Fed Cuts Pace Of Treasury QE By 50% To “Only” $15 Billion Per Day, Yields Spike

From an initial $75 billion per day when the Fed announced the launch of Unlimited QE, the us central bank reduced its daily buying to $60 billion per day, then two weeks ago announced another ‘taper’ in its bond-buying program to $50 billion per day, which was followed by last week’s reduction to 30 billion per day. Now, the Fed has slashed its buying by another 50%, to “only” $15BN per day.

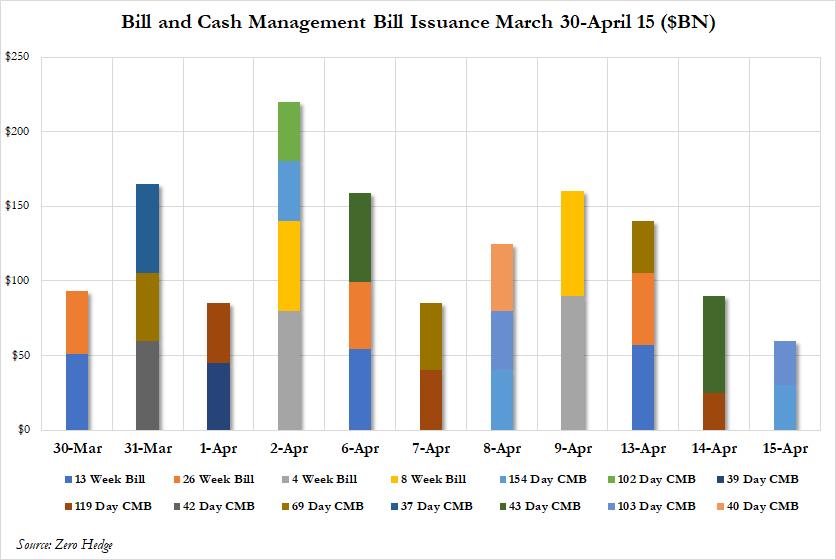

Having implicitly confirmed there is now a shortage of bonds – at least coupon bonds considering the $1.382 trillion flood in T-Bills and Cash Management Bills in the past two weeks to fund the stimulus package…

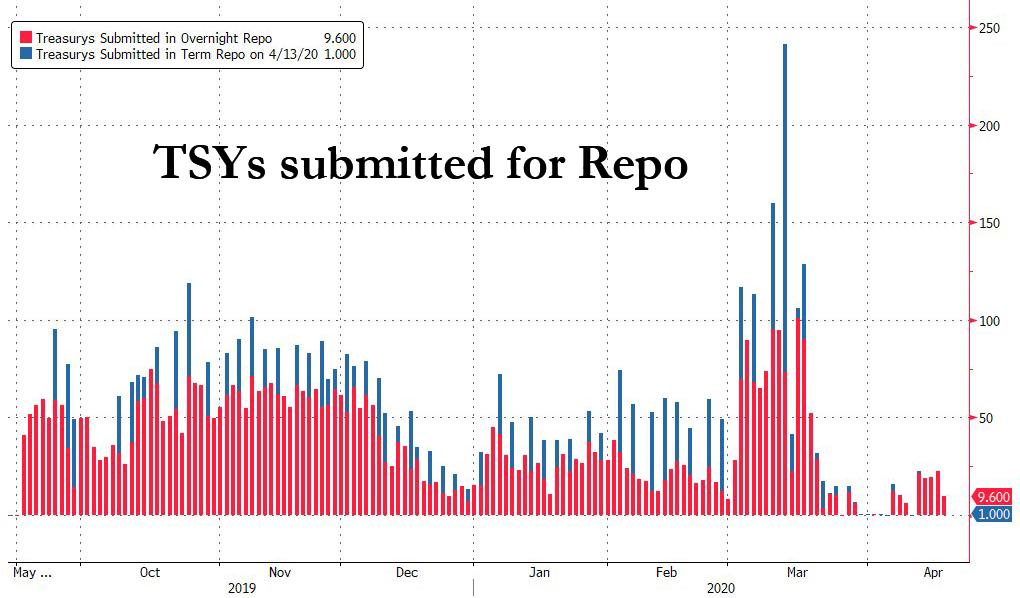

… as demonstrated by the recent repo ops that saw zero submissions as instead of using repo to park bonds with the Fed Dealers merely sell them back to the Fed, the NYFed has announced it will continue cutting back, or tapering, its “unlimited QE” bond-buying next week.

Here is the full schedule for the week ahead.

Additionally, the Fed will also taper its MBS buying from $15 billion to $10 billion in MBS per day next week:

- Mon: $10.709

- Tue: $8.938

- Wed: $10.709

- Thur: $8.938

- Fri: $10.7019

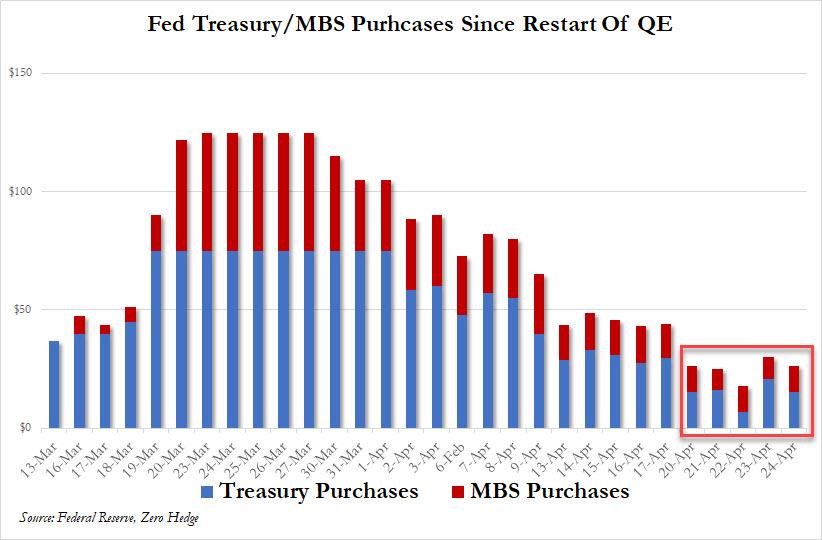

The chart below summarizes all the Fed Treasury and MBS buying completed and scheduled since the relaunch of QE on March 13:

So, in aggregate, The Fed will buy a total of $125 billion of MBS/TSYs next week, still vastly more on a weekly basis than the largest QE programs monthly totals before this crisis, if well below the $625 billion in purchases conducted in the week starting March 23, when the financial system was once again on the verge of collapse and only the Fed could bail it out… just don’t call it a bail out because nobody could have possibly anticipated an economic shock especially after banks repurchased trillions in their own stock in the past decade.

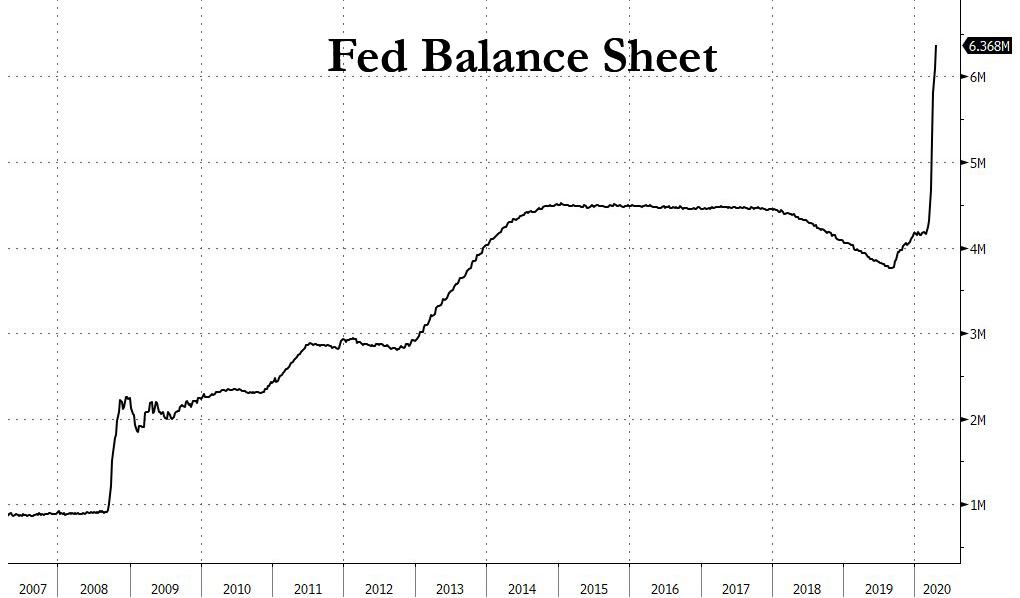

And for those curious, after the Fed mysteriously delayed the publication of its closely followed H.4.1 statement summarizing the size of its balance sheet on Thursday, the central bank updated the numbers this morning, which showed that as close of Aptil 15, the Fed’s balance sheet was a record $6.368 trillion, up $285 billion on the week and up $2.4 trillion from a year ago.

Treasury yields were not happy that the Fed is again shrinking the pace of debt monetization, and yields jumped by 5bps following the announcement.

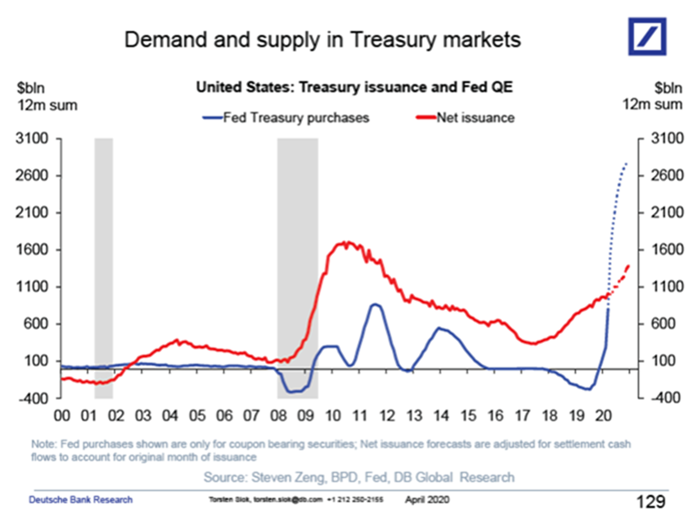

Finally, for those wondering what the big picture looks like, here it is: as we reported last night when the Fed did QE in the years following the 2008 financial crisis monthly Treasury purchases never exceeded US Treasury net issuance, but the Fed is now on track to buy double the amount of net issuance.

Tyler Durden

Fri, 04/17/2020 – 14:26![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com