Albert Edwards: We Are Transitioning From “The Ice Age” To “The Great Melt”

Tyler Durden

Thu, 06/11/2020 – 08:55

Back in March, when the Fed unleashed Unlimited QE with the added kicker of buying corporate bonds as central banks around the globe activated the monetary firehose of helicopter money, Albert Edwards finally admitted that the deflationary “Ice Age”, a term he coined back in the 1990s, was coming to an end. Three months later, the SocGen analyst is now convinced: “We are transitioning from The Ice Age to The Great Melt” he writes, as “massive monetary stimulus is combining with frenzied fiscal pump-priming in an attempt to paper over the current slump.”

Looking back to the start of his working career in financial markets in 1982, Edwards writes that inflation and bond yields in developed economies have enjoyed a one-way disinflationary slide, although as he notes “It has not been all plain sailing” and points out that his “Ice Age thesis explained how a tipping point would be reached where western financial markets would mirror what we saw in Japan during the 1990s and beyond.”

Said tipping point would arrive as “a gravitational pull towards outright deflation (exacerbated by policy mistakes) would cause a re-rating of stability in absolute and relative terms compared to cyclicality.” To be sure, the last few years of the Ice Age served not only bond investors but also equity investors well, “as bond proxies within the equity market have massively re-rated relative to cyclicals.”

However, all that is coming to an end as Edwards now believes that the world is finally in the transition phase as The Ice Age begins to thaw. The reason: “this economic bust is so serious and so deflationary that policymakers felt they had no choice but to cross the policy Rubicon.” Looking ahead to what he called the “The Great Melt”, Edwards posits – correctly – that there will never be any serious attempt to reverse policy stimulus. “Indeed we will see more and more stimulus until the deflationary ice melts.”

But there is one final, interim step before The Great Melt gains proper real economy and inflationary traction: According to the SocGen analyst “first we need to fully embrace The Great Melt-Down – the final stage of the Ice Age.” And although even Edwards has thrown in the deflationary towel and is now a believer that inflation will be properly re-ignited in the next economic cycle, “the markets remain focused on what lies ahead and not on the deflationary crevasse that has just opened up beneath them.”

Case in point, yesterdays May US CPI data saw an unprecedented three consecutive mom declines in core CPI, Edwards notes, adding that “previously even a single sighting of a 0.1% mom decline in core CPI was as rare as hens teeth. Before this year there were only three mom declines since inflation peaked in 1982! US core CPI has now slumped into deflation and the markets will find this a most difficult crevasse to bridge.”

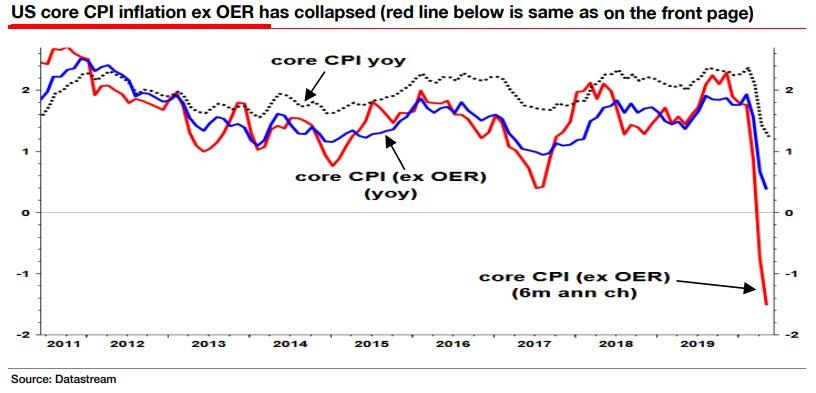

Referring to the chart below, Edwards writes that in May, US core CPI (ie ex food and energy) continued its unprecedented slide with the yoy inflation rate slowing to 1.2%, half the rate seen as recently as February. But excluding imputed Owner Equivalent Rent (OER is not included in the eurozone measure) this comparable measure is rising only 0.4% yoy and falling sharply on a 6m basis.

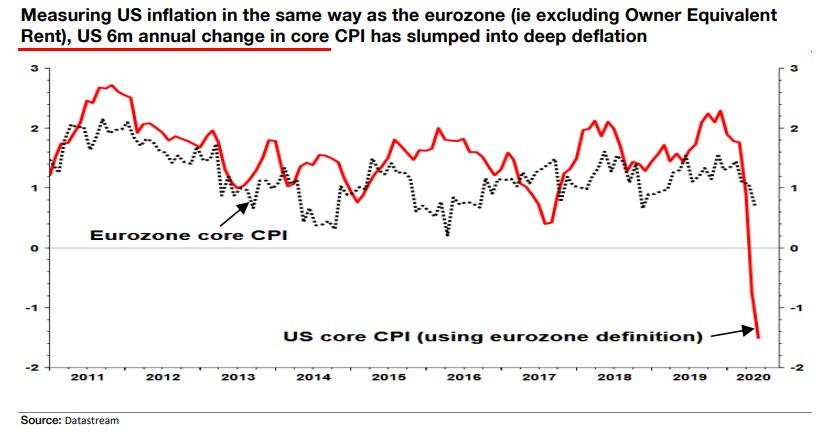

Indicatively, if one uses the Eurozone’s definition of core CPI for the US, one would get the following dramatic slide into outright deflation (of course, try explaining that to all those millions of people who can’t afford rent at any cost).

