JPMorgan Now Expects A Global Depression In The Second Quarter

Earlier we reported that in a report titled “the lamps are going out all across the economy”, JPMorgan’s chief US economist, Michael Feroli slashed his Q2 US GDP forecast to a staggering -14%, which he optimistically expects to form the bottom of a V-shaped recovery that then lifts the US economy by +8% and +4% in Q3 and Q4, respectively (at least until the next downward revision in his forecast).

We doubt the V-shaped recovery will take place, in fact if there is any “recovery” it will be L-shaped especially if medical experts are correct that the pandemic will take 12-18 months to full clear out. That said, the Q2 prediction alone is catastrophic, and if that slowdown persists the US is facing not only a recession, but probably a second Great Depression.

However, if JPM’s forecast revision for the US was catastrophic, than its latest global outlook is downright apocalyptic.

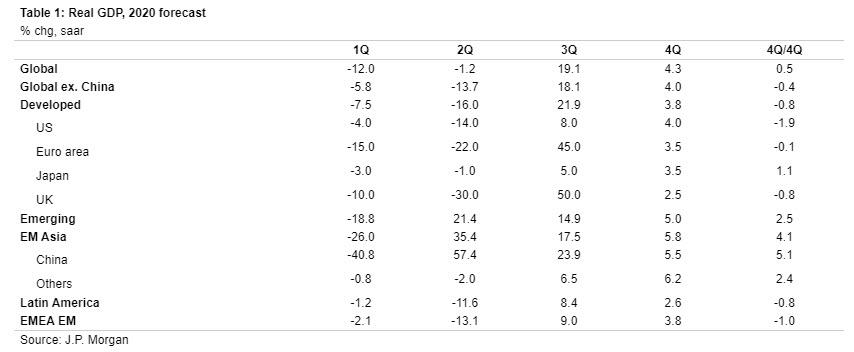

In a separate note by JPM’s Bruce Kasman, has also taken a flamethrower to his global economic forecasts, and the bank’s head of economic policy now anticipates Europe to implode an unprecedented 22%, the UK to crater by a depressionary and with the US plunging 14%, he sees the global economy ex China contracting by a whopping -13.7%. In short, JPM now expects no less than a global depression in the second quarter. This will follow a Q1 quarter in which China is expected to collapse by -40.8%, which however will somehow surge by 57.4% in the second quarter.

This is how Kasman lays out his latest forecast:

