.

We’ve laid out four scenarios of how the virus impact could affect the global economy. At the moment it appears scenario four could be playing out, indicating a massive economic shock could tilt the world into recession. Global growth rates could be headed to zero on the year with a $2.7 trillion hit in global output.

Business travel across the world has crashed. Big tech firms, including Amazon, Google, Apple, Microsoft, and others, have restricted employees from traveling overseas. Many of these employees are being sent home for the next month. Similar restrictions are being seen with major US banks. As a result of reduced travel by corporate America and consumers as a whole, the travel industry is headed for a crash, which means airlines, hotels, restaurants, cruise ships, and casinos are going to see a sharp decline in traffic for the next several months.

Executives of Salus Brands, an Arizona-based company, that sells swimming-pool accessories, said its Chinese shipments for the summer vacation season will likely be missed.

“If we can’t get the product in stores by Memorial Day week or shortly after, we lose our season,” said Salus Brands CEO Dave Balkaran.

Andrew Shoyer, a former US trade official who is a partner at the law firm Sidley Austin, said the “small and medium-sized enterprise will get hurt the most and the soonest.” He noted larger companies are more flexible with larger stockpiles of goods and can easily switch suppliers.

We’ve noted on several occasions that West Coast port activity has plunged over the first quarter. Specifically, year over year volume at the Port of Los Angeles, the busiest seaport in the US – could see upwards of a 15% decline this quarter.

And to make matters worse for companies already suffering from supply shocks, the next shock could be a demand one. The director of the National Institute of Allergy and Infectious Diseases, Dr. Anthony Fauci, recommended all baby boomers on Sunday to avoid travel and large crowds in the US. This would effectively mean that one of the wealthiest generations could be removed from spending money in the economy as the virus outbreak worsens in the weeks ahead.

Tyler Durden

Wed, 03/11/2020 – 05:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com