“It Is Likely Too Soon To Declare A Lasting Bottom”

Authored by Laura Cooper, macro commentator at Bloomberg

Extraordinary central bank measures alongside fiscal efforts have injected periods of calm into ailing equity markets. Yet with so much uncertainty still in the air, it is likely too soon to declare a lasting bottom.

With more than 2/3 of the global economy facing some form of lockdown, investors are staring down the barrel of what could be the worst recession on record. Central banks kicked into action and fiscal pronouncements finally caught up to the risk cycle, but there remain many unknowns that could hold back an equity recovery

Ensuring companies and households have sufficient cash to mitigate widespread unemployment and curb insolvencies could mean the difference between a sharp, yet short, contraction and a prolonged deep recession.

Details on deployment timelines are uniformly missing from the direct fiscal injections amounting to 4.5% of German GDP, more than 2% for the U.K. and an even bigger package for the U.S.

Quick delivery is critical.

1/Three weeks is too long to wait to get money into the hands of those who need it. The line cook, server, bellman, hotel housekeeper etc. needs help NOW. They can’t pay rent on April 1. They can’t feed their families TONIGHT.

— Scott Wapner (@ScottWapnerCNBC) March 26, 2020

https://platform.twitter.com/widgets.js

The gap between the passage of the U.S. stimulus bill in February 2008 and cash in hand was three to four months, a luxury that firms and consumers facing income shortfalls can’t afford.

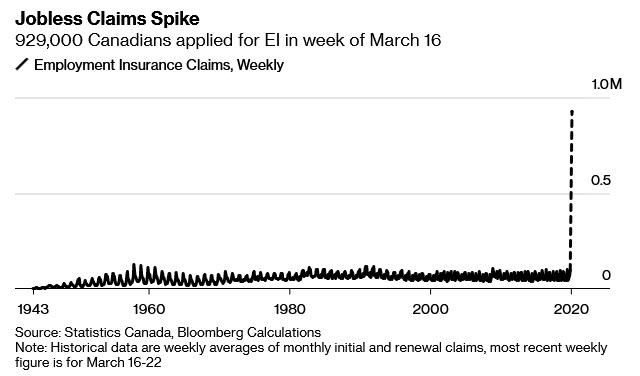

The labor market is deteriorating rapidly and direct injections may not come soon enough. Jobless claims have already touched record highs in several countries — close to 5% of the Canadian workforce applied last week and historically high figures are expected out of the U.S. on Thursday. Timely frameworks for wage top-ups and bridge loans can ease a cash crunch from becoming an insolvency crisis.

The U.S. fiscal package looks calibrated to backstop the economy for up to two months. But in the absence of a framework for effective and timely deployment, firms are already struggling to pay rents, there are pockets of funding stress in credit markets as default risks build and earnings guidance is abandoned.

Add in the unprecedented uncertainty facing financial markets on the duration of social distancing, the depth of the economic shock and when the infection rate curve will flatten, and there are many unknowns that could undermine confidence.

No corner of global markets is shielded. Equity drawdowns underpinning record capital flight from emerging markets ex-China outpace that seen in the global financial crisis and far exceed the Asian debt crisis.

Then the challenged fiscal capacity of EM countries like South Africa and Brazil to mitigate the growth shock is aggravating debt outflows despite central bank actions.

To be sure, policy makers are heading into uncharted territory and embraced lessons of the global financial crisis. But despite the flurry of action coming from central banks and on the fiscal front, timing is everything to prevent a long-term erosion to the labor market, the economy and asset prices.

Tyler Durden

Thu, 03/26/2020 – 13:55![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com