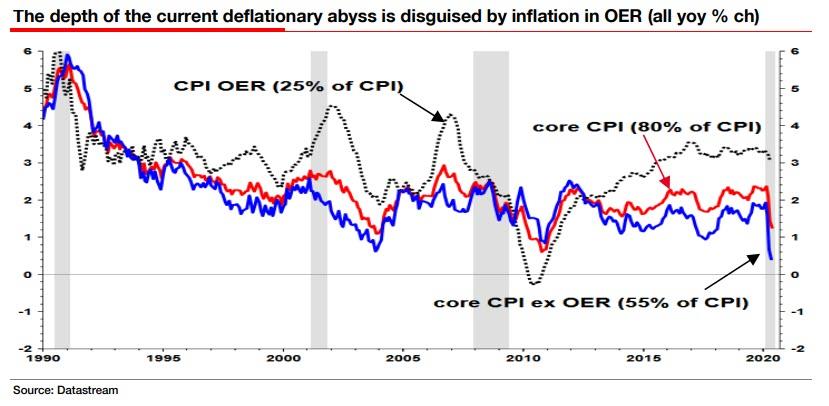

Indeed, it appears that sticky rent prices via OER inflation (which tends to mirror actual rent inflation) have held up core CPI. The rapidity of the slump in the core inflation ex OER is shocking and we have discussed the likely temporary nature of high OER/rent inflation on core CPI previously.

Yet despite the quasi-deflationary data reported by the CPI, inflation expectations remain anchored, and in fact the Fed’s latest survey of consumer expectations showed that people believe inflation is set to rise (see below).

As Edwards notes, “it is curious that investors have not absorbed the current deflationary reality”, suggesting that the next leg of US “Japanification” may be a shift in long-term price outlooks (unless of course most Americans remain focused on the abovementioned rents and food prices which remain rather sticky).

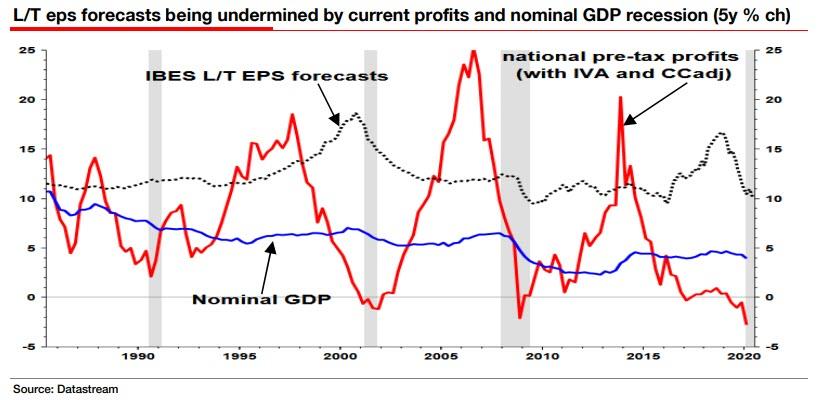

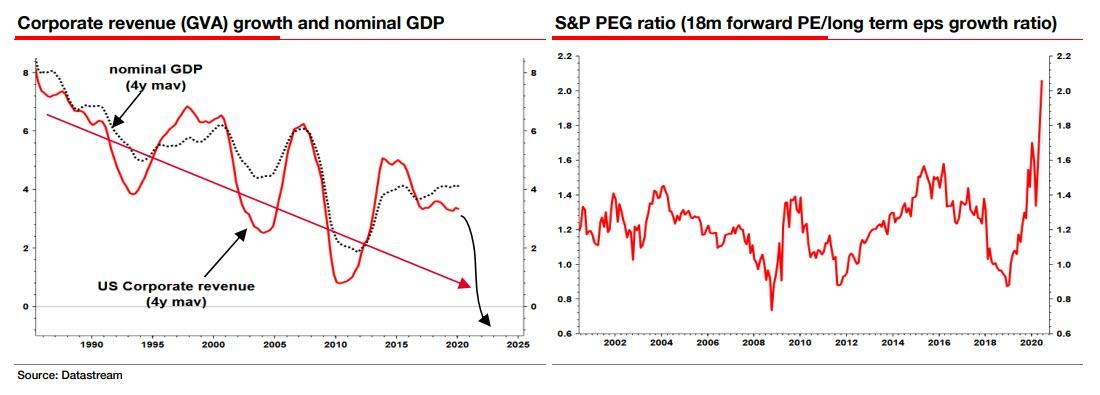

In any case, the slump in inflation feeds into the core of Edwards’ Ice Age thesis and concerns equities too. Indeed, nominal GDP growth is set to slow further (blue line in chart below) dragging down analyst forecasts of long-term eps growth, which are already weighed down by the ongoing profits collapse, and forcing the Fed’s hand further.

Finally, and most ominously, the slump in core CPI is bringing the Japanification of US nominal growth to an economy already saddled with record debt, which in turn will lead to a reset in price levels as investors realize companies are unable to “grow” into their record high valuations.

For those wondering what this means for stocks, Edwards saves the best for last: “As this will trigger a further decline in L/T eps, nose-bleed expensive PEG ratios will likely be fatally undermined. Before markets can properly embrace The Great Melt, they first need to comprehend the new normal: deflation has arrived.”

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com