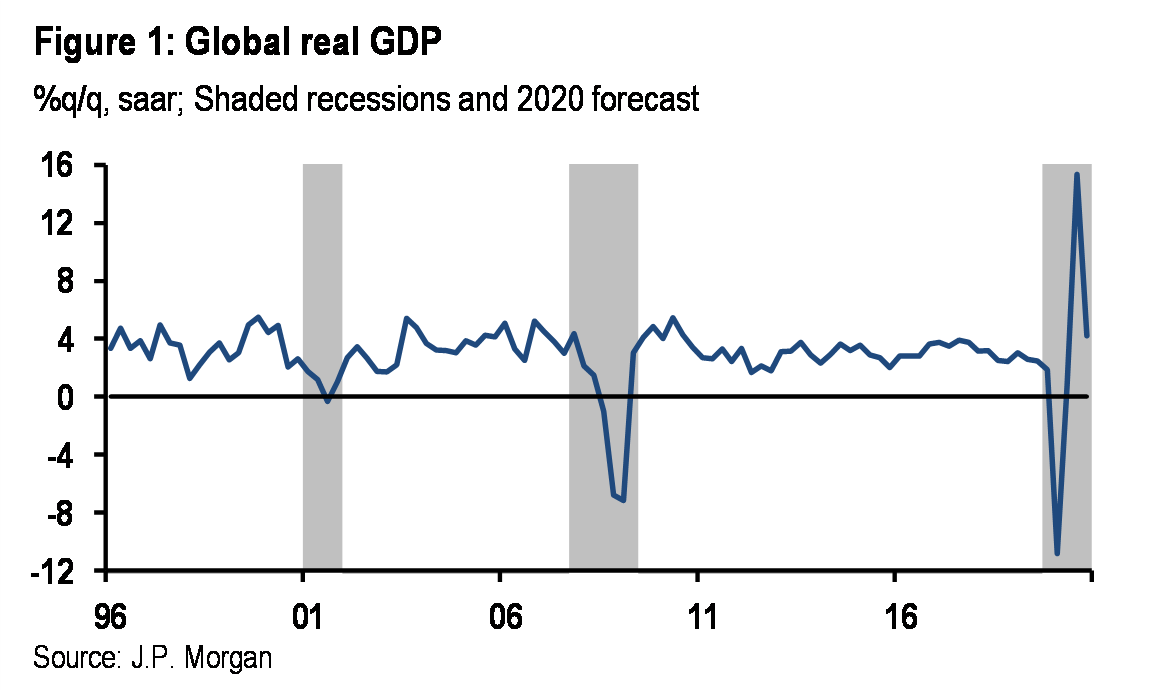

Last week we concluded that the COVID-19 shock would produce a global recession as nearly all of the world contracts over the three months between February and April. This week’s reports, which show a collapse in China’s activity in February and in survey readings for March elsewhere in the world, validate this view. There is no longer doubt that the longest global expansion on record will end this quarter. The key outlook issue now is gauging the depth and the duration of the 2020 recession.

Here are some more details on the timing of the upcoming depressionary collapse:

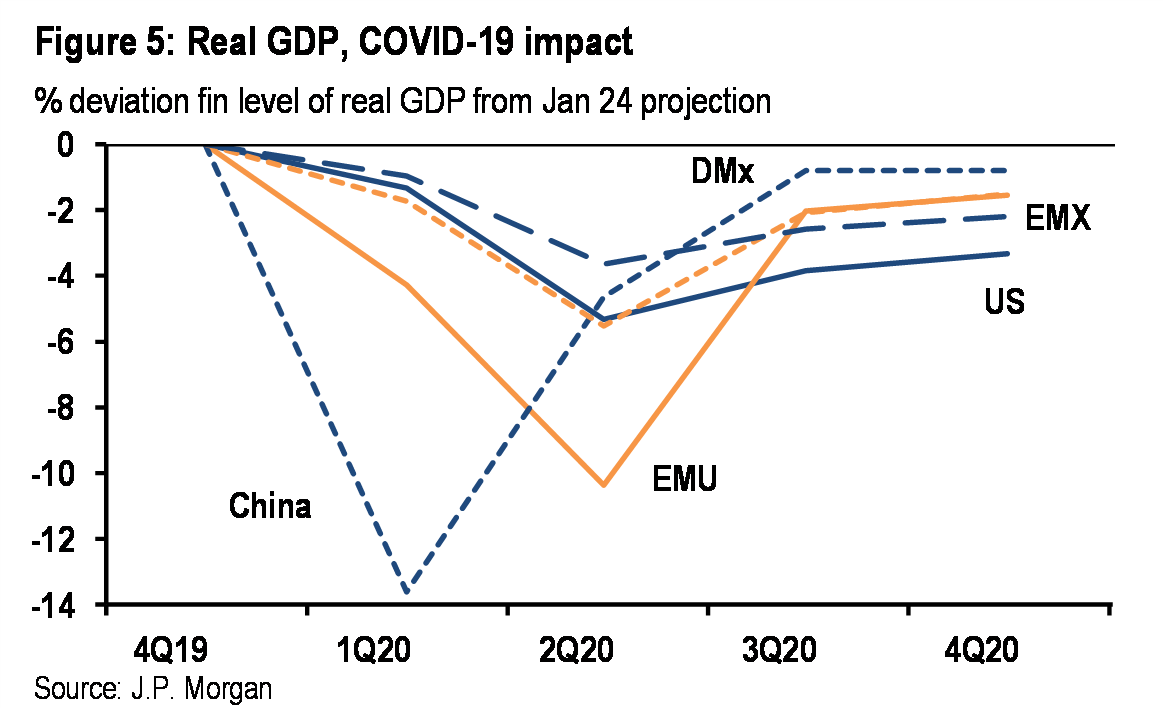

As the virus spreads rapidly across the globe, we have also been rapidly adjusting our estimates of the impact on 1H20 growth. This week we have again lowered forecasts. For China this quarter and the rest of the world next quarter, these GDP declines represent the biggest quarterly contractions recorded over the past 50 years at least. These contractions will be sufficient to tip 2020 global GDP growth down 1.1% on a year average basis (0.5% 4Q/4Q). Of particular note (Table 1):

- China collapses this quarter. We have reduced 1Q20 China GDP growth to -40%q/q, saar. Economies closely tied to the China supply-chain (such as Korea and Taiwan) will directionally follow China’s growth path. Forecasts there have also been lowered.

