Fed Tapers Daily Treasury Purchases To Just $5 Billion Per Day

Tyler Durden

Fri, 05/22/2020 – 13:25

From an initial $75 billion per day when the Fed announced the launch of Unlimited QE in mid-March, the US central bank first reduced its daily buying to $60 billion per day, then announced another ‘taper’ in its bond-buying program to $50 billion per day, which was followed by a reduction to $30 billion per day, which then was again cut in half to $15 billion per day. Then, four weeks ago the Fed again slashed its daily POMO by another 33%, to $10BN per day, before cutting it to $8 billion three weeks ago, then again to $7 billion one week later last week, and to $6 billion last week. Fast forward to today when, in its latest just published schedule, the Fed unveiled – as we hinted last night – that in the coming week it would purchase “only” $5BN per day, or a total of $20BN for the week (with Monday a holiday).

The Fed is continuing the practice of incremental tapering, and providing a weekly preview of its purchasing operations, which in the coming week will amount to just $20BN in TSYs, down $10BN from the current week since the Fed can’t buy bonds on Labor Day.

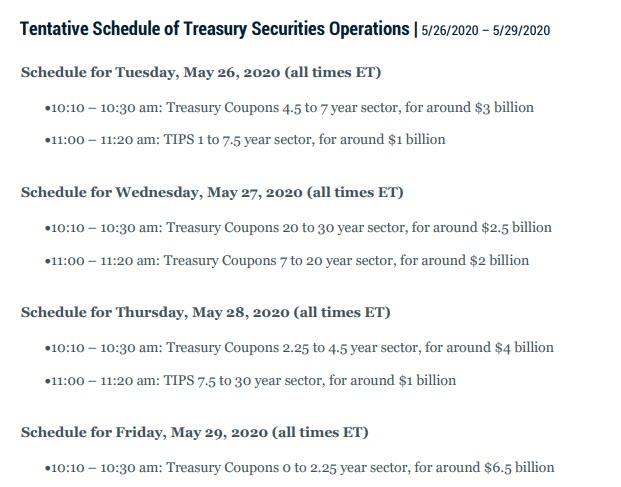

Here is the full schedule of Treasury purchases for the week ahead.

