Auto Registrations In Europe Plunge 76% In April, The Largest Drop On Record

Tyler Durden

Fri, 05/22/2020 – 02:45

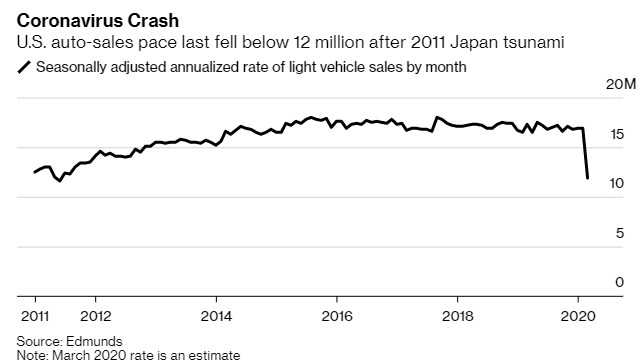

The hits just keep on coming for the auto industry. Frozen amidst a global lockdown due to the coronavirus, auto sales and registrations data continues to be atrocious around the world and the industry that was mired in recession even before the pandemic became a problem continues to face odds that look insurmountable.

The latest batch of cheery optimism came out of Europe, where auto registrations plunged 76% in April. According to the European Automobile Manufacturers Association, the number of new cars sold fell from 1,143,046 to just 270,682 YOY.

The ACEA said: “The first full month with COVID-19 restrictions in place resulted in the strongest monthly drop in car demand since records began.”

The data was driven by each of the 27 EU markets recording double digit declines in April, with Italy and Spain spearheading the misery, posting losses of 97.6% and 96.5% respectively. Sales plunged 61.1% in Germany and France dealt with an 88.8% contraction in April. The U.K. also posted a sales drop of 97.3%, according to CNBC.

Sequentially, the numbers are worse than March, when new car sales fell 55%. It was in mid-March that most European countries instituted their lockdowns.

The global auto industry can only be best described as in the midst of imploding into itself right now. Just a couple of days ago, we reported the news that China NEV sales plunged 43% last month.

Last month we also reported that April was going to be the worst month on record for auto sales.

Earlier this month we noted how dealers were desperately turning to incentives to try and move inventory off their lots. The consequences of the shut down have been immense. Toyota reported a 54% sales decline in April, for example. Hyundai and Mazda reported drops of 39% and 45%, respectively.

Recall we also wrote last month that ships full of cars were being denied entry to ports in California due to the massive inventory glut. Such was the case on April 24 when a cargo of 2,000 Nissan SUVs was approaching the port of Los Angeles. They were told to drop anchor about a mile from the port and remain there.

John Felitto, a senior vice president for the U.S. unit of Norwegian shipping company Wallenius Wilhelmsen said:

“Dealers aren’t really accepting cars and fleet sales are down because rental-car and fleet operators aren’t taking delivery either. This is different from anything we’ve seen before. Everyone is full to the brim.”

“There are basically no sales,” we wrote about the auto industry heading into April. One automotive researcher said of the industry-wide crisis: “The whole world is turned upside down right now.”

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com