- The US and Europe follows next. For the US and Western Europe, the COVID-19 shock will likely straddle the first two quarters of the year. The stall in activity in March is likely sufficient to tip both economies into contraction this quarter but the shock’s impact is expected to be concentrated next quarter, where both regions are expected to contract at a double-digit annualized pace. These outcomes are worse than were recorded during the global financial crisis or the European sovereign crisis.

- The EM is not immune. While the COVID-19 shock is moving more slowly through EM countries outside Asia, their vulnerability is increasing along a number of fronts. In addition to their heightened sensitivity to falling DM demand for manufactured goods and commodities, they are experiencing a significant tightening in financial conditions. Oil producers are experiencing concentrated terms-of-trade losses. Finally, their relatively weak public health

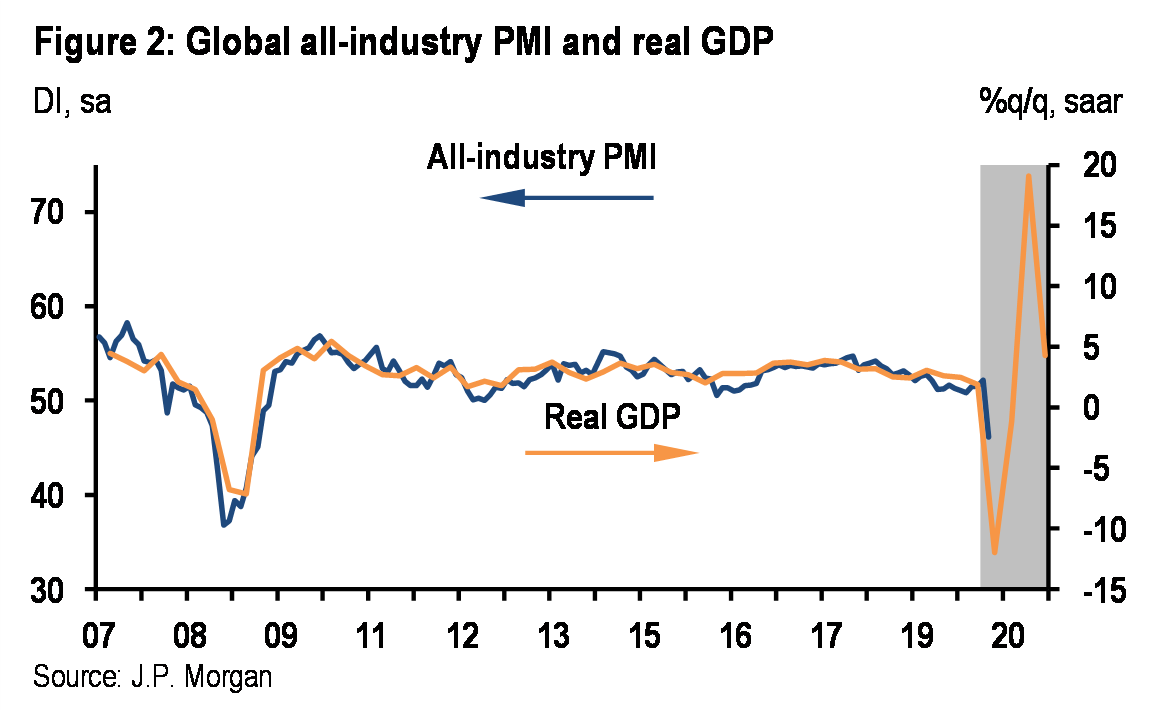

With these outcomes representing an unprecedented seizing up in activity across a wide range of sectors, JPM warns to brace for a “disturbing” set of economic releases in March and April, arguably as soon as tomorrow’s jobless claims report which according to some, may surge by over a million newly unemployed workers (!). Commensurate with the projected sharp decline in GDP, February-March global industrial production is now expected plunge by more than 10% and US and Euro area PMIs may test their global financial crisis lows.

