European Traders Want To Continue Working From Home In Future

Tyler Durden

Sat, 06/13/2020 – 08:45

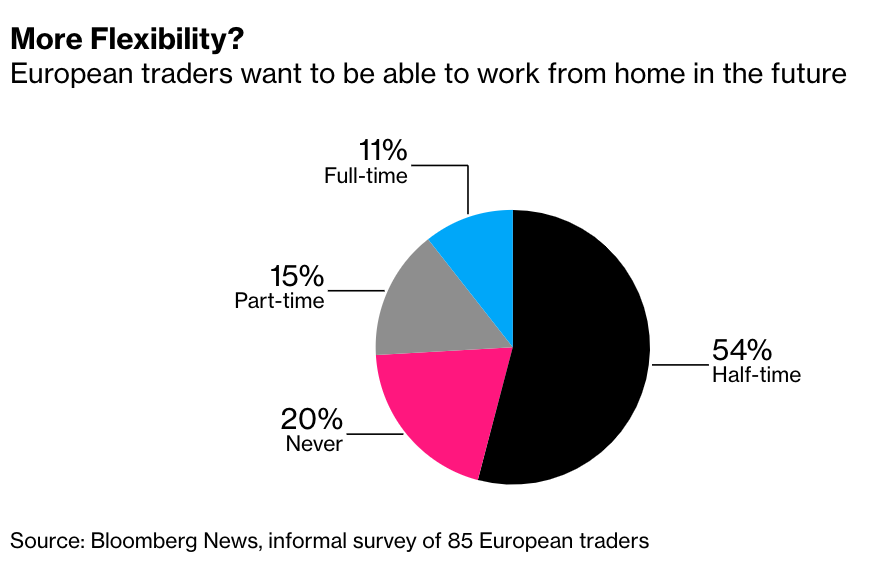

As lockdowns ease across Europe, professional stock traders, many of whom were forced to work remotely for the last several months, are beginning to rethink their work-life balance in a post-corona world. Bloomberg found, in a new survey of traders, that a majority want to continue working from home in the future.

About 80% of the 85 traders said they would like to work remotely for at least some of the workweek once strict social distancing ends. In a more extensive survey pool, Bloomberg found 90% of the responses from 254 traders want a restructured work-life that is remote.

“There was an accepted norm that at least to fulfill some roles effectively, you had to be in the office for extended hours, and that would be the only way to work,” said Joseph Sproul, associate director at Alpha FMC, a London-based consultancy firm to the wealth management industry.

“The experience over the last two months has shown that there are other ways of working, and in some roles, a much more balanced approach can be just as effective, if not more effective,” Sproul said.

Professional traders surveyed by Bloomberg could be in luck as Danske Bank A/S recently announced employees can work from home for at least a quarter of the week. JPMorgan Chase & Co. told employees that its offices would be kept half full for the “foreseeable future.”

Matthew McLoughlin, London-based head of trading at Liontrust Investment Partners LLP, said splitting the workweek up between the office and home would improve work-life balance:

“I have been surprised how well shifting the world of trading to working from home has gone,” McLoughlin said. “I have thoroughly enjoyed working from home and can definitely say that I have never felt both mentally and physically healthier. I feel that my company has benefited too, I am able to work longer hours where necessary, while still enjoying more free time due to the lack of commute.”

Bloomberg said 97% of analysts and 94% of fund managers surveyed said they would like to see a balance of office and home in the future. About 58% of the folks surveyed were based in London, and the rest were in Paris, Frankfurt, and Amsterdam. About 33% were traders, 19% fund managers, and 47% analysts.

While lockdowns and social unrest have become the norm in many Western countries, more than half of the respondents said they would consider moving out of metro areas.

The tide is indeed shifting for anyone who works on a trading floor — Bloomberg Intelligence said Europe could double to 30% of employees working at home across all industries. It also said Norway, Spain, and France are some member states that are witnessing the quickest changes of people working from home.

With concerns over a second coronavirus wave emerging — many firms will likely leave their trading floors operating at less than full capacity through 2020, which means people in the financial industry working from home should probably build out their home offices if they have not already.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com