Futures Jump Above 3,200; Brent Surges As Dollar Selling Accelerates

Tyler Durden

Sun, 06/07/2020 – 19:45

The risk-on euphoria in the aftermath of Friday’s blowout payrolls report, errors and all, has continued on Sunday night – as hedge funds (net exposure at 2 year highs), joining the retail army – and S&P futures have jumped back above 3,200 and are on pace to not only take out Friday’s intraday high of 3,210.5, but to go green for the year.

Supporting the bullish sentiment was overnight news that China’s trade surplus surged to a record in May as exports fell less than expected, while imports tumbled driven by declining commodity prices sales. A Bloomberg report that AstraZeneca has approached Gilead about what would be the biggest health care deal in history, will likely spark a rally among other Merger Monday candidates.

Oil is also surging after six straight weeks of gains, as Brent rises above $43 following Saturday’s OPEC+ decision to extend oil output cuts for another month, coupled with Saudi Aramco’s decision to hike oil export prices by the most on record.

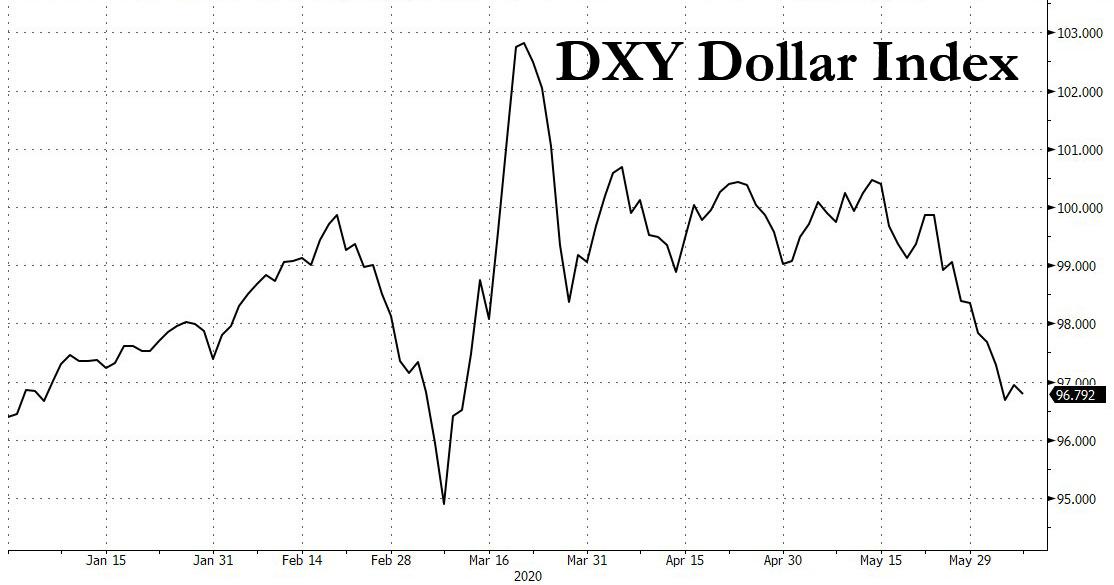

The dollar has continued its furious decline, with the DXY index just shy of where it started the year!

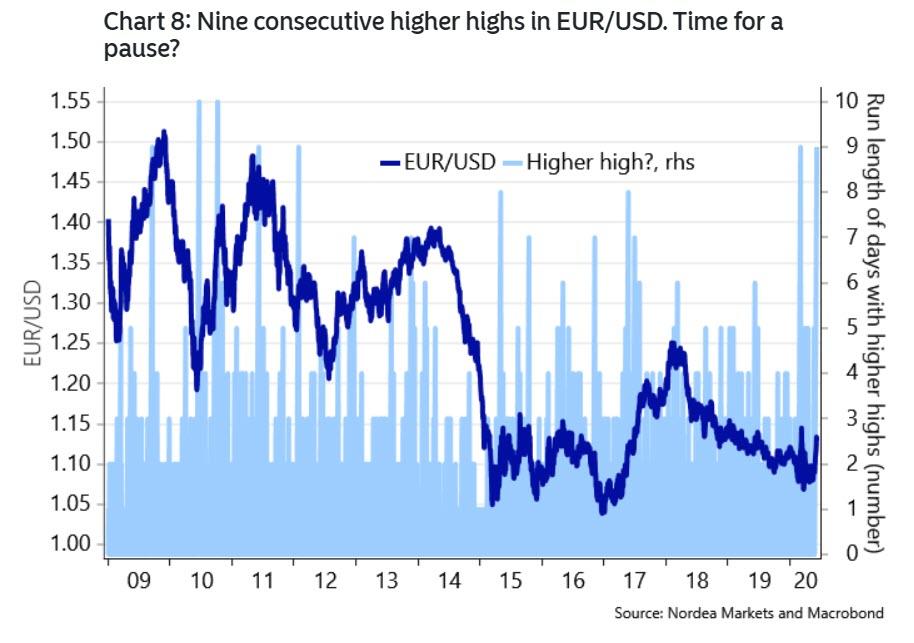

The EURUSD has continued its historic ascent, rising back over 1.13.

As Nordea writes earlier today, we have had nine days of higher highs in EUR/USD driven by a combination of reflationary vibes and increasing momentum for the “Next Generation EU” debt deal. If we get another high in the Monday session – and absent some dramatic reversal that appears inevitable – it would be the first streak of ten consecutive higher/highs since October-2010.

Investor now turn their attention to the Fed’s meeting on Wednesday, where Powell is expected to re-commit to using their “full range of tools” to support the U.S. economy during the pandemic, with some speculating that the Fed may also unveil Yield Curve Control to keep long-rates in check. At the same time, global governments are gradually easing their coronavirus lockdowns to revive growth while controlling the spread of Covid-19, even as millions of US protesters breached social distancing norms, potentially sparking a new round of infections, although good luck to anyone who tries to enforce another round of closures.

In other news, the Minneapolis police department will soon cease to exist as the local city counsel decided to disband it, in an ominous harbinger of the chaos that may soon come to every major American city.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com