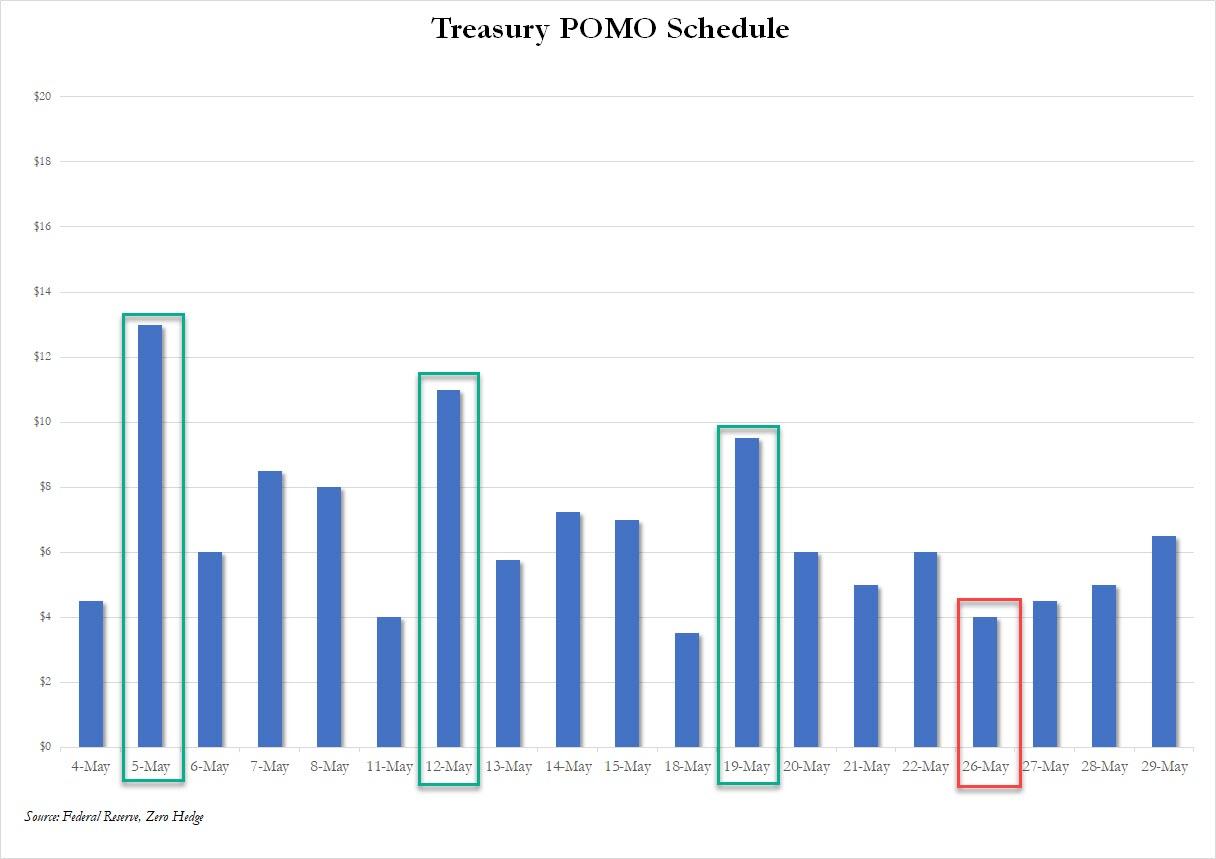

Curiously, unlike recent weeks when the weekly POMO peaked on Tuesday (as we showed last week), this week the Fed decided to rearrange the buying, with the coming Tuesday, May 26, set to see the lowest amount of POMO in the coming week.

Somewhat surprisingly, the Fed decided not to taper its daily MBS buying, which will average $4.5 billion per day next week, the same as last week:

- Mon: No purchases, vs $4.545BN last Monday

- Tue: $4.23BN vs $4.433BN last Tuesday

- Wed: $4.770BN vs $4.545BN last Wednesday

- Thur: $4.230BN vs $4.433BN last Thursday

- Fri: $4.770BN vs $4.545BN last Friday

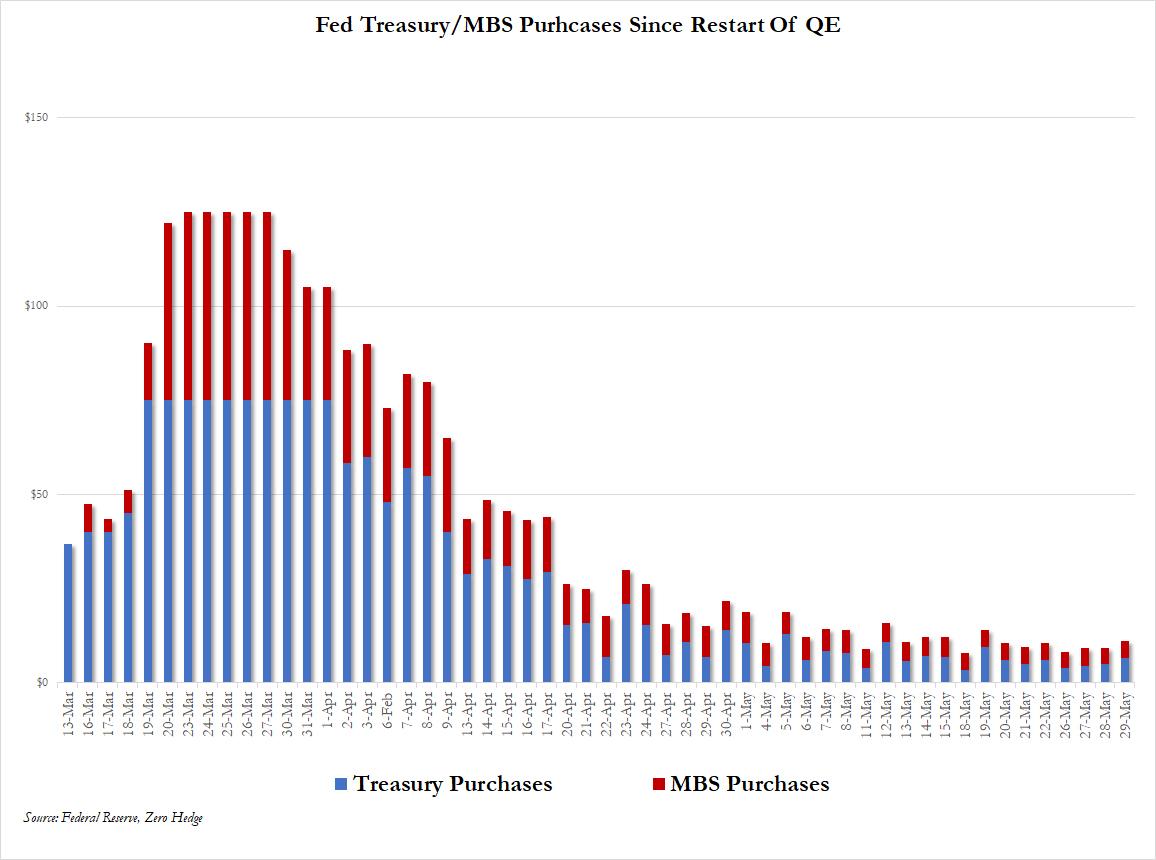

The chart below summarizes all the Fed Treasury and MBS buying completed and scheduled since the relaunch of QE on March 13:

Iin aggregate, the Fed will buy a total of $38 billion of TSYs/MBS in the holiday shortened week, down $52.5 billion last week, and dangerously close to spark concerns that the Fed is no longer monetizing all the Treasury issuance, of which there is and will be trillion in the coming quarters.

Notably, unlike last week when the news of the latest POMO taper pushed yields to session highs, this time there was no similar reaction, with the 10Y trading at 0.66%, 2bps above where it was trading at exactly this time one week ago, and unchanged from 2 weeks ago.

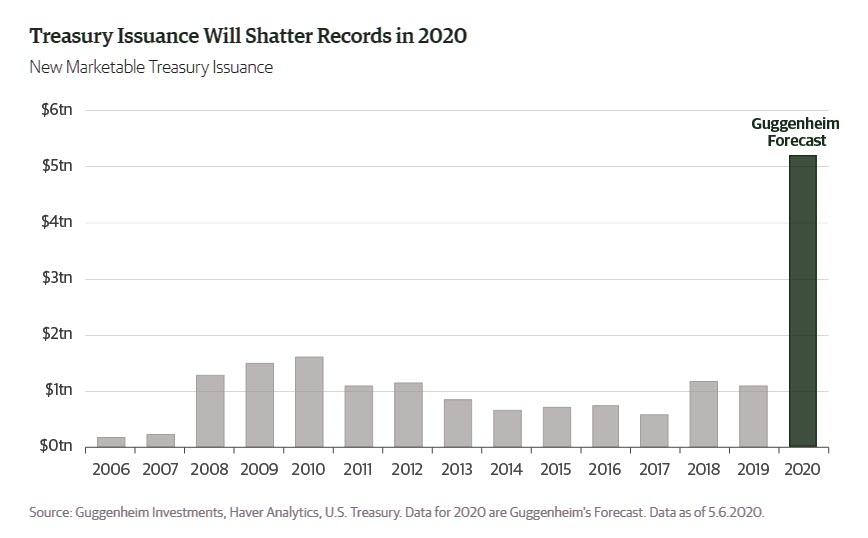

In any case, bonds are clearly not yet getting anxious about the pace of Fed QE tapering, which may be a mistake because as Goldman warns, the increase in sovereign bond supply is rapidly outpacing global QE. Then again, if and when Powell cuts a few billion more, we may finally see a bond market tantrum as traders realize they have no choice but to force the Fed to keep buying bonds at a more brisk pace, especially with some $3 trillion set to be sold this quarter, to fund 2020’s total issuance which according to Guggenheim will be an absolutely insane $5+ trillion.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com