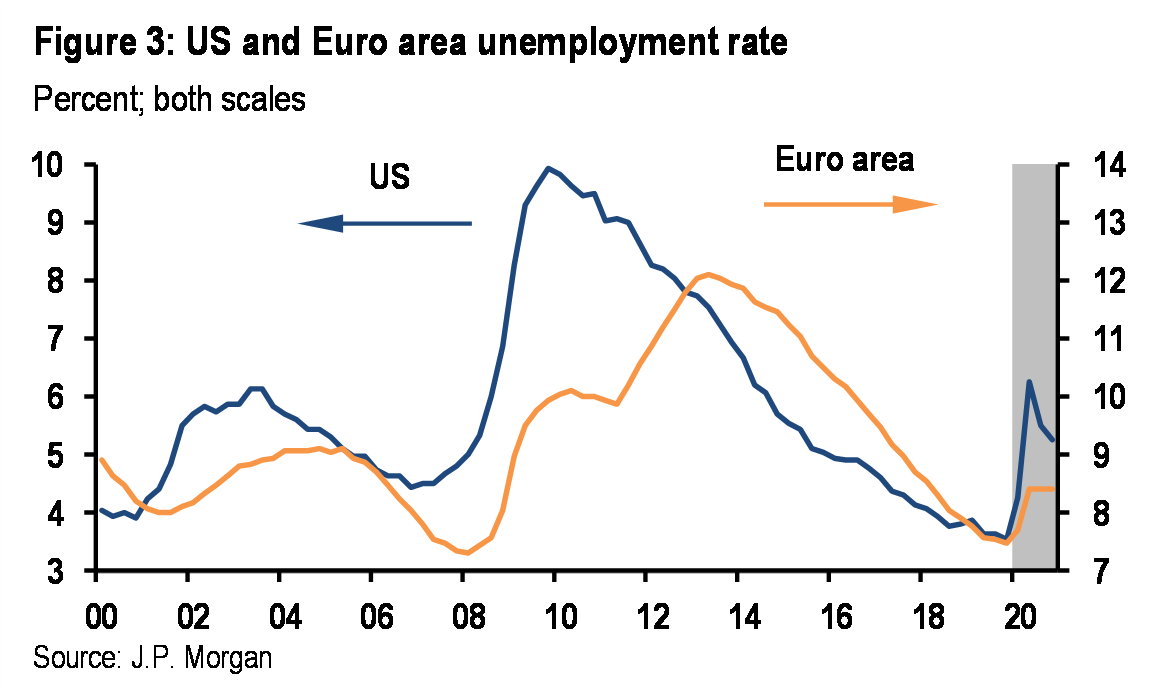

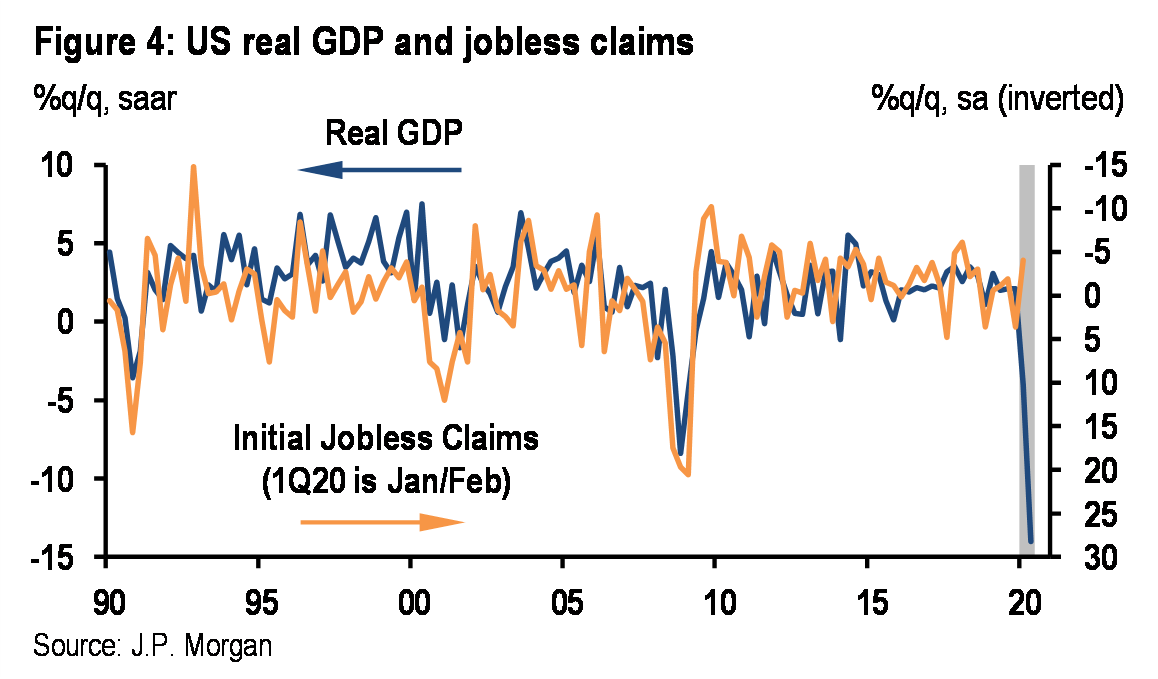

Yet while JPM expects the crash in industrial production to normalize swiftly, it anticipates a much more extended hit to the unemployment rates, as a result of what it now sees as a much deeper downturn: for the DM as a whole the bank now forecasts the unemployment rate to rise 1.6%-pts in the next two quarters. As was the case during 2008-9, this move reflects a much sharper rise in the US than in the Euro area, even if smaller in magnitude (Figure 3). Most immediately, US initial jobless claims should spike above 400,000 in the coming weeks (Figure 4).

And so with every Wall Street bank having given up on the first half, and certainly on Q2, the only hope is that the coming massive depression will also be the shortest on record. That may be an overly aggressive assumption.

For his part, this is how Kasman does his best to put an optimistic twist on depressionary data:

As this disturbing news rolls in, it will be natural to extrapolate that the global recession will extend well into 2H20. However, our baseline forecast continues to see the dynamics of the March-April dive laying the foundation for a strong rebound in 2H20 global growth. This outcome, which projects 9% ar global GDP growth over the final two quarters of the year, does not ignore the likely lasting damage from the COVID-19 shock.

And yet, in the very next sentence the JPM economist refutes his own optimistic take: “With the income shock from lost first-half growth revenue unlikely to be reversed and tighter financial conditions expected to linger, our forecasts see the level of global GDP growth ending 2020 2.1%-pts below the baseline path before the outbreak.”

More importantly, JPMorgan admits that its V-shaped recovery is contingent on three catalysts all playing out as expected:

- The relaxation of social distancing policies before mid-year. Implicit in the forecast is the view that the imposition of aggressive containment measures will cause the number of active infections to peak around 10 weeks after the confirmation of cases in individual countries. The fading of the virus threat, alongside a growing recognition that the economic costs of maintaining aggressive containment policies are very large, should then begin a process of selective removal of containment measures.

