China Cuts One And Five-Year Loan Prime Rate

One of the more entertaining and fake narratives in the world right now is that China’s economy has experienced a “V-shaped post-covid” recovery, with various economic indicators such as trade and PMIs (if not so much GDP), staging a miraculous recovery after the economy collapsed in February. Not only is this not true, with vast stretches of China’s output still shut down as a result of collapsing demand, both domestically and internationally, but watching Beijing huff and puff even as it sends conflicting signals in hopes of further stimulating the economy is downright hilarious.

Case in point, last Wednesday China cut the rate on its one-year Medium Term Lending Facility – or the cost the central bank charges on 1-year funding to banks – from 3.15% to 2.95%, which of course is just one of the many, many rates that have emerged in China in recent years in a time when Beijing is afraid of cutting the overnight funding rates as China’s economy remains an overlevered time bomb. Indeed, as Rabobank’s Michael Every wrote last week, “yet again we have a muddle over which rate really matters most in that economy, but the underlying picture is crystal clear. China needs to get far more liquidity into the real economy, but can’t match the level of easing being seen abroad for fear of destabilising CNY and ending up dealing with the kind of USD real politik being shown above.“

Indeed, as China’s Politburo made clear during a meeting on April 17, more cuts would be coming (almost as if there isn’t really a V-shaped recovery but there is a whole lot of new liquidity). As Goldman reported, the most tangible and meaningful statements from the meeting chaired by President Xi “was the mentioning of RRR and interest rate cuts in the discussion of monetary policy stance. While this language is vague in the sense that RRR cuts could be partial, which the PBOC has done a number of times already, and it is not clear which interest rate needs to be cut, the short-term interbank rate has already been guided to a very low level, so the mention of these likely increases the odds of broad-based RRR cut and/or a benchmark deposit rate cut.“

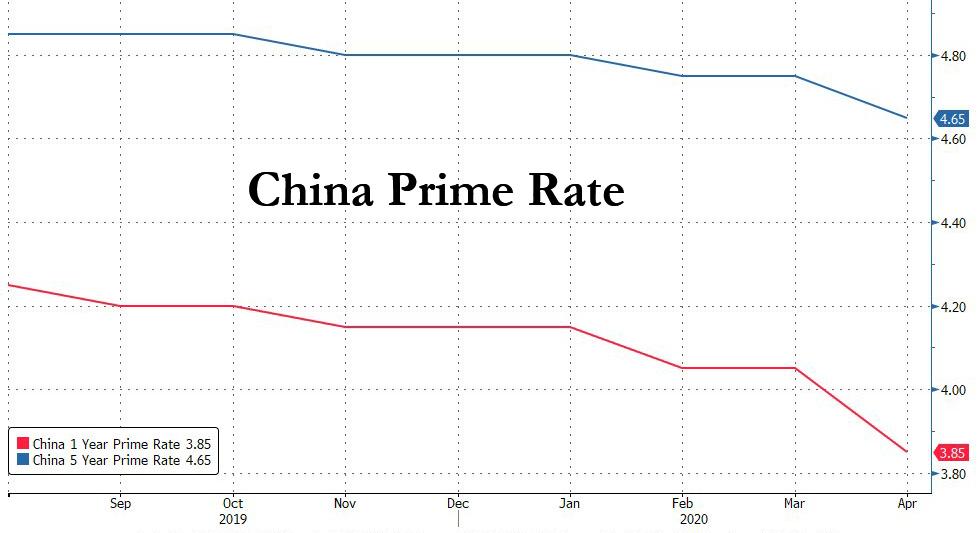

Yet while China has been leery of touching it RRR which it cut last at the start of the year, it had no choice but to cut more and with traders expecting some announcement out of the PBOC, the Chinese central bank did not disappoint when on Monday morning it announced that China cut the 1 and 5-Year Prime rate – the benchmark rate local financial institutions charge for new loans – from 4.05% to 3.85%, and from 4.75% to 4.65%, respectively, sending both rates to their historic lows (which is not really all the long since China only introduced the Loan Prime Rate, better known as China’s Libor, only last summer). The rate decided by a group of 18 banks is released on or around the 20th of every month and is reported in the form of a spread over the interest rate of the central bank’s medium-term loans. The steady decline in the LPR since August last year has led to lower borrowing costs in the wider economy, and also to lower profits for banks.

According to Bloomberg, some analysts had expected a cut of 20 basis points after the central bank trimmed several of its policy rates since the last LPR was set in March, and added liquidity to the financial system. The five-year tenor, a reference for mortgages, was cut to 4.65% on Monday versus 4.75% in March.

In addition to the MLF cut last week, the central bank also cut the cost of short-term open market operations in late March by the most since 2015, and announced a two-phase cut to the reserve ratio requirement for smaller banks.

As a reminder, Friday’s data showed GDP dropped the most since at least 1992.

And, as noted above, hours after the dismal economic reports, the country’s leaders pledged to deliver more stimulus including interest rate cuts to boost domestic demand. Authorities will keep liquidity “reasonably ample” by cutting the amount of reserves banks need to hold, China Central Television reported after a meeting chaired by President Xi Jinping.

Tyler Durden

Sun, 04/19/2020 – 21:55![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com