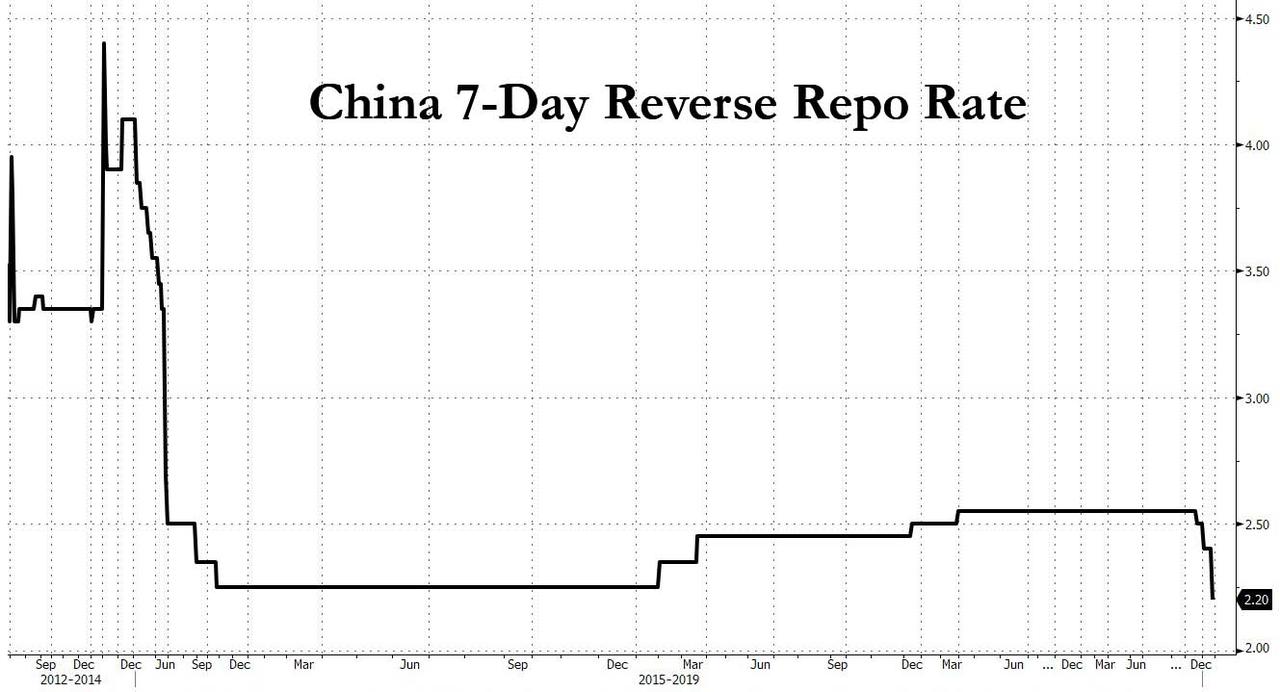

China Unexpectedly Cuts Reverse Repo Rate To The Lowest On Record

China’s central bank joined the global easing bandwagon early on Monday when it unexpectedly cut the rate on reverse repurchase agreements by 20 basis points, the largest in nearly five years, as authorities stepped up measures to relieve pressure on an economy ravaged by coronavirus pandemic.

Without giving a reason for the move, the People’s Bank of China said on its website that it was lowering the 7-day reverse repo rate to 2.20% from 2.40%, the lowest on record. This was the first rate cut since a 10bps cut in December 2019, and the third cut in the 7-day rate since November.

Also on Monday, the PBOC injected 50 billion yuan ($7 billion) into money markets through seven-day reverse repos, breaking a hiatus of 29 trading days with no fresh fund injections via the liquidity tool.

“The unexpected cut is a response to the politburo meeting last Friday,” said Xing Zhaopeng, markets economist at ANZ in Shanghai. “The medium-term lending facility (MLF) rate and Loan Prime Rate (LPR) will be cut at the same pace this month. We believe this cut is a signal to urge all loans to refer LPR as the benchmark so that the PBOC can improve the effectiveness of monetary policy transmission.”

At Friday’s meeting, the Communist Party’s Politburo said the government will step up policy measures and tighten enforcement in a bid to achieve full-year economic and social development targets. The government pledged to appropriately increase budget deficit ratio, guide market interest rates lower, and keep liquidity level reasonably ample.

Speaking to the media after the rate cut announcement, central bank adviser Ma Jun said China still has ample room for monetary policy adjustment and the rate decision took into consideration the return of Chinese companies to work, the global virus situation and a deterioration in the external economic environment. The rate cut took place one day after we reported that “China’s Consumer Default Tsunami Has Started.”

In a note to clients, Capital Economics said “a lot more easing will be needed, especially on the fiscal front, to help the economy return to its pre-virus trend.”

Chinese 10-year government bond futures initially responded positively to the cut, with the most-traded contract for June delivery rising as much as 0.23%, before pulling back to last trade down 0.07%; at the same time China’s money market rates ticked up on tighter quarter-end liquidity despite the PBOC injection. The overnight repo rate climbed 25 basis points to 1.36% while the 7-day rate climbed 43 basis points to 2.10%.

“There’s stronger liquidity needs ahead of the quarter end and there had also just been a round of tax payment – albeit small – last week,” said Becky Liu, head of China macro strategy at Standard Chartered Plc. “Both factors tighten interbank liquidity conditions temporarily, therefore injecting 7-day money into the system to meet such short-term needs is appropriate.”

* * *

As Reuters notes, analysts expect China’s economy to contract sharply in the first quarter due to widespread disruptions to business and consumer activity caused by the virus as authorities put in place tough public measures to contain the pandemic. Nomura has lowered its annual GDP growth forecast to 1.0% this year, and adjusted quarterly GDP forecasts to a 9.0% annual contraction.

“We all expected the PBOC to announce some cuts. If it was deposit rates, it would be a big move, but now it seems to be repo only,” said a senior portfolio manager.

Tyler Durden

Mon, 03/30/2020 – 08:21![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com