- The success of targeted, coordinated policies. One of the consequences of the global financial crisis is that policymakers have experience in dealing with acute financial sector stress. As such, they are moving rapidly to attempt to ameliorate the threat to financial market functioning and are working to cushion the blow to corporates and households most impacted by the shock. Ensuring that credit will be provided by banks, deferring (or cancelling) tax payments, and subsidies for short-time work have been key areas of focus.

- Fiscal and monetary policy stimulus is building. Usually it is monetary easing that provides the initial line of defense in responding to an economic slowdown. However, the constraints facing central banks and the flexibility provided to fiscal authorities in an extremely low interest rate environment suggest that fiscal easing will be delivered earlier in this episode.

JPMorgan’s summary:

“If a normalization in activity from depressed levels takes hold midyear alongside building policy stimulus, the depth of the current downturn can be seen as a springboard for a strong snapback in growth. However, there is a significant risk that the virus outbreak persists and activity remains restricted for a longer time. In this environment, risks rise that the depth of the initial shock unleashes negative forces that magnify the hit to activity into 2H20. Notably, firms that had been hovering on the margins of viability pre-crisis may not have sufficient equity to justify even a subsidized extension of credit and may close. The longer the duration of the interruption to activity, the deeper into the population of firms likely closures will occur, and the greater the feedback into consumer incomes and expectations.”

In short, the world is facing an assured economic depression in Q2, and the only question is whether this depression persists into the second half and 2021 or reverses in Q3. The answer will depend on a combination of “price to perfection” events all turning out just as hoped for. Which, in a world of record political polarization, ascendant nationalism, and a torn social fabric, is recipe for not only disappointment but also disaster.

Tyler Durden

Wed, 03/18/2020 